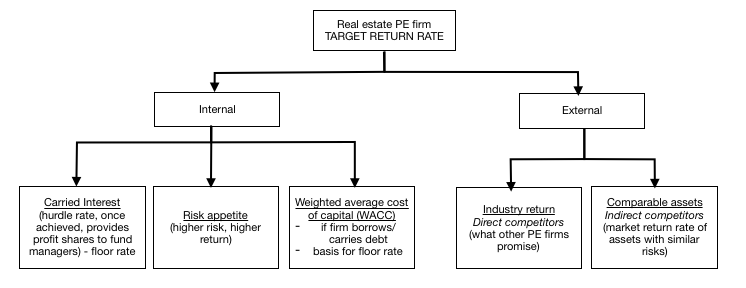

Real estate PE firm (investing in airports around the world) asks for your help in:

1. Setting the firm's target return rate

2. How to best achieve it

How to best structure this problem?

-------------

Thanks for the input. I have my issue tree below. What do you think of it?

(editiert)

Thanks for the input. I have my issue tree above. What do you think of it?