Our client BeautyCo is a large European perfumery company with 500 shops across Europe. However, BeautyCo has been struggling with a decrease in profitability for some time and would like to work with us to understand what the causes and possible actions could be. Therefore, as a first step the client wants us to identify the cause of the profitability issues.

Case Prompt:

Short Solution

The clear structuring of the problem (development of a profitability driver tree for BeautyCo) as well as strong quantitative skills (calculation of profit margins, market assessment) are important. This case also tests the candidate's creativity (generation of possible countermeasures).

Question 1: After deriving a profit tree, the candidate should conclude that the profitability decline is driven by a decrease in volume. The candidate should identify the profitability decline primarily stemming from a shift from offline to online and particularly a relative loss of market share to Amazon, which is driven by lower prices on Amazon.

Question 2: The candidate should calculate the profit and operating margin for BeautyCo, which are 60% and 8%, leaving little room for lowering prices. The candidate should then discuss how Amazon is able to offer lower prices and identify not only scale but also the “Grey Market” as a sourcing platform.

Question 3: The candidate should calculate the overall size of the grey market and realize that it represents a significant portion of the overall market, 34%.

Question 4: BeautyCo should consider exerting slight pressure on suppliers, while positioning itself as a strategic partner to jointly protect the market from grey goods.

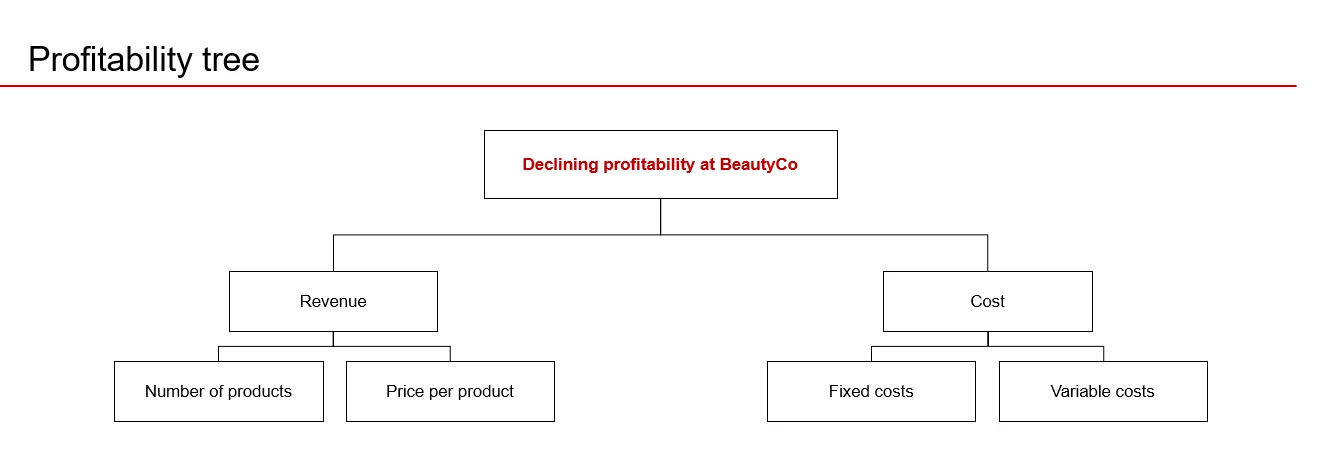

Question 1: What could be the drivers of declining profitability at BeautyCo?

In the first step, the candidate should draw up a profitability tree for BeautyCo.

This results from:

- (a) revenue minus (b) costs

- Revenue consisting of

- aa) number of products sold times

- ab) price per product

- Costs consisting of

- ba) fixed costs plus

- bb) variable costs

The candidate should then derive hypothesis and ask questions to identify the cause.

Question 1.1: Where do the profitability problems of BeautyCo stem from?

- Beauty Co's revenue has decreased significantly.

- We observe that fix costs and variable costs per unit (COGS) have remained the same.

- In addition, BeautyCo's selling prices have remained the same.

