There are several common case types that occur in case interviews for management consulting roles. Profitability cases are some of the most frequent ones. These cases require a structured approach, analytical thinking, and a deep understanding of business fundamentals. Let’s take a look at what profitability cases actually are and how you can approach them successfully.

Profitability Cases

Profitability Cases – The Number 1 Reason for Most Consulting Projects

One of the most common reasons why firms instruct consulting firms with their projects is that they struggle with their profitability. As a consultant you will have to diagnose the underlying issues, come up with potential solutions and recommend actions to improve profitability.

As a candidate in a case interview, the task is pretty much the same, but on a smaller scale. The good news is: Once you have understood the basic structure of profitability cases, you can solve them no matter the industry or concrete business scenario. The underlying concept is always the same and not very difficult.

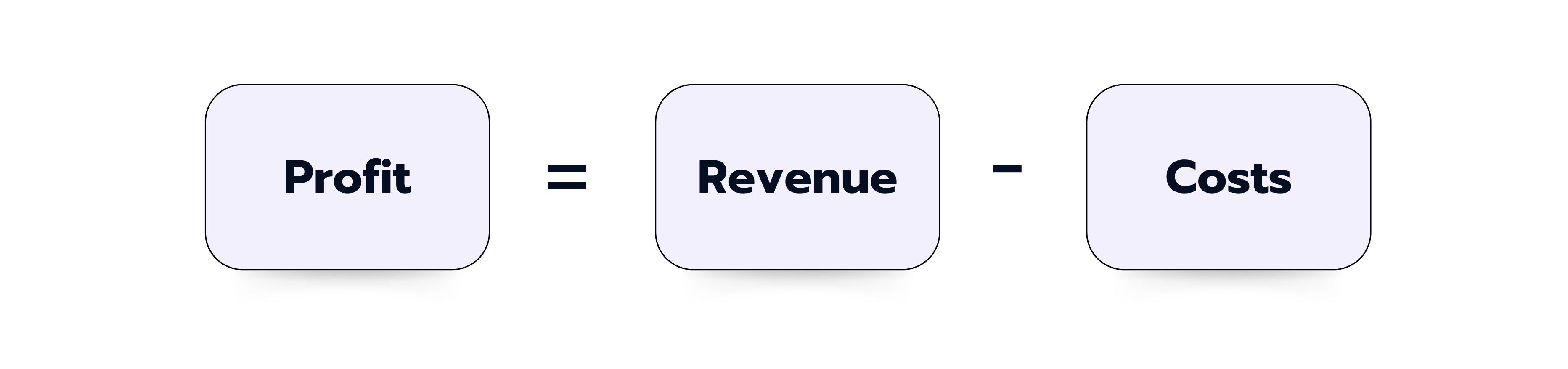

Profitability issues always stem from falling revenues, rising costs, or both. It is as simple as that. Your task will be two-fold: Perform a structured and quantitative analysis of the data to isolate the problem, and then find a promising solution. In most cases, you can use the profitability framework to structure the problem, but make sure to not blindly apply it, but to really understand the problem at hand and make adjustments as needed in the concrete business scenario.

The Profitability Framework – A Basic Tool to Structure Your Profitability Case

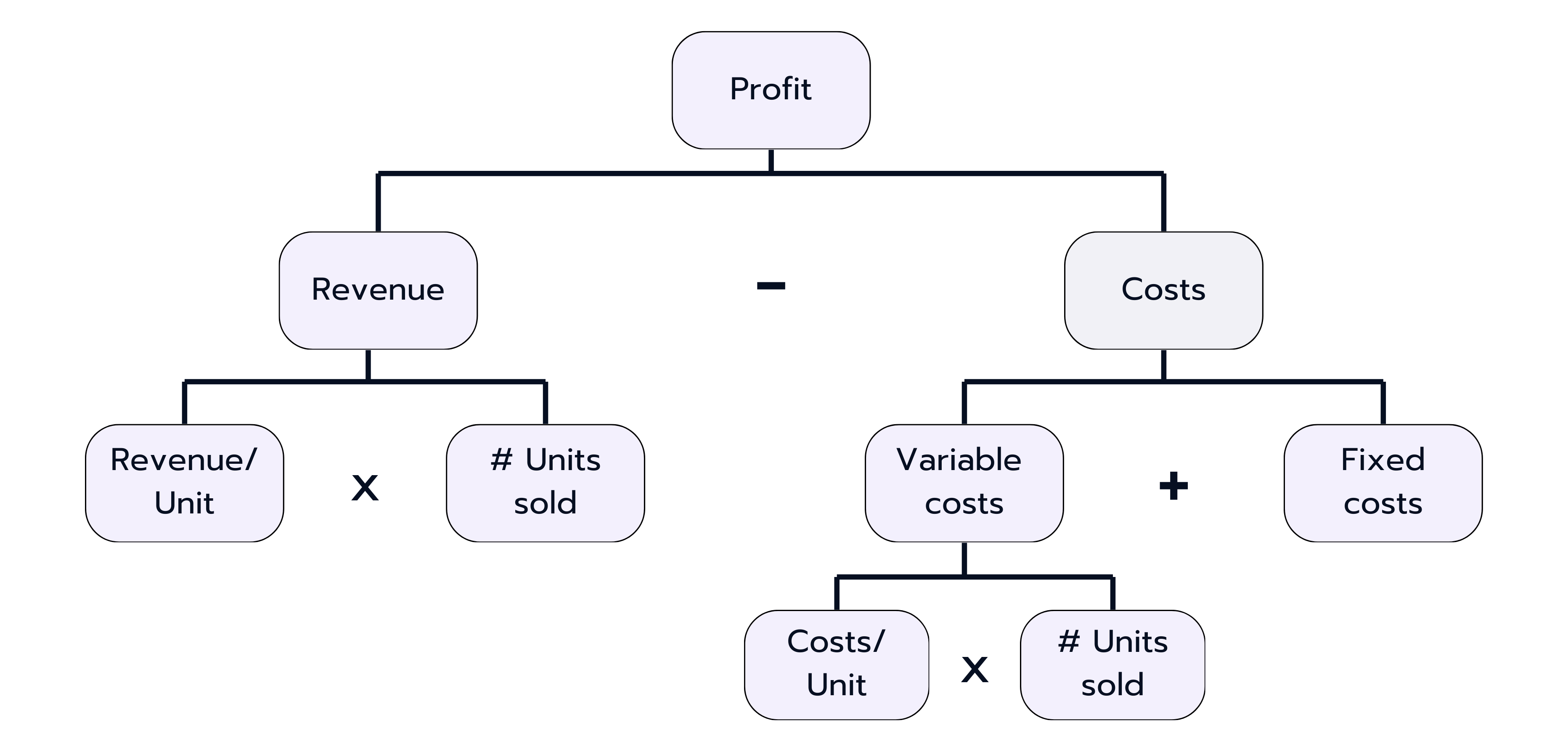

The Profitability Framework is a fundamental tool for approaching profitability cases. It is basically an issue tree that breaks down profitability into its key components: revenues and costs.

