How to Calculate the Internal Rate of Return

The Internal Rate of Return (IRR) describes the discount rate at which the present value of all future cash flows exactly equals the initial investment. In other words, IRR is the return at which an investment mathematically generates neither a profit nor a loss. This is precisely why it is well suited for comparing different investments.

To calculate IRR, all future cash flows of an investment are set in relation to the initial investment, and the discount rate is determined at which the net present value equals zero.

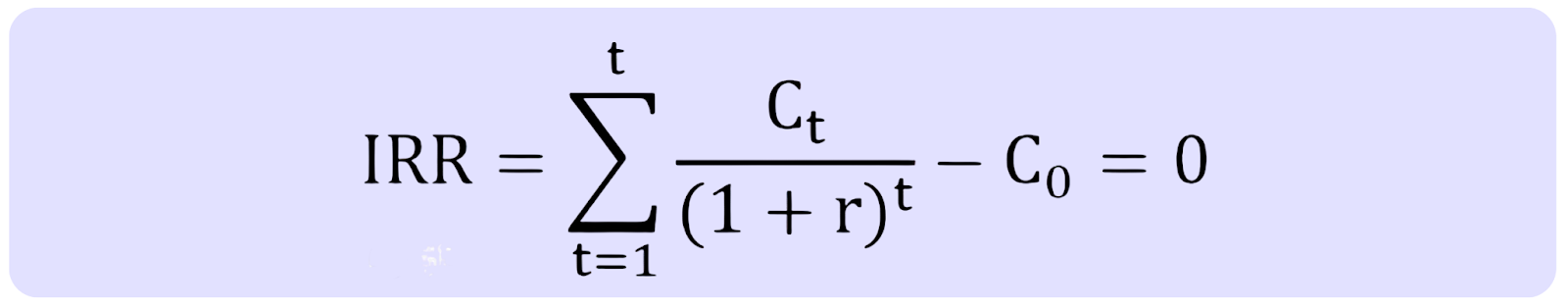

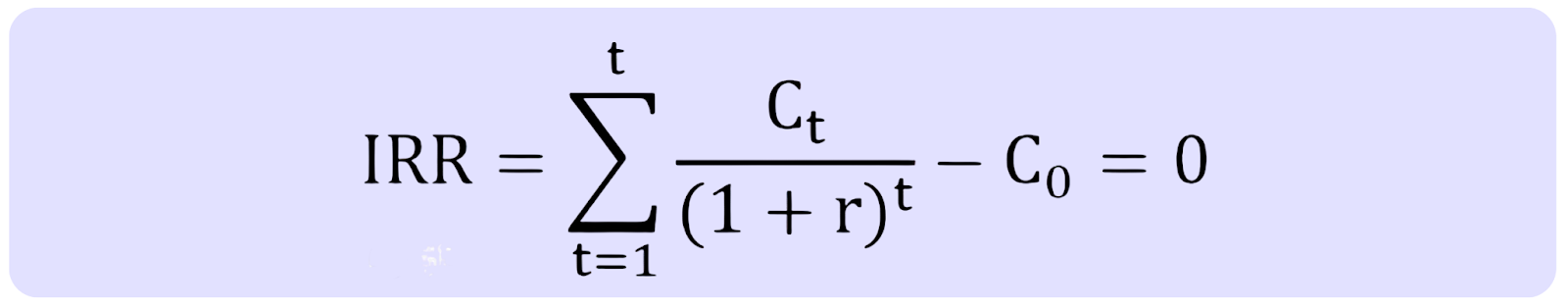

The formula is:

Before applying it, let us briefly look at the individual components:

- t represents the time period in which a cash flow occurs, for example year 1, year 2, and so on

- Cₜ is the cash flow in period t

- C₀ is the initial investment and is usually negative, since cash is paid out

- r is the Internal Rate of Return, meaning the return we want to calculate

In theory, you are looking for the discount rate r at which the sum of all discounted cash flows equals zero. In practice, IRR is almost always calculated using Excel or a financial calculator, as it cannot be solved directly.

Practical Example of Calculating the Internal Rate of Return

Imagine you invest 1,000 euros in a project today. After one year, you receive 600 euros, and after two years, another 600 euros. Your initial investment C₀ is −1,000, and the cash flows C₁ and C₂ are both +600.

The IRR is the discount rate at which the present value of these two repayments equals exactly 1,000 euros. If the IRR is, for example, 13 percent, this means the investment generates an annual return of 13 percent in mathematical terms.

Applications of the Internal Rate of Return in Finance

The Internal Rate of Return (IRR) is used so frequently in finance because it expresses an investment’s return as a simple percentage. This makes it easy to compare different investments, even when the size and timing of cash flows differ.

IRR is particularly relevant in the following three areas:

Corporate Finance

Companies use IRR to assess whether a project creates value. If IRR is above the WACC (Weighted Average Cost of Capital), the project is considered attractive. When comparing multiple projects, the one with the highest IRR is often preferred, provided strategy and risk are aligned.

Private Equity

In private equity, IRR is the key metric for evaluating deals and funds, as it considers both the size and timing of cash flows.

Investment Banking

In investment banking, IRR is used in M&A and LBO analyses to assess whether target returns are achieved. In LBOs, target IRRs often range between 20 and 25 percent.

Limitations of the Internal Rate of Return (IRR)

Although the Internal Rate of Return (IRR) is a very popular and intuitive metric, it has several important limitations you should be aware of:

- Reinvestment assumption: IRR assumes that all interim cash flows can be reinvested at the same rate of return. In reality, this is often unrealistic, as suitable reinvestment opportunities at exactly this rate rarely exist.

- Multiple IRRs: If cash inflows and outflows alternate over time, the calculation can result in multiple IRRs. This makes interpretation difficult, as it is unclear which value is meaningful.

- Project size and duration: A high IRR does not automatically mean a project is better. A small project may have a very high IRR but create little absolute value, while a larger project with a lower IRR may generate more total value.

For this reason, IRR is almost always considered together with Net Present Value (NPV) in practice, as NPV shows how much value a project actually creates. In interviews, you score particularly well if you demonstrate that you understand both the strengths and limitations of IRR.

Typical Interview Questions on the Internal Rate of Return (IRR)

Here you will find common finance interview questions on the Internal Rate of Return (IRR), along with concise answers to help you prepare for interviews in investment banking, private equity, or corporate finance.

1. What is IRR?

The Internal Rate of Return (IRR) is the discount rate at which the Net Present Value (NPV) of an investment equals zero. Put simply, it shows the annual return an investment generates over its lifetime, while also accounting for the timing of cash flows.

2. How is IRR interpreted in practice?

In practice, IRR is compared to a company’s cost of capital. If IRR is above the WACC, the project creates value and is considered attractive. If it is below, the return does not cover the cost of capital and the project should be rejected.

3. What are the main weaknesses of IRR?

IRR assumes that all cash flows generated during the investment period can be reinvested at the same rate, which is often unrealistic. In addition, alternating inflows and outflows can lead to multiple IRRs, reducing clarity.

Moreover, IRR does not account for project size. A small project can have a very high IRR but create little value, while a larger project with a lower IRR may generate more overall value. This is why IRR should always be considered together with NPV.