The candidate should conclude that BeautyCo's profitability problems stem either from a change in product mix (e.g., increased sales of low-priced products, fewer high-priced ones) or that BeautyCo is fundamentally selling fewer products.

- BeautyCo sells products in three segments: Fragrances, cosmetics and skincare.

- The product mix and their relative share of total revenue has remained the same.

- Moreover, the shares of high- vs. low-price products have not changed considerably.

- Also, we do not have any availability issues or products being out of stock.

The candidate should now infer that the profitability problems stem from a decline in volume, which is driven by a decline or shift in demand. Therefore, it makes sense to look at the overall market environment to identify where the change in demand is coming from.

Question 1.2: Which effect does the market environment have on BeautyCo's declining profits?

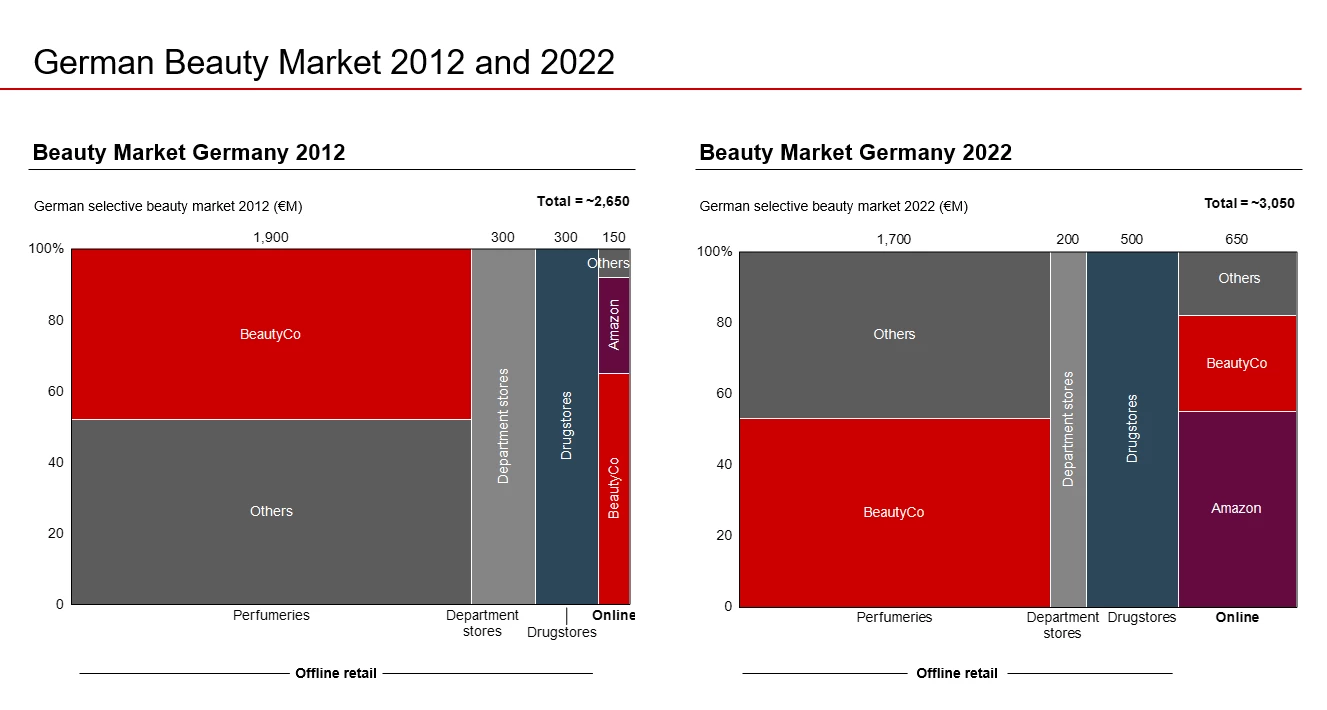

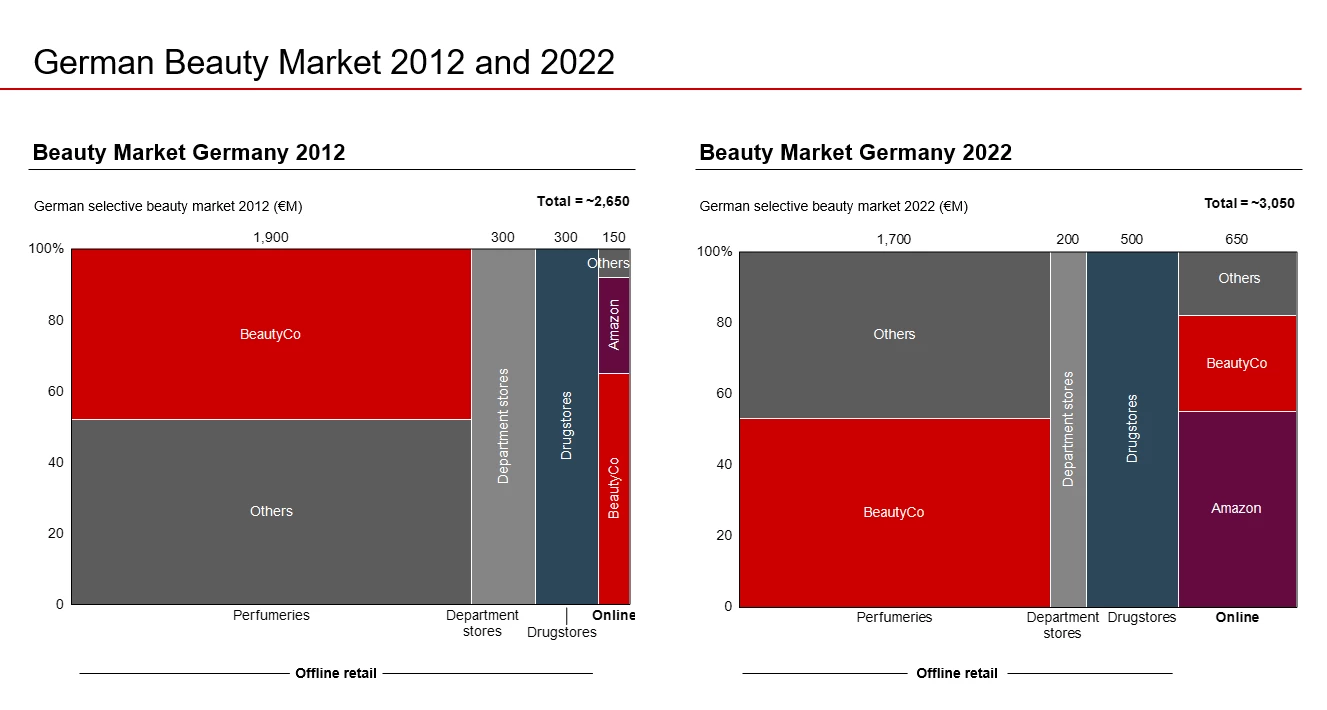

To better understand the change in demand, let’s have a look at exhibit 1, illustrating the German Beauty Market in 2012 and 2022.

The candidate should observe the following points on exhibit 1:

- The market has grown from 2012 to 2022 (around 15%).

- Offline retail has shrunk significantly, while online retail has grown at a strong rate (more than 4x as big as 10 years ago).

- Amazon and other online players are a strong competitor to BeautyCo's online store and are taking part of its online market.

- The drugstore market is also growing.

Revenues have fallen because BeautyCo has lost market share to other players, primarily Amazon and drugstores, shifting from offline to online. This is what drives our decline in volume and profitability.

Question 1.3: Why are customers more likely to buy from Amazon & other online players than from BeautyCo?

The candidate should identify the following options, questions can be answered by the interviewer:

- Broader product offer on Amazon 🡪 No, not the case.

- Greater convenience for the customer 🡪 Only limited relevance – BeautyCo's online shop is comparable to Amazon and Co.