In the first place, this equation is pretty straightforward and not complicated at all. Next, it is your task to understand each side of the equation and identify the cause for declining profitability. There could be three reasons:

- Revenues have been declining.

- Costs have been increasing.

- Revenues have been declining and costs have been increasing.

(Always make sure to remember this option. It happens pretty easily that candidates identify either revenue or cost issues as the problem, completely focus on one side of the issue tree and forget to zoom out again, take a look at the big picture and consider the other side of the equation as well.)

So, the first question to get an answer to is “Have revenues been declining?”, “Have costs been increasing?”, or “Have revenues been declining and costs been increasing? And if so, which one is the bigger problem?”. Whenever you get the information that something has changed: quantify it! Ask by how much and in what time period. Depending on the answer, you will know on which side of your profitability tree you need to start your analysis. Always start with the most relevant driver (Pareto Principle).

💡 Pro Tip: When trying to find out where to start your analysis, keep in mind to communicate like a consultant. A Bainie would not go to the client and bluntly ask “Have your revenues been declining?”, but rather formulate a question like “How have your revenues been developing over the past five years?”. It may be possible that your interviewer will then share an exhibit with you that not only contains revenue information, but also valuable insights on product lines, geographies or other relevant data, which you can use throughout the case.

Scenario 1: Revenues Have Been Declining

Let’s assume, the profitability problem stems from declining revenues. There are many potential reasons for this and you need to find out which one applies in order to come up with a solution. Most important for your analysis is to stay structured at all times.

1. Understand How the Business Makes Revenue

To structure your analysis of declining revenues, you need to understand the business model of the company you advise. So basically answer the questions:

- How does this company make revenue?

- What does the revenue consist of?

- Which component of the revenue has been declining?

Understanding your client’s business model is absolutely crucial for your revenue analysis. Only when you know which products the company sells and which customers it serves, will you be able to give solid advice on how to solve profitability problems.

2. Break Down the Revenue into its Single Components

Once you have understood the general business model of your client, you can go on and break down the revenue into its components. Depending on the business model of the company, the equation can differ.

Let’s take a look at some examples depending on different industries:

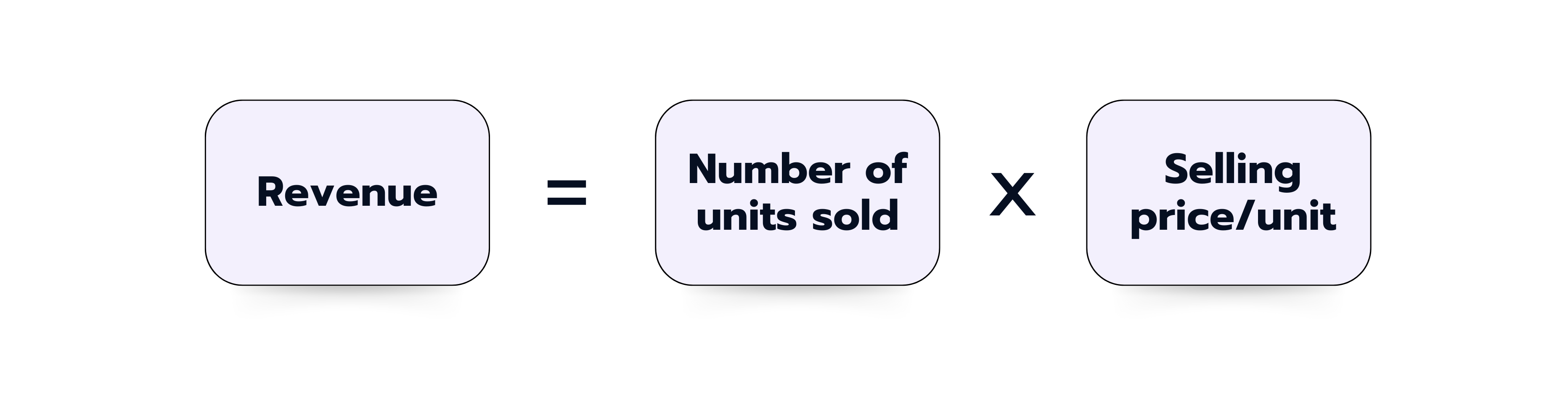

Manufacturing and Retail Industry

Revenue = Number of Units Sold × Selling Price per Unit

Number of Units Sold: The total quantity of products manufactured or sold to customers.

Selling Price per Unit: The price at which each unit of product is sold to distributors, retailers or customers.

Subscription-Based Services (e.g., Streaming Services, Software as a Service)

Revenue = Number of Subscribers × Monthly Subscription Fee

Number of Subscribers: The total number of customers who subscribe to the service.

Monthly Subscription Fee: The amount charged to each subscriber on a monthly basis.

