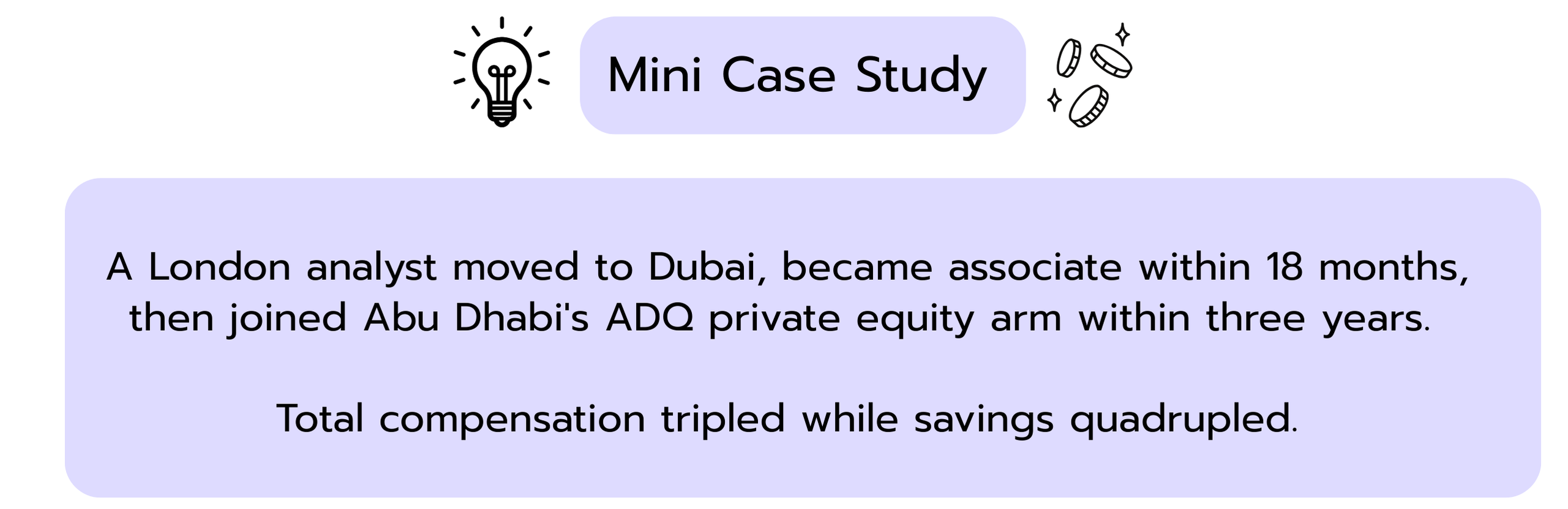

Dubai is attracting growing interest from aspiring and experienced investment bankers alike and it’s easy to see why. With tax-free salaries, international deal flow, and a vibrant expat lifestyle, the city offers some real advantages. But behind the skyline views and beach weekends, the market is tough, competitive, and selective.