- Accessibility and availability 🡪 BeautyCo’s online shop is among the top results in Google and other big search engines, making the consumer journey to its online shop straight forward.

- Brand awareness 🡪 BeautyCo has a very widely known brand.

- Better prices 🡪 Yes. Especially in the category "Fragrance". This will be crucial for later analyses.

Question 2: What is BeautyCo’s current Gross and Operating Profit Margin?

The candidate should know – or can be prompted – that Gross Profit Margin is accounting revenues for COGS and Operating Profit Margin also deducts fixed overhead costs. Therefore, we need to calculate the following aspects: Revenue, variable costs, fixed costs and then the gross and operating profit margin.

From exhibit 1, the candidate should estimate the revenues. It is okay to round here to make calculations easier.

- Offline: 50% * €1,700 M= €850 M

- Online: 30% * €650 M = €195 M

- Total revenues: €850 M + €195 M = €1.045 bn

1. Variable (interviewer to provide candidate with the following information):

- Total variable costs: €400 M

2. Fixed (the candidate should come up with the below categories without significant support and make assumptions and educated guesses here about the numbers, interviewer can support as necessary)

- Personnel costs for employees: 10,000 employees * €40,000 average salary = €400 M

- Stores:

- Store rent: €10,000 per branch

- Number of branches: 500

- Therefore total cost for stores: €10,000 * 500 * 12 months = €60 M

- Marketing expenditures: €40 M

- Other fixed cost:

- Other SG&A like admin, insurance, legal, utilities: €10 M

- Online shop maintenance: €10 M

- Total fixed costs: €520 M

- Total variable and fixed costs: €920 M

The candidate should now proceed to calculate profit and operating margins with the numbers calculated above.

The candidate can round revenues to €1 bn to simplify the calculation.

- Gross Profit: €1 bn - €400 M = €600 M

- Gross Profit Margin: €600 M / €1 bn = 60%

- Operating Profit: €600M - €520M = €80 M

- Operating Profit Margin: €80 M / €1 bn = 8%

Question 2.1: How does Amazon sell at lower prices?

After the candidate has calculated the margins for BeautyCo, the candidate should infer that BeautyCo has limited room to decrease prices given its operating profit margin of 8%. Lowering prices – with everything else being equal – might quickly decline profitability too much and generate losses. We know, however, that Amazon is more attractive to shoppers because of lower prices, especially in the category “Fragrance”.

This is a brainstorming exercise to discuss how Amazon manages to set low prices.

The candidate should mention some of the following aspects:

- Scale advantage: Amazon’s global scale is larger than BeautyCo’s. This allows for greater purchasing power and enables lower sourcing prices. Also, as a pure-online player, fixed costs are lower (e.g., no rent for stores).

- Strategic priority: Amazon may pursue strategic price setting (at low profit or even at a loss) to enter a market and gain market share.

- Marketplace on Amazon: Amazon has limited control over third-party sellers and their prices on its platform.

- Grey Market: Amazon and its third-party sellers buy exclusively on the "grey market" (producers + distributors sell part of their products through unofficial distribution channels, at lower prices).

The candidate should mention a few of these points – if the "grey market" is not addressed, the interviewer can pass this information on to the candidate.

- Grey market (information to be shared with candidate, after candidate shared his/ her guess on what the grey market is exactly)

- The product manufacturers sell their products to so-called grey-market distributors – those distributors then resell the products to companies such as Amazon.

- Goods come from other countries (arbitrage).

- Manufacturers themselves sell goods at lower prices to grey market distributors, e.g., to achieve volume targets, surplus goods (and thus ruin their own price).

Question 3: How big is the grey market in Germany?