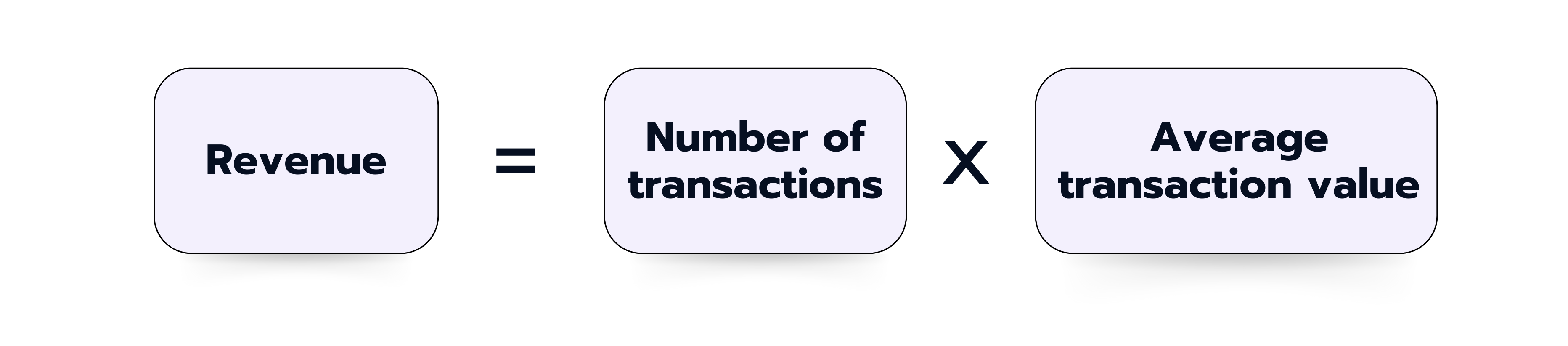

E-commerce Industry

Revenue = Number of Transactions × Average Transaction Value

Number of Transactions: The total number of orders placed by customers.

Average Transaction Value: The average amount spent by customers per transaction.

Advertising Industry (e.g., Digital Advertising, Print Media)

Revenue = Impressions or Clicks × Cost per Impression or Click

Impressions or Clicks: The total number of times an ad is viewed or clicked by users.

Cost per Impression or Click: The cost charged to advertisers for each impression or click generated.

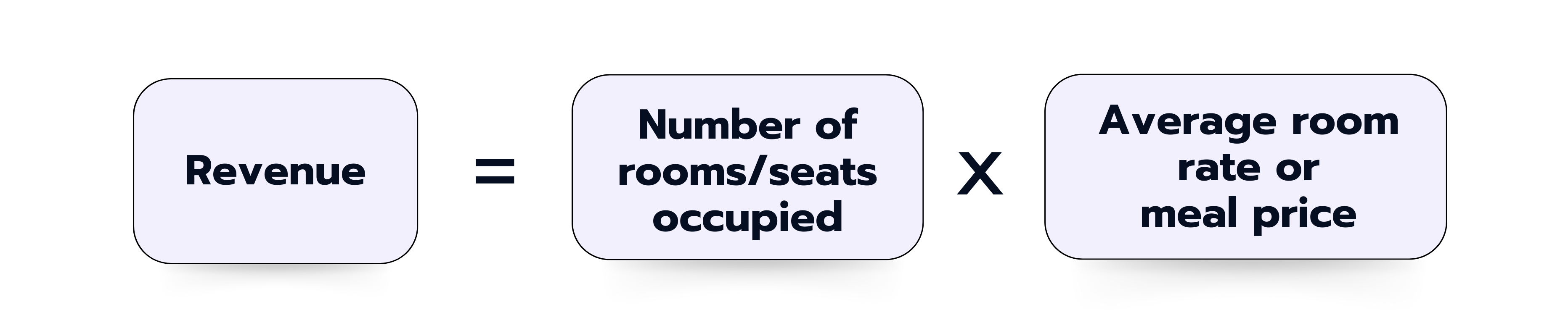

Hospitality Industry (e.g., Hotels, Restaurants)

Revenue = Number of Rooms or Seats Occupied × Average Room Rate or Meal Price

Number of Rooms or Seats Occupied: The total number of rooms booked or seats occupied by guests.

Average Room Rate or Meal Price: The average price charged per room or meal.

It becomes obvious that there is no one-size-fits-all-solution for a revenue analysis. You need to adjust your approach according to the client’s business model and needs.

3. Analyze the Single Components of the Revenue Model

Once you have a clear picture of what the revenue of your client is composed of, you can go on with your analysis by focusing on the component of the equation that appears to be the problem. For example, if your client is a manufacturer with declining revenues, you should find out if the number of units sold has been decreasing or the selling price per unit has been lowered (or a combination of both).

If the number of units sold has decreased, you go on with a further analysis on the reasons behind. These can be manifold, so make sure to stay structured and use segmentation to get to the root cause of the problem.

The segmentation you use needs to be customized to the case at hand. Make sure to let your interviewer know your thoughts and guide him or her through the case. That way, you will usually get valuable hints on which direction to go.

Examples for segmentations are:

- Product segmentation: Product types? Price ranges? Packaging sizes?

- Customer segmentation: Small / medium-sized / large businesses? Age groups? Sex? Income groups?

- Market segmentation: Geographies? Industry verticals?

- Channel segmentation: Distribution channels?

If you’ve found the biggest driver of the problem, you oftentimes have to switch to a more qualitative framework (for example the 4 Cs) to find the underlying root cause. For example: when you have less revenue, but the price is the same and units sold dropped, you have to find out why. Is there a new competitor on the market? Do you have quality problems, or did you just stop a marketing initiative that you ran for years prior to this drop?

The same procedure applies if pricing seems to be the issue for declining revenues. “Let’s increase prices” might be an easy recommendation to give, but most likely too easy to be valuable. It is crucial to understand first, why prices have decreased and again, the reasons might be diverse. Make sure to use a structured approach in order to pinpoint the exact problem.

Possible reasons and forces for decreasing prices may be:

- Internal:

- Increased Supply: Overproduction or excess inventory can lead to discounted pricing to clear out stock.

- Competitive Pricing: Aggressive pricing strategies by competitors can force companies to lower prices to remain competitive.

- External:

- Price Sensitivity of Customers: Changes in customer price sensitivity and purchasing behavior can influence demand and pricing strategies.

- Market Saturation: Increased competition and market saturation can lead to price wars and downward pressure on prices.

- Economic Conditions: Economic downturns or recessions can impact consumer purchasing power and demand for products.

- Exchange Rates: Fluctuations in exchange rates can affect import/export prices and overall cost structure.

It may not be surprising that when looking out for the reasons of the client’s revenue problem, staying structured is most important. Come up with solid hypotheses and validate or neglect them in the dialogue with your interviewer and based on the data that will be provided to you throughout the conversation. This requires flexibility and spontaneity, so learning frameworks by heart will not help you here. It is important to internalize the way of thinking a consultant uses and solve cases with peers to put it into practice.