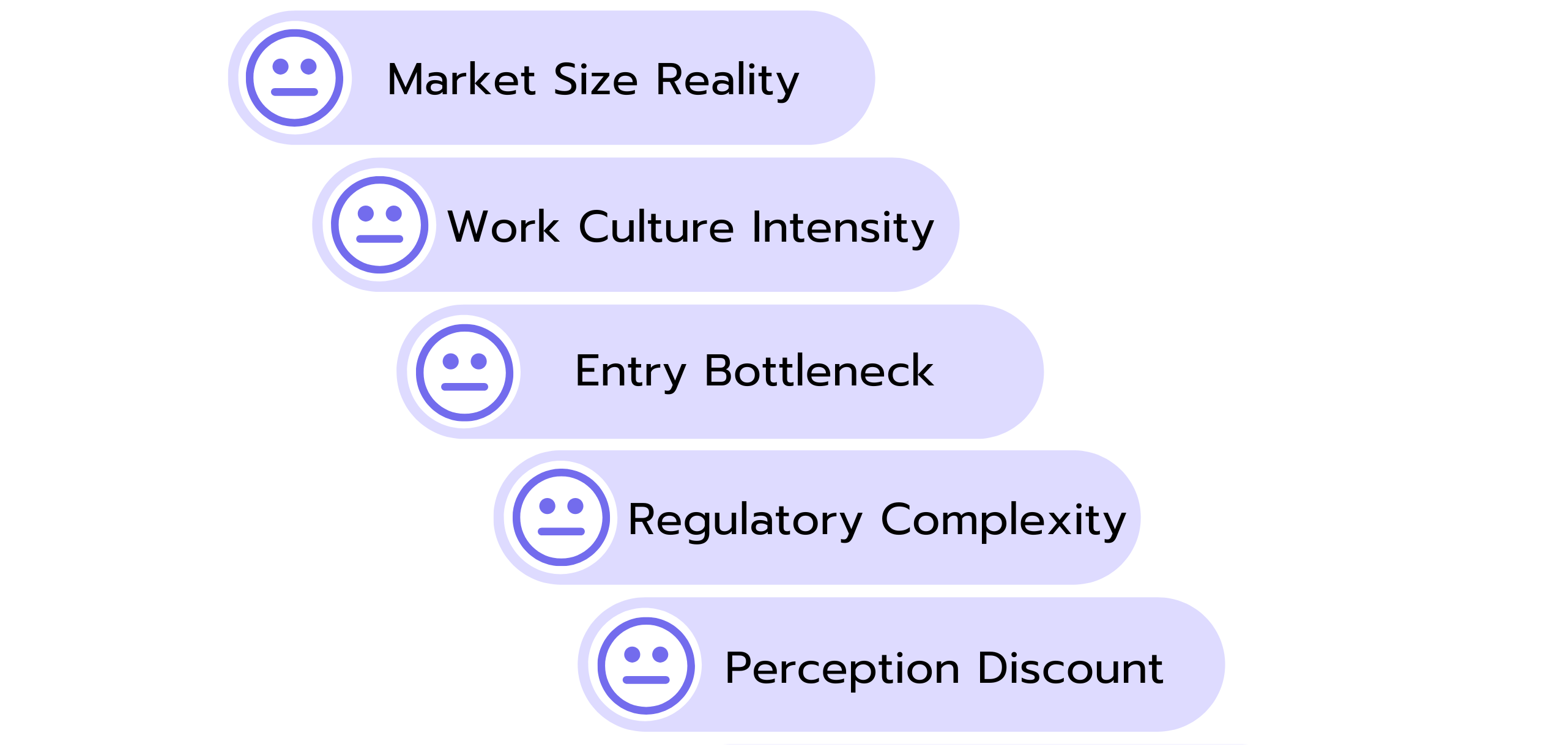

Breaking into investment banking in Dubai takes more than ambition. Roles at top firms are limited, and expectations around hours, output, and experience are just as demanding as in New York or London.

