What Is the Income Approach Method?

The income approach is a valuation method that determines a business's or an asset's value based on the income it generates. It requires historical financial records on which to base future income projections. Hence, it’s more useful for established companies with stable and predictable revenue.

Besides business valuation, the income approach is used in real estate to value income-generating or commercial properties like office buildings, apartment complexes, and shopping centers. It’s also used to value other assets with predictable income streams, such as bonds or other investments.

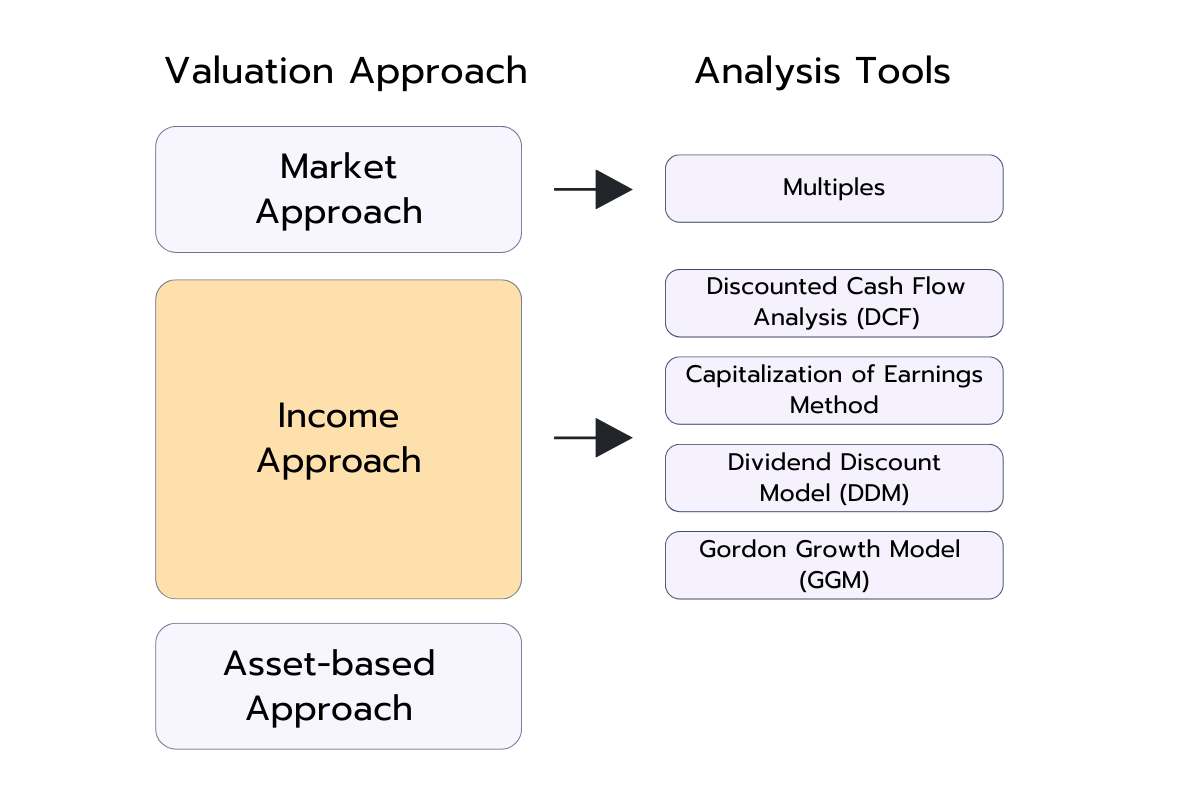

The two most commonly used valuation methods under the income approach are:

- Discounted cash flow (DCF) analysis

- Capitalization of earnings method

Discounted Cash Flow (DCF) Analysis

DCF valuation method projects a company's future free cash flows and then discounts them back to their present value using an appropriate discount rate. In most cases, the discount rate is the Weighted Average Cost of Capital (WACC).

WACC = (Cost of Equity × Equity Percentage) + (Cost of Debt × Debt Percentage × (1 - Tax Rate)) + (Cost of Preferred Stock × Preferred Stock Percentage)

DCF is especially suitable for companies with varying growth rates or those in developmental stages.

Capitalization of Earnings Method

This method values a company based on its normalized annual earnings divided by a capitalization rate. It's essentially a simplified version of DCF that assumes relatively stable, consistent growth. Normalized earnings means any non-recurring or unusual items are removed to get a more representative and sustainable earnings level.

The process for valuing a business using capitalization of earnings method includes:

- Determining the company's normalized annual earnings

- Establishing an appropriate capitalization rate based on risk and market conditions

- Dividing the annual earnings by the capitalization rate to get the company's value

The capitalization of earnings methods is more appropriate for mature businesses with established operating histories and steady earning patterns. That’s because analysts can use the historical trends as inputs for future expected earnings.