👉 To find like-minded candidates for mock interviews, take a look at our Meeting Board and simply accept one of the open invitations.

4. Recommend Actions to Get Revenues Back on Track

Once you have successfully narrowed down the problem, there is one last thing for you to do: Come up with actions that get your profitability back on track. Most likely these will be actions to improve your revenues (also increasing the total value of your business), but there is a slight chance that at this point of your case, you may have to take a look at the big picture again and consider cost cutting measures as well.

Whatever you do, don’t get too excited before you have crossed the finish line. Even at this final stage of your case interview, one thing is absolutely crucial. You might have guessed it: Structure!

Don’t come up with a random list of possible solutions. Prioritize them based on their impact and categorize them, for instance by short-term or long-term actions or according to the difficulty of implementation.

Last but not least, remember to communicate your outcome of the analysis answer-first. Start with what the client should do and then go on with the reasons behind.

Scenario 2: Costs Have Been Increasing

If revenues have been flat or increasing, but profitability is going down, your client might have a cost problem. The task for you as a consultant (or candidate in a case interview) is the same as for scenario 1: Identify the cause(s) and come up with recommendations to solve the problem. Use a structured approach for your analysis and communicate clearly what you are doing while working through your case.

1. Understand the Business Model and General Cost Structure of Your Client

Before you can start to analyze the cost issue(s) of your client in detail, you need to understand what the business is actually doing and which business model is behind. The question of how the company makes money and which industry it is in, already implies which cost structure may be behind. For example, a service company will most likely have labor costs as its main cost driver while a manufacturing company will most likely have high spendings on raw materials. So, before you dig deeper into the cost structure of your client, get a better understanding of its business model first.

2. Break Down the Costs into its Single Components

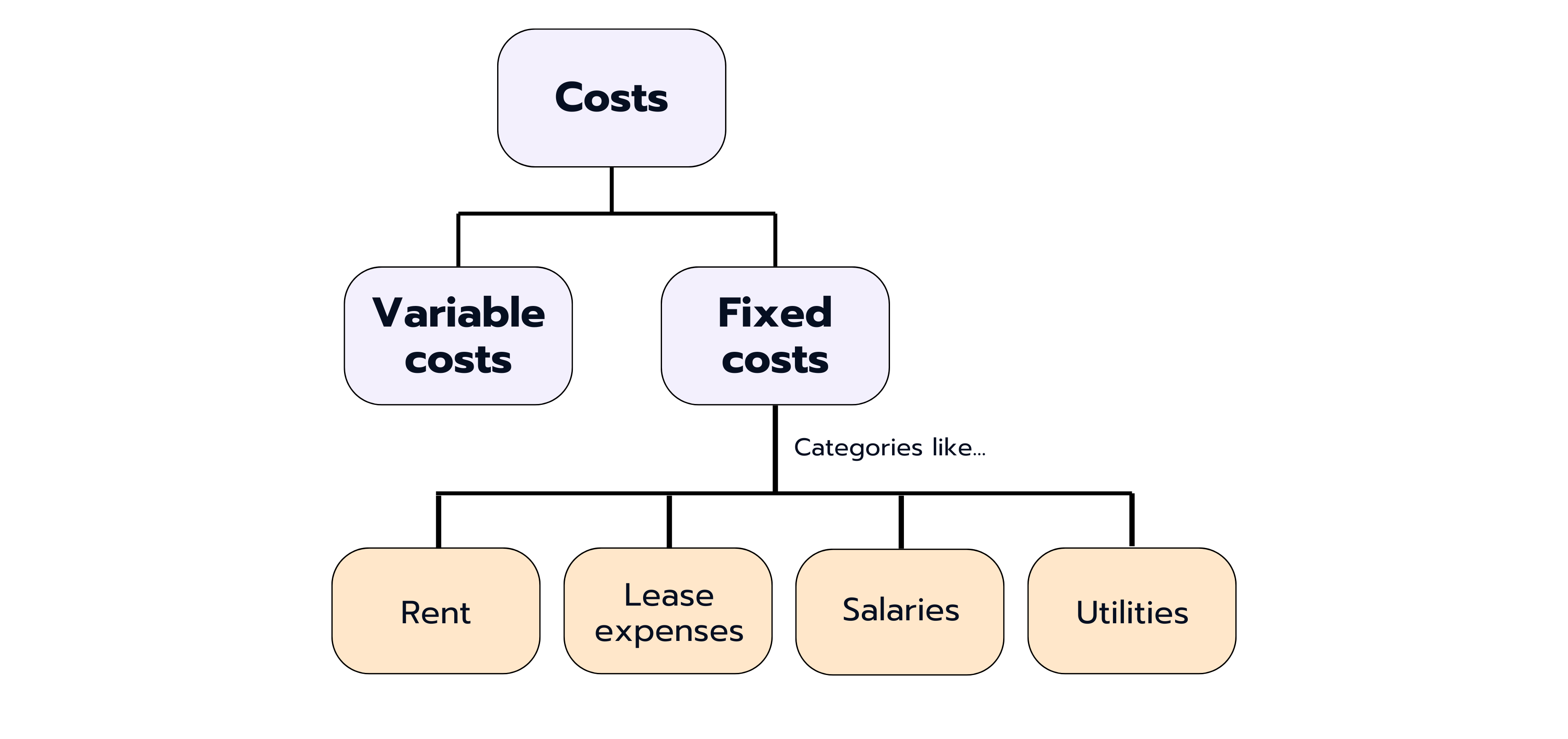

To start off with your cost analysis, you need to develop a structured approach first. Segment your costs into different categories (and remember the MECE principle while doing so). A common way to break down the costs is to differentiate between fixed and variable costs. Fixed costs do not vary with production or sales volume while variable costs change in proportion to the sold goods or services.

3. Analyze the Single Components of Your Cost Structure

Once you know which component of your total costs has increased, you can go one step further down your issue tree and focus on that component first. But always remember to stay structured and segment as you go on identifying the root cause of your profitability issue.

If your fixed costs appear to be the problem, you would go on by separating different cost categories (e.g. rent or lease expenses, salaries, utilities etc.) and taking a closer look at each one of them. Based on the business you are advising, you should make educated guesses on which cost categories may be the most relevant ones and start with these ones first. Let your interviewer know your thoughts and he or she will guide you in the right direction.