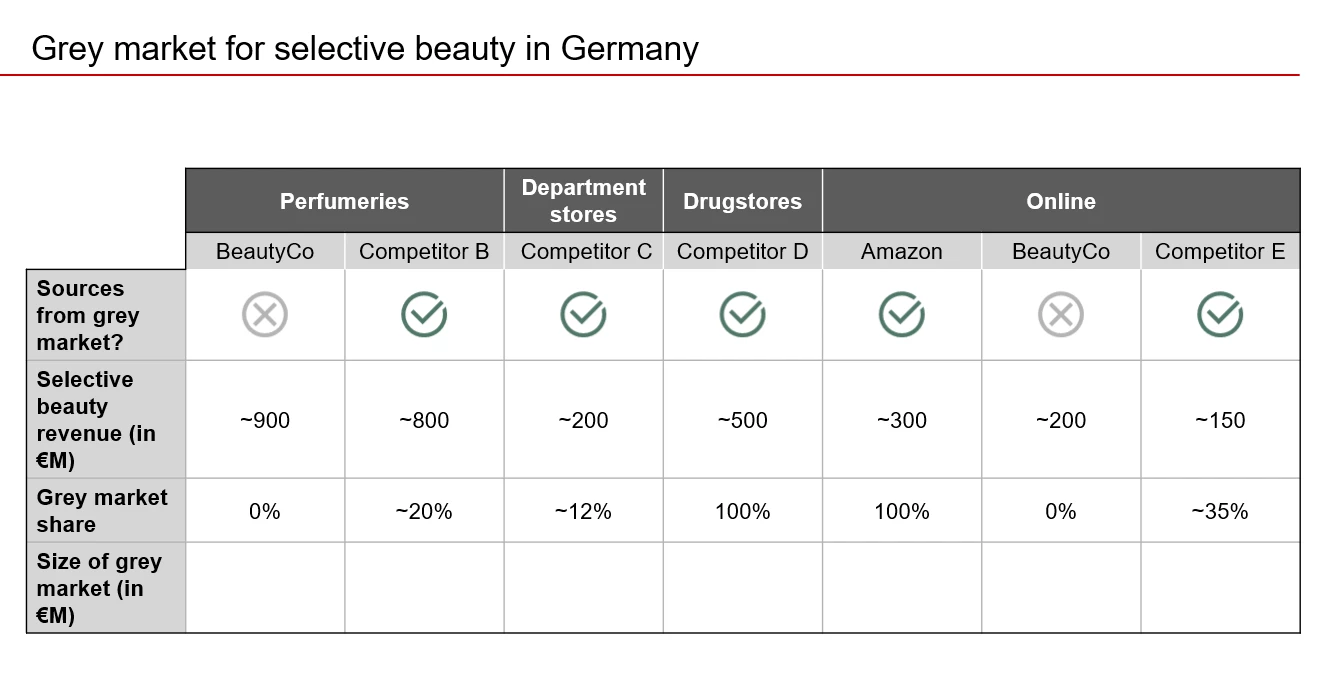

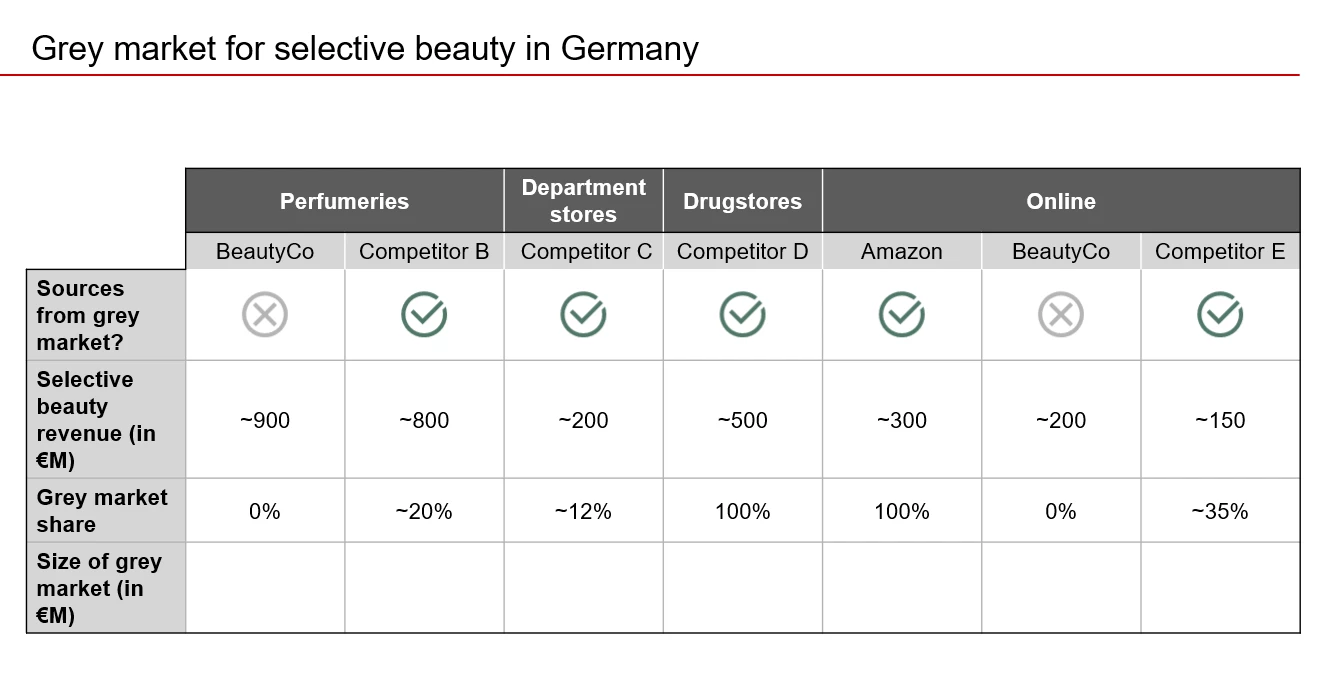

Many players buy part of their sales volume in the grey market. To better understand the problem, let's look at the size of the grey market. The interviewer should share exhibit 2 directly with the candidate.

In the next step, the size of the grey market can be calculated (in writing).

€900 M * 0% + €800 M * 20% + €200 M * 12% + €500 M * 100% + €300 M * 100% + €200 M* 0% + €150 M * 35% = €1,036.5 M

It is important that after calculating, the candidate thinks about whether the number is realistic or not (therefore it makes sense to set it into context with the overall market from exhibit 1).

€1,036.5 M / €3,050 M = ~ 0.34 = ~34%

It is around 34% of the total market – seems realistic and relevant. Furthermore, the candidate should note that BeautyCo, as per exhibit 2, is the only major player not sourcing from the grey market, giving BeautyCo a serious competitive disadvantage.

Question 4: What can BeautyCo do to increase its own competitiveness?

This task is for brainstorming for the candidate (creativity is needed here, additional ideas are highly welcome):

- Sourcing products also via the grey market

- Pro: Lower purchase prices and thus higher competitiveness

- Con: Possible consequences under contract law; risk of losing one's own manufacturer; reputation risk if this is made public

- Put pressure on manufacturers by threatening them with consequences such as delisting

- Pro: If successful, cheaper purchase prices or contained grey market and thus weakened competition

- Con: Grey market sourcing may increase in case of delisting, delisting harms sales, reputation damages, potential negative PR

- Strategic alliance with the manufacturer to protect the market

- Pro: Win-win for manufacturer and BeautyCo

- Con: If the manufacturer does not comply, persistent weak competitiveness

- More ideas could be:

- Offer superior purchasing experience in stores and online to justify higher prices

- More focus on private-label or own products

- Analysis of fixed cost to create room for price decrease

- Partnership with Amazon

Conclusion (important, that the candidate finishes with an action-oriented and concise answer)

- If BeautyCo does not take steps against the grey market, the problem will intensify with the expansion of the drugstore and online business, so BeautyCo will continue to lose market share.

- It seems most sensible to exert slight pressure on suppliers, but at the same time to position itself as a strategic partner to jointly protect the market from grey goods.

Bain Case: BeautyCo – Where Did the Profits Go?