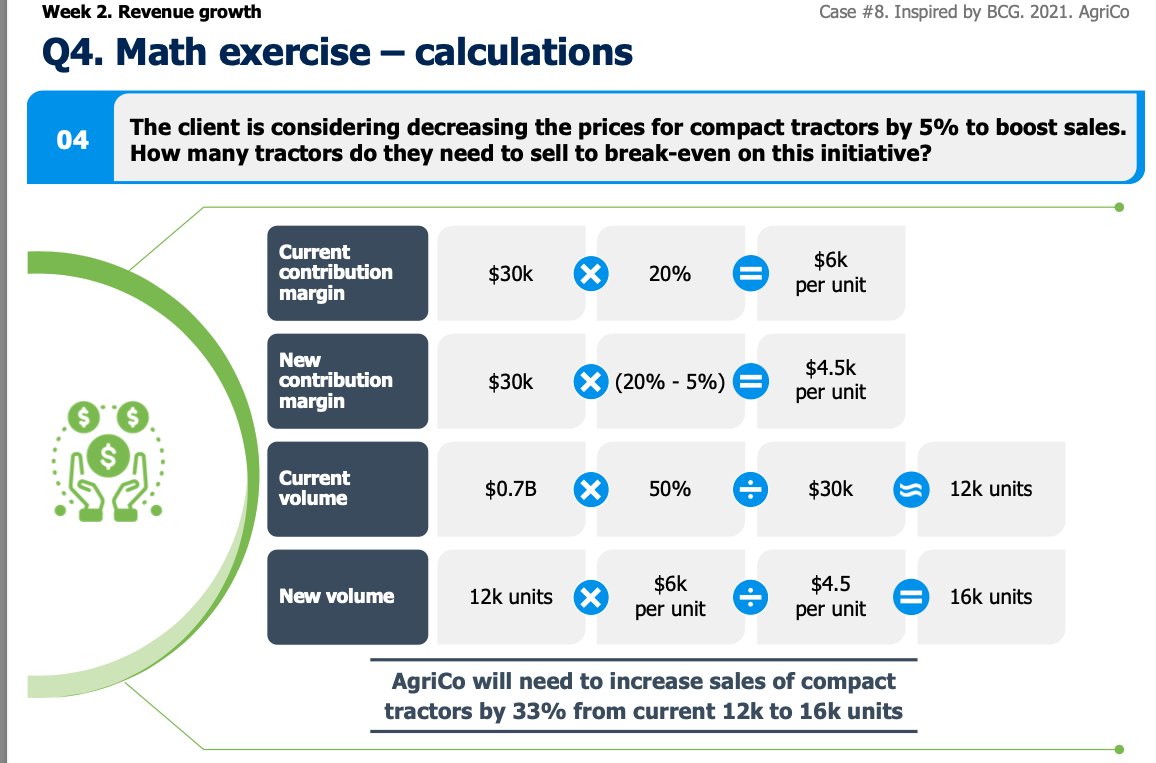

Can someone please explain the reasoning behind the AgriCo Case from Casebook MBB Casebook 2021- Peter - K and specifically the calculation part.

Overall question is: The client is considering decreasing the prices for compact tractors by 5% to boost sales. How many tractors do they need to sell to break-even on this initiative?

We know that;

• The client’s sales of tractors were $0.7B in 2020

• The share of compact tractors (under 40 PH) is 50%

• The gross margin for compact tractors is 20% • The average price of a compact tractor is $30k

Can someone please elaborate on the calculation attached.