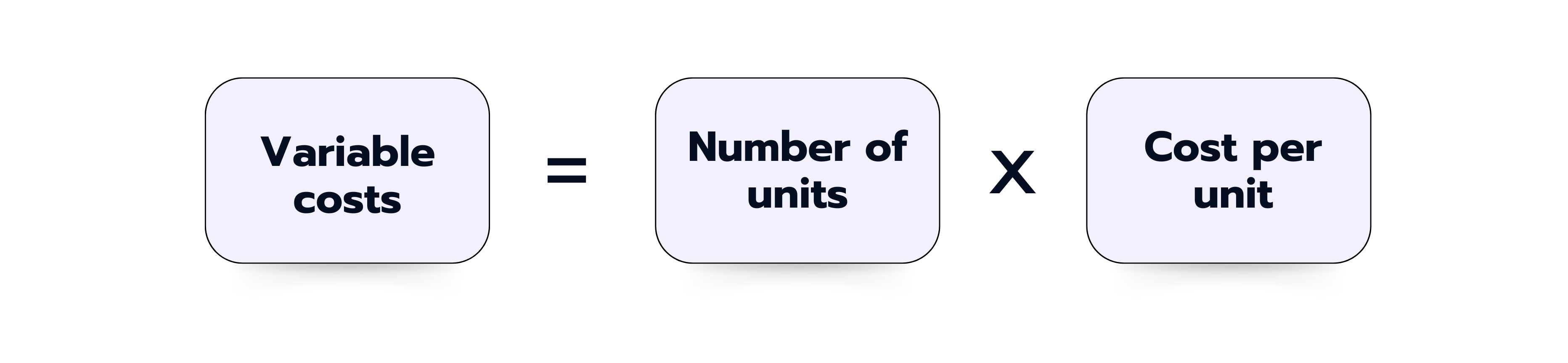

If your variable costs appear to be the problem, you would go on with splitting these costs into its components. The equation is the following:

Variable Costs = Number of Units × Cost per Unit

Number of Units is the total quantity of units produced or sold.

Cost per Unit is the cost incurred to produce one unit of product, excluding fixed costs.

Remember to adjust the equation to the business model of your client. Which units are we talking about? Which kind of cost per unit do we need to consider? The equation might look different depending on whether your client is a manufacturer or service company, so it is important to internalize these basic approaches and adjust them flexibly to your case.

Once the composure of the variable costs is clear, you will go on by analyzing either side of the equation. Start with the one that seems to be more relevant first. Let your interviewer know why you would want to focus on that and receive feedback if you are on the right track.

At this point, you will most likely be able to quantify the cause of your rising costs and need to get more qualitative in the identification of possible reasons. Don’t make random guesses, but think before you speak and stay structured. For example, you could start off by differentiating internal or external reasons. If the problem seems to be internal, you could go on by working through the value chain. It is important that each of your steps follows a comprehensible logic.

Your procedure highly depends on the case you were given and there is no standard framework that will help you out at this point. But don’t worry: With a good amount of practice, you can develop the mindset of a consultant and significantly improve your performance. We recommend at least 10-15 mock interviews with peers before the final day, so check out our Meeting Board and schedule meetings with like-minded candidates.

4. Recommend Actions to Improve Profitability

As a last step, identify actions that help your client get its profitability back on track. If rising costs are your main issue, cost cutting measures may seem obvious. However, there may be cases where rising costs are your main problem, but there is not much you can do about it (e.g. if the prices for necessary raw materials increase due to climate changes), so remember to keep the big picture in mind, zoom out and do not forget that measures to increase revenues might also be a good solution to your profitability issue.

Categorize, structure and prioritize your recommendations. What are the most important measures and why? Make sure to communicate the outcome of your analysis and the corresponding recommendations clearly. You have made it this far, so stay concentrated until the end of the case and leave a lasting impression.

Scenario 3: Revenues Have Been Decreasing and Costs Have Been Increasing

This is the worst scenario your client could possibly face. Profitability is going down, because revenues have been decreasing and costs have been increasing. How can you approach this case in a case interview?

It is actually quite simple. First, you need to understand which one is the bigger problem or the problem you have more scope of action to address: Decreasing revenues or increasing costs. Focus on that problem first and follow the procedure you have learned in scenario 1 and 2. If you notice, you are going down the wrong path, go up your issue tree again and take the other branch. Not validating your initial hypothesis is always fine as long as you communicate it clearly to your interview and stay structured in everything you do.

Profitability Case Example

Let’s take a look at a profitability case example just like the ones you might encounter in your case interview:

Your client is a chewing gum manufacturer. The CEO of the manufacturing company is concerned because her company is experiencing declining profitability. Please investigate the reasons for the decline and give suggestions for improvement.

1. Clarify the Problem.

Start off by making sure you have understood the question correctly. A good way to do so restating the problem: “Just so we are on the same page, our main objective is to determine the reasons behind the decline in profitability for a chewing gum manufacturer and provide recommendations to improve the profitability of the business, is that correct?”

You can then go on and ask further questions to better understand the structure of the company and industry. What is the size of the company? Which kind of chewing gum do they sell? Who are the customers? What is the price of the product and how does it compare with competitors? Who are the key players in the industry?

Ask what you need to know to understand the situation of the customer and take notes. Summarize your findings, collect feedback from the interviewer if you have understood everything correctly and go on with the preparation of your structure.

2. Prepare your Structure.

“Thank you, may I take a minute to prepare my structure?”

Based on the term “declining profitability” in the case prompt (“falling sales” or “rising costs” can also be hints), it is valid to assume a profitability case and work the corresponding framework as a basis for your structure. But be careful: Don’t jump to conclusions too fast and make sure in step 1 that you have really understood the situation of your client and prepare a structure that is customized for it. Off-the-shelve-frameworks are never a good idea - neither in case interviews nor in the real consulting world.

Here, we do have a profitability case that can be analyzed by using the profitability equation to isolate and quantify the problem:

When profits go down, you either have a decline in revenue, rising costs, or both. The best way to find the root cause is to sketch the problem as an issue tree. Start with the more promising part, for instance, revenues - because the market is highly competitive. Obviously, you would share that thought with your interviewer and be on the lookout for hints. For example: “I am going to look at revenues first, since in a competitive market like the market for chewing gums, I’d expect this to be a big driver.”