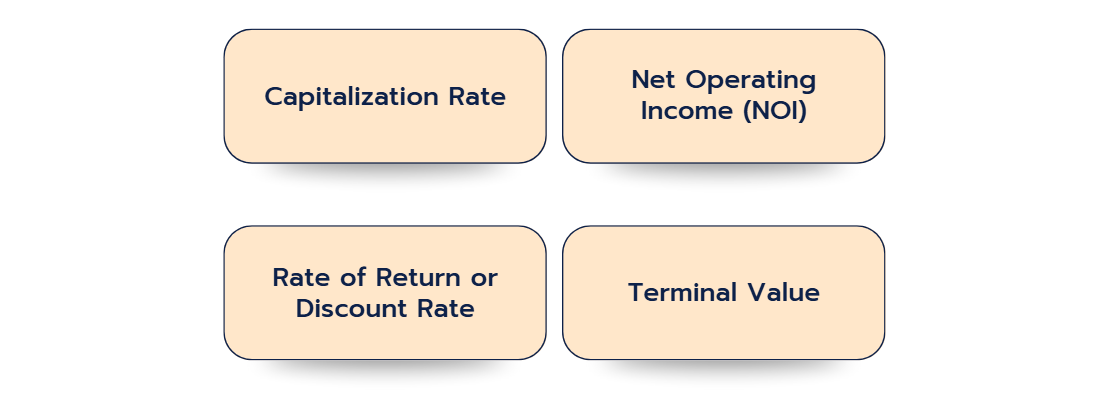

Key Concepts of the Income Approach

There are several fundamental concepts that form the backbone of the income-based valuation methodology. Here are the key ones.

Capitalization Rate

The capitalization rate (cap rate) is applied in the capitalization of earnings method. It shows the expected rate of return on an investment. It’s like the annual percentage return an investor wants to get from a business's earnings.

Cap rate is used to convert a single period's earnings into an estimated company value. It's like saying, "If I want a X% return, and the business makes Y amount of money each year, then the business must be worth Z." For instance, if an investor wants a 10% return and the business makes an annual profit of $1000, then it’s value is $10,000 (1000/0.10).

The cap rate is usually lower for companies with stable earnings and higher for businesses with more uncertain earnings or lower growth expectations. Hence, the cap rate reflects market conditions, risk factors, and growth expectations.

Net Operating Income (NOI)

NOI is the annual income generated by a property or business after deducting all operating expenses but before accounting for debt service, income taxes, or capital expenditures. It provides a clear picture of the asset's income-generating capacity regardless of financing structure. For businesses, this is referred to as EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) or adjusted operating income.

Rate of Return or Discount Rate

The discount rate is applicable in DCF analysis. It’s the required rate of return used to convert future cash flows to their present value. It accounts for both the time value of money and the risk associated with the future cash flows.

For businesses, this rate can be determined through the Build-Up Method, which starts with a risk-free rate and adds premiums for various risk factors. Another strategy is through the Capital Asset Pricing Model (CAPM).

Terminal Value

In DCF analysis, terminal value represents the value of all cash flows occurring beyond the explicit forecast period. It's calculated using either the perpetuity growth method which assumes a constant growth rate indefinitely. The other way is the exit multiple method which applies a market multiple to the final year's projected earnings or cash flow.

Common Income Approach Interview Questions

To prepare effectively for your finance interview, it’s important to practice common technical questions thoroughly. Below, you’ll find some frequently asked questions about the income approach, along with brief explanations to help you answer them confidently.

1. What are the major limitations of using the income approach valuation method?

The income-based valuation methodology relies heavily on projections and assumptions about future performance, which introduces uncertainty. The accuracy depends on the quality of forecasts and the appropriateness of the selected discount or capitalization rate.

It may be less reliable for businesses with unpredictable cash flows, startups without established earnings history, or in volatile economic conditions

2. When would you not use a DCF in a Valuation?

DCF valuation is inappropriate for companies with volatile or unpredictable cash flows, such as early-stage technology or biotech startups. It's also unsuitable when debt and working capital function differently than in standard businesses, as with financial institutions where working capital constitutes a major portion of their balance sheets and debt isn't reinvested in the traditional sense.

3. What’s typically used for the discount rate?

For discount rate calculation, WACC (Weighted Average Cost of Capital) is the standard approach. However, the Cost of Equity might be more appropriate in some DCF models depending on the specific analysis structure.

4. What is the main difference between the Discounted Cash Flow (DCF) Analysis and the Capitalization of Earnings Method?

The main difference between the two methods is that the DCF Analysis projects a company's future free cash flows and uses an appropriate discount rate, while the Capitalization of Earnings Method estimates a company's value by capitalizing its normalized earnings at a specific rate.

5. How would you adjust historical financial statements for an Income Approach valuation?

I would normalize the financial statements by:

- Removing non-recurring items

- Adjusting owner's compensation to market rates

- Adding back discretionary expenses

- Standardizing accounting methods

- Adjusting for non-operating assets/liabilities

- Rectifying any unusual transactions

👉 Want to practice more valuation questions? You’ll find a full set in our case library.