What’s Behind the WACC?

Imagine a company wants to buy new machines. For that, it needs money. And that money can come from two sources:

- From equity (for example, from investors who buy shares in the company)

- Or from debt (like loans from banks)

Both types of capital come with a cost:

- Investors expect a return on the money they invest

- Banks expect interest on the money they lend

The WACC combines both and answers the question: How much does the company have to pay on average to get capital? The word “weighted” in the name means: it takes into account what percentage of the capital comes from equity and what percentage from debt.

How the WACC Is Calculated

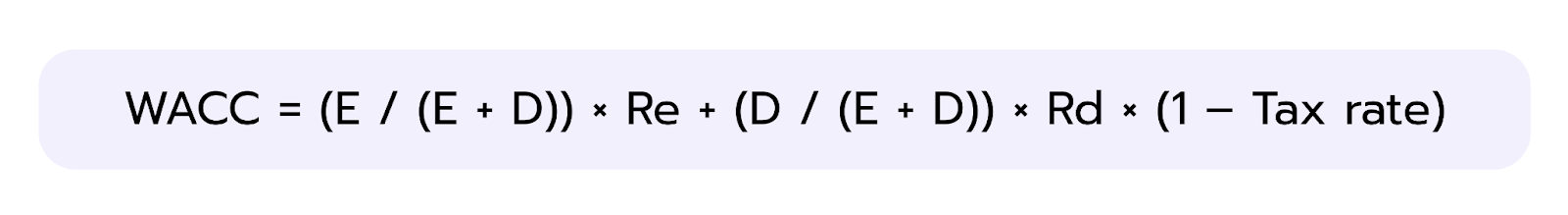

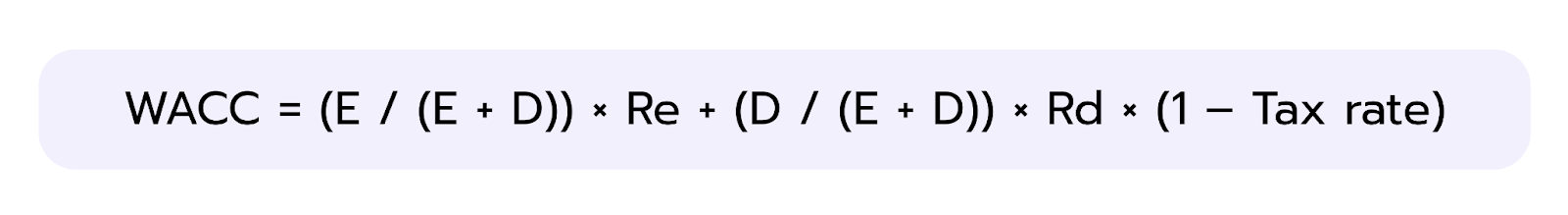

The WACC formula might look complicated at first, but let’s go through it together. Here’s a simplified version:

These are the key elements:

- E = Equity

- D = Debt

- Re = Cost of equity (expected return)

- Rd = Cost of debt (interest rate)

- Tax rate = important because interest is often tax-deductible – this reflects the tax advantage of debt (called a tax shield)

Let's look at an example:

A company is financed with 60% equity and 40% debt. The expected return is 8%, the interest rate is 5%, and the tax rate is 30%.

So: WACC = 0.6 × 0.08 + 0.4 × 0.05 × (1 – 0.3) = 0.048 + 0.014 = 6.2%

What does this result mean?

The company needs to generate a return of at least 6.2% on its investments. If a project stays below that, it’s not attractive from the point of view of capital providers.

How Can You Use the WACC in Practice?

Once you understand the WACC, you can make better decisions when it comes to investments or company valuation. Companies use the WACC for:

- Investment decisions: Only projects above the WACC create long-term value

- Company valuations: The WACC is often used to discount future cash flows (for example in a DCF analysis)

- Financing strategies: Companies analyze how more debt or equity would affect their overall capital costs

Typical Interview Questions About the WACC

If you're preparing for a finance interview, you should be able to explain the WACC and demonstrate that you understand it. Below are some common interview questions you might encounter – including sample answers that can help you stand out.

What is the WACC and why is it important?

The WACC (Weighted Average Cost of Capital) shows how much it costs a company on average to raise capital through equity and debt. It plays a key role in investment decisions, because only projects where the expected return is above the WACC create long-term value for the company.

Why are the costs of debt adjusted by the tax rate in the WACC?

Because companies can often deduct interest payments from taxes, which decreases the actual cost of debt. That’s why the interest rate is multiplied by (1 – tax rate).

What happens to the WACC if the share of debt increases?

The WACC may decrease at first, because debt is usually cheaper than equity. But more debt also means more risk for the company. That can increase the cost of equity, which can make the WACC go up again.

How is the WACC connected to company valuation?

In company valuation, the WACC is used as the discount rate to calculate the present value of future cash flows. A higher WACC leads to a lower present value – and that means a lower company value.

👉 With the question sets from our case library, you can practice questions like these – so definitely check it out!