You can further break down the profit tree like below:

Now you can start with one of the branches. Let's take the revenue side.

Try to start with the branch of the tree that also has the biggest impact on the case solution. Share your hypothesis with the interviewer and watch out for hints if you are on the right track.

3. Analyze the Revenue Side.

To understand the revenue side of the chewing gum manufacturer, segment the revenue streams. You can ask the interviewer whether you can segment the revenues into its component parts. If the interviewer prompts you to do the segmentation, you can think about different customer segments (small business / large business, etc., age group, sex, etc…), product lines, or regions (South America, Asia, etc.). This segmentation will help you isolate the root of the problem. You'll be able to develop better and more targeted analyzes.

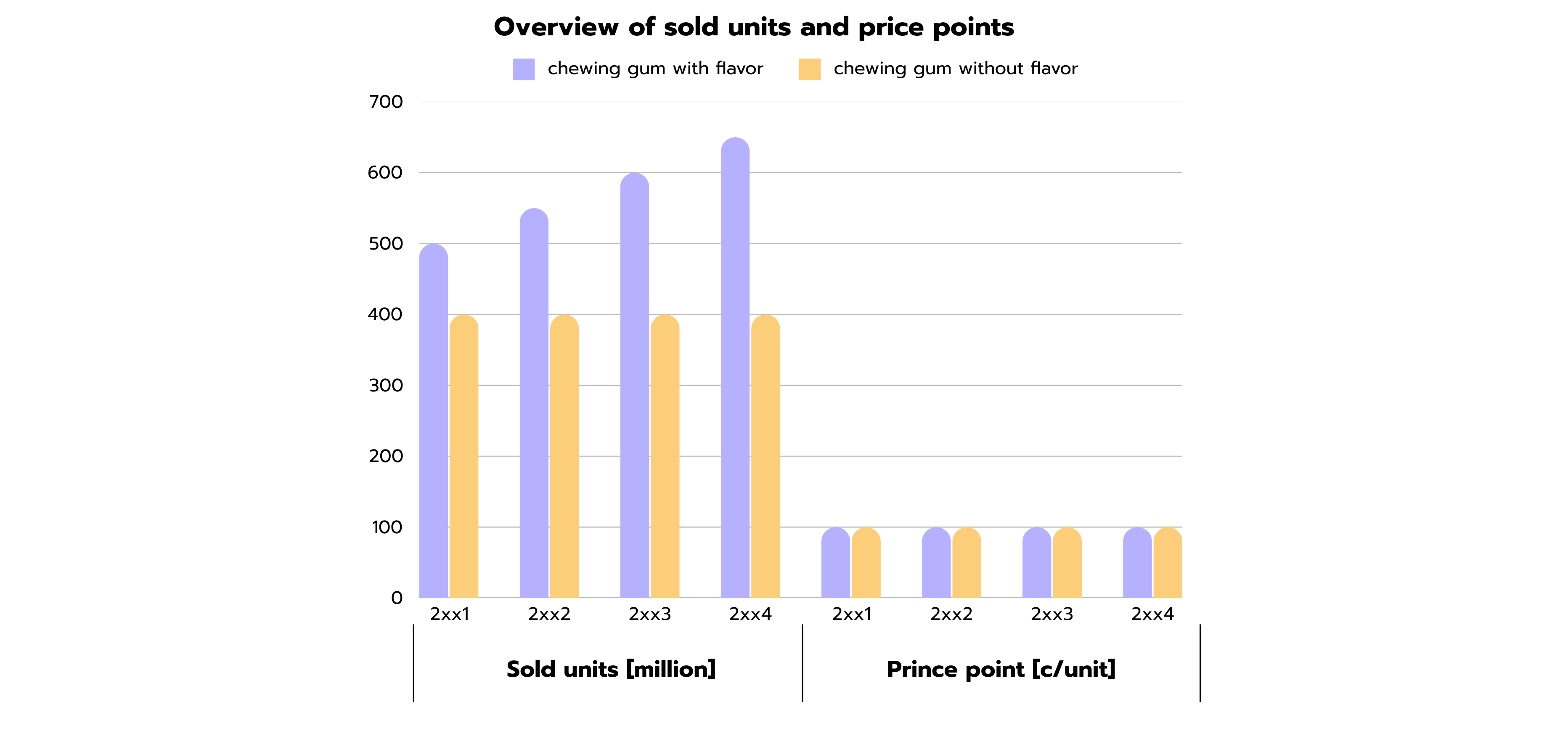

To help the chewing gum manufacturer improve her profitability, you may ask: “What are the revenue sources?”. The interviewer tells you that all revenue comes from two products: Flavored and non-flavored chewing gums. At this point, you might want to know the development of sales over the past couple of years. “How have sales figures developed over the years for both products?” She shares the following diagram with you:

It now becomes clear that revenue is not the problem because it has grown steadily in recent years. Therefore, it must be costs that rose significantly, leading to a drop in profitability.

4. Analyze the Cost Side.

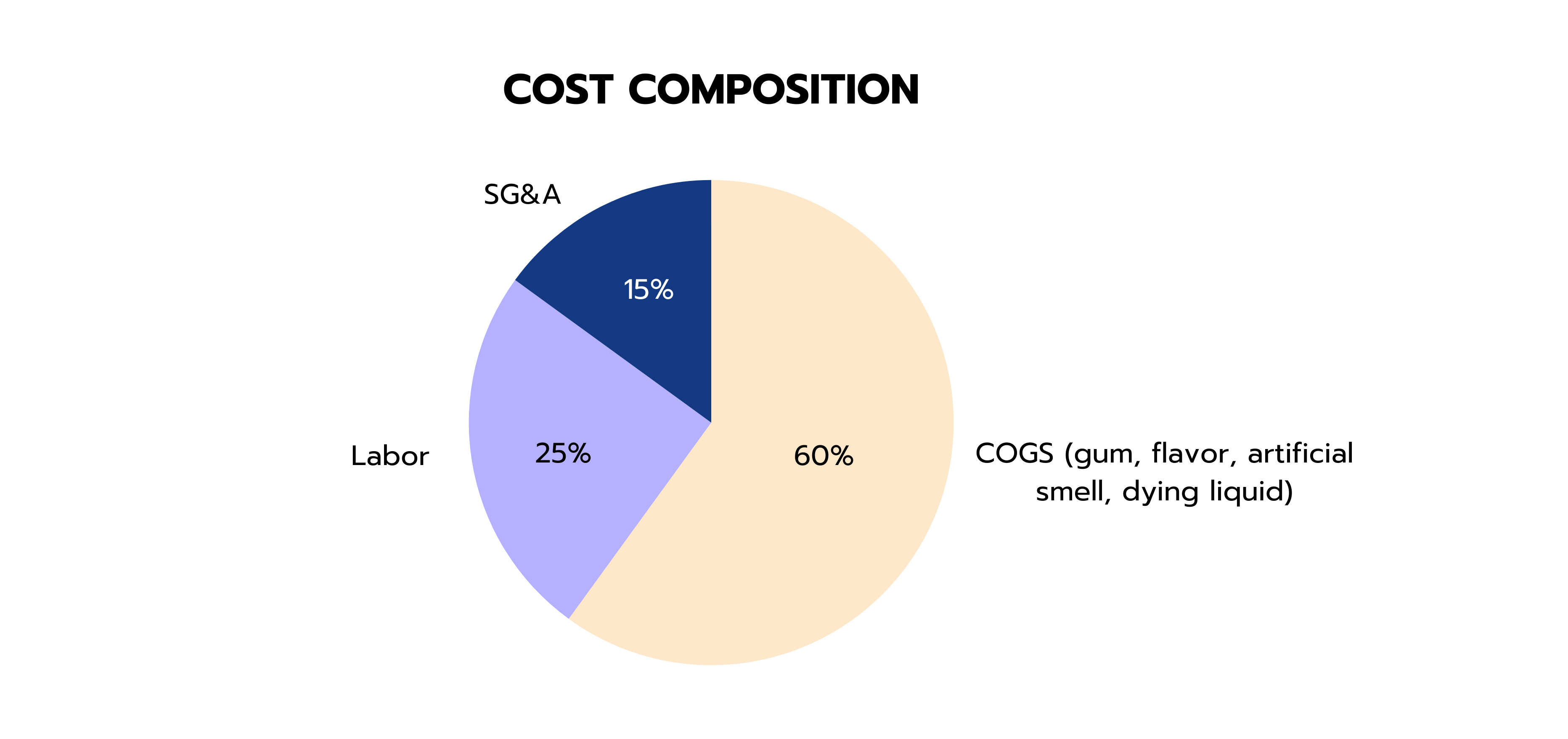

Now explore the cost side. You know that costs can be broken down into fixed and variable costs. You can then inquire about the breakdown of costs: "Please tell me about the direct/indirect cost split for the products.” The interviewer hands you the following graph:

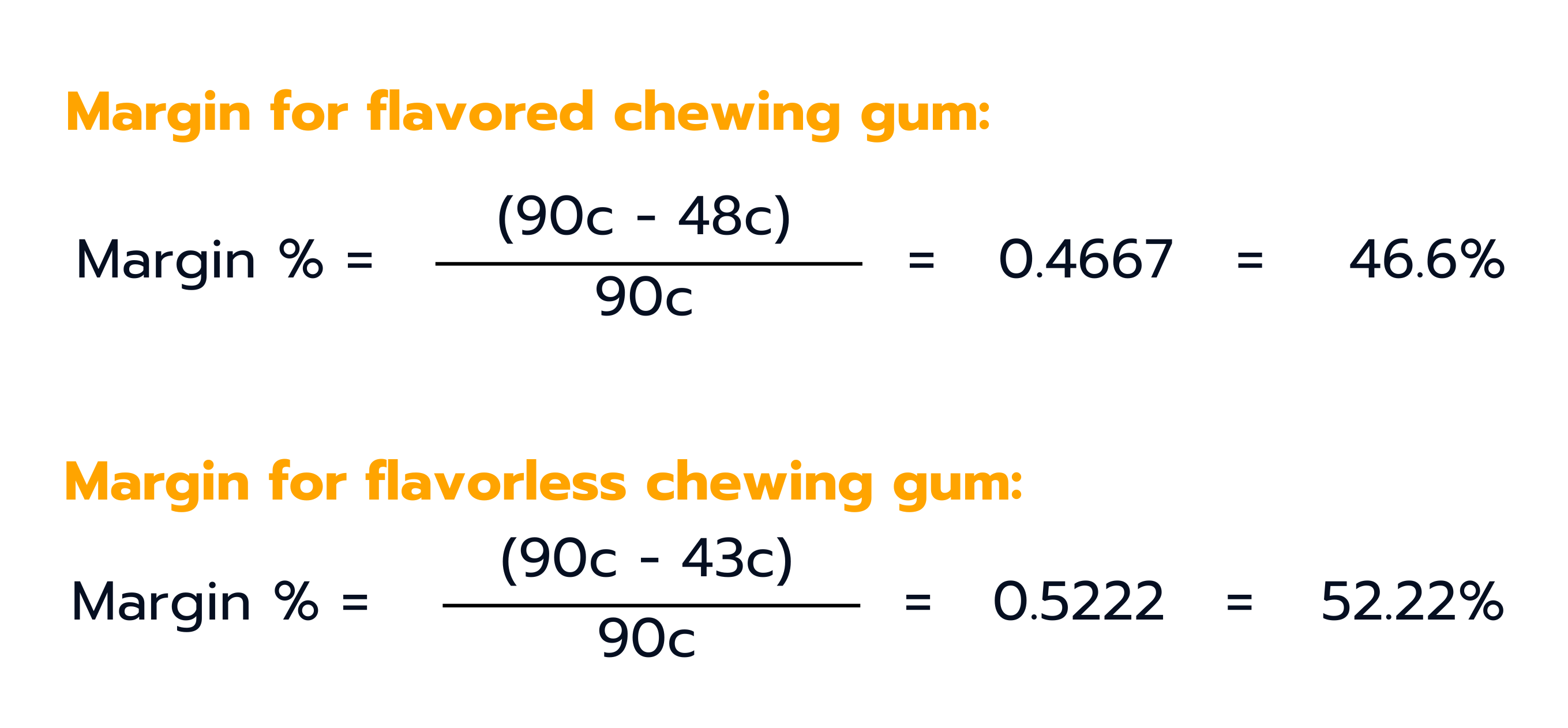

As we know that there are two different product lines, it is advisable to calculate their margins to check if there is a more profitable product line.

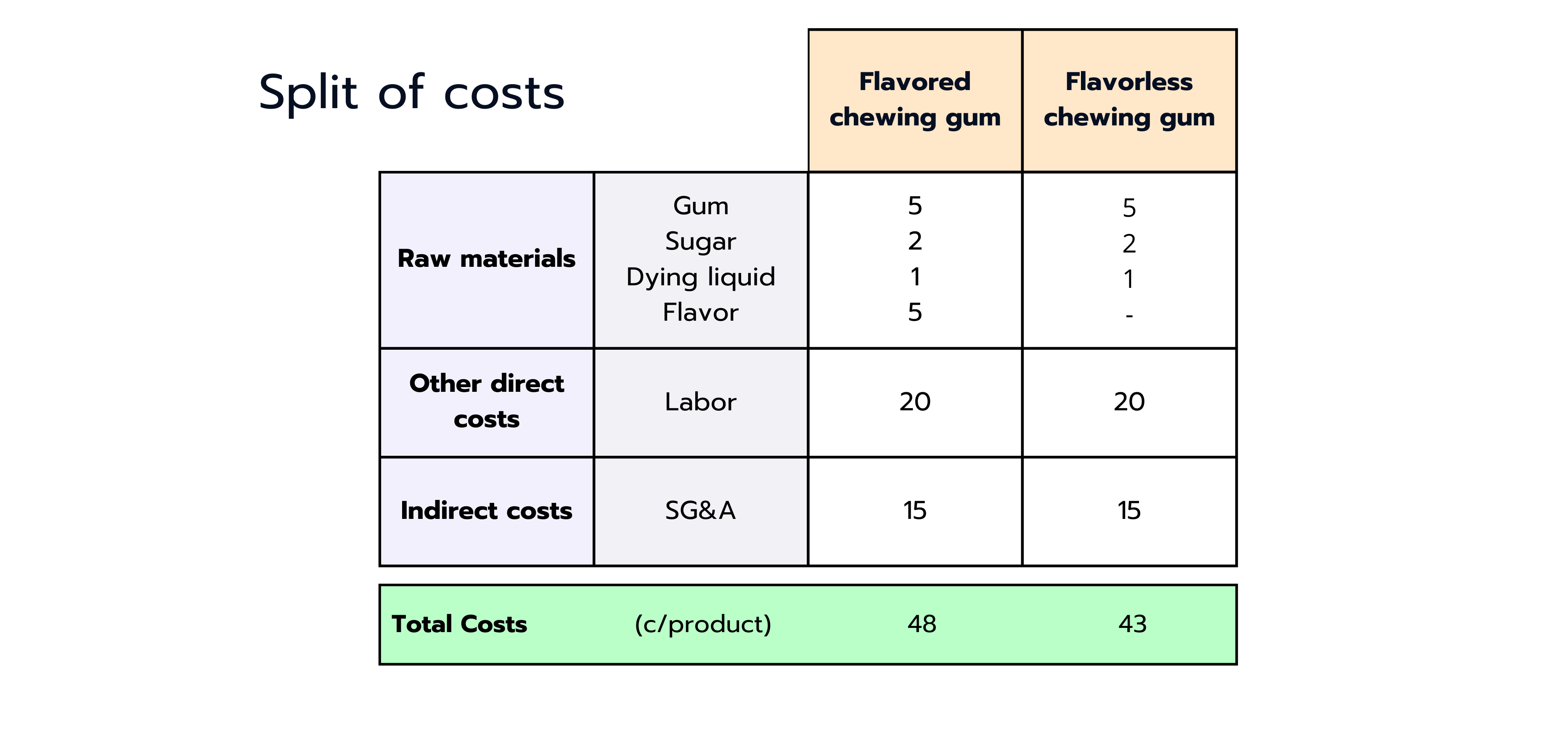

“I'd like to calculate the margins for both products; do you have information on the different prices and costs for each of them?” The interviewer hands you the following graph:

You calculate the margin for both products based on the following formula:

The root cause of the profitability problem becomes clear: “Analyzes show that the product whose sales have increased (flavored chewing gum) is also the one with lower margins due to the added flavor. Therefore, total profit margins have decreased while sales have increased.”

5. Close the Profitability Case.

After you have determined the root cause, you must develop a good logical solution (e.g., developing a competitive response, starting a marketing initiative, etc.)

It is important to stay structured even if you think you have reached the final stage. Therefore, categorize your approaches, for instance on a timeline:

Short term

- Negotiate with current suppliers.

- Look for other suppliers (form partnerships or buy greater amounts with batch discounts).

Long term

- Vertical integration.

- Release new products with better margins (e.g., low-calorie flavor gum or tooth cleaning gum).

- The client could also increase the price of the flavored gum, risking decreasing sales if customers do not see any added value with the price rise (high price sensitivity).

Key Takeaways - 7 Tips to Ace Your Profitability Case with Confidence

Profitability problems are frequent in consulting case interviews and nothing to worry about. We have summarized the 7 most important tips to keep in mind when solving profitability cases:

- Understanding the business model of your client and adjusting your approach according to the company’s needs is crucial to success. The standard profitability framework can be a good base to structure your case, but needs to be customized individually.

- Profitability equals revenues minus costs. Use this profit formula to build an issue tree and tackle down the root cause of your problem (but don’t forget about tip 1).

- Quantify your problem and look for trends. Locate the biggest driver of your profitability issue and prioritize it in your analysis.

- Combine quantitative and qualitative analysis to not only identify facts, but also understand the reasons behind.

- Keep the big picture in mind when recommending actions to improve the client’s profitability. The most obvious may not always be the most sustainable and best solution in the long run.

- Stay structured in everything you do and make sure you communicate your thoughts clearly to the interviewer. This applies to all cases and is the most important skill to master prior to your interviews (and the actual consulting job as well).

- Practice makes perfect: Solve one or two profitability cases on your own and then make sure to connect with peers and practice together. There is no better way to not only get into the habit of thinking like a consultant, but communicating like one as well. You will receive valuable feedback and improve your abilities much faster than with self-study only. Find plenty of case partners on our interactive Meeting Board and get started now!