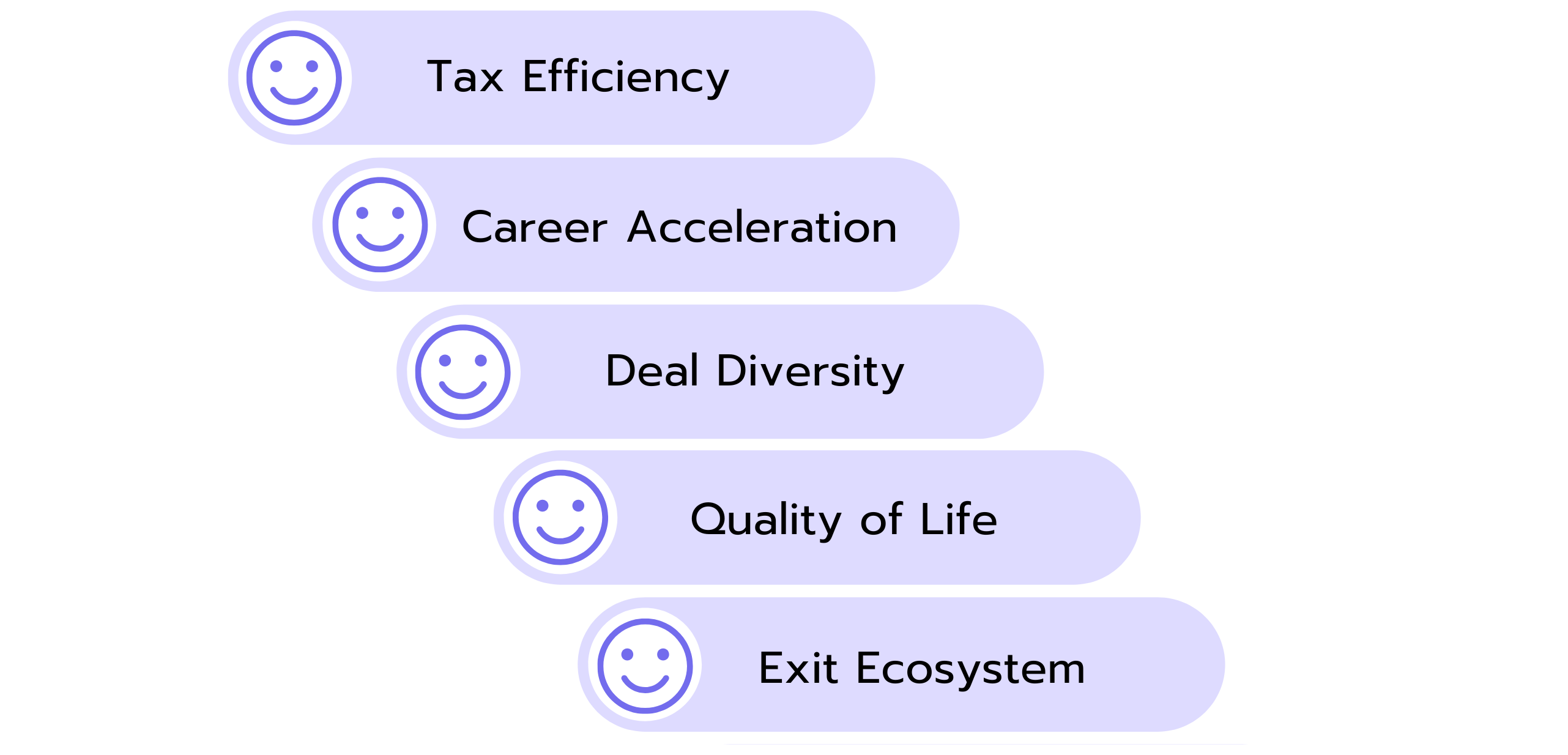

In this guide, we weigh the upsides and downsides of pursuing a banking career in Dubai. You’ll get a clear overview of the most important banks operating in the region, work culture, deals, exit opportunities, and what compensation typically looks like.

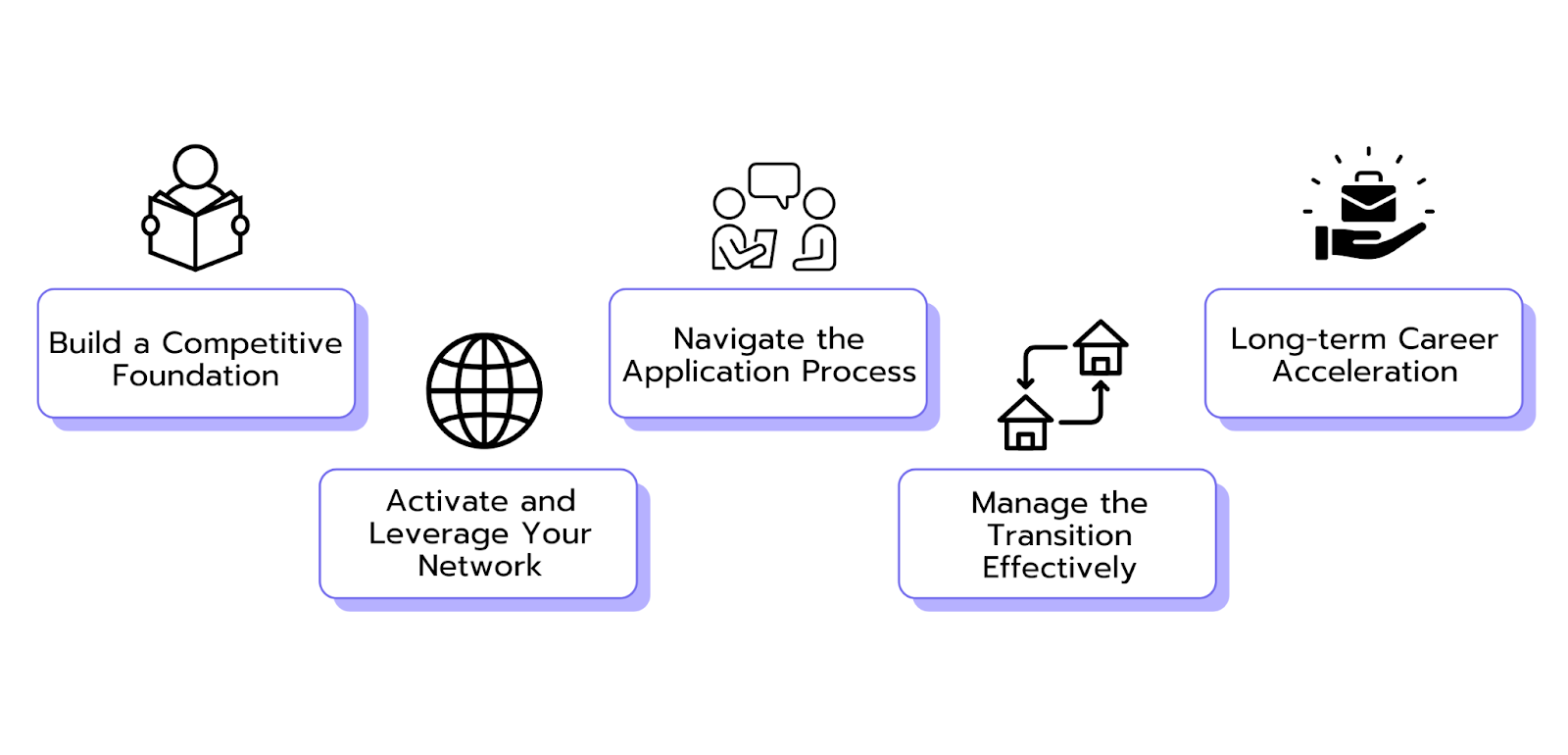

To help you take action, we’ve included a step-by-step career plan to improve your chances of landing an investment banking job in Dubai. By the end, you'll have a realistic and structured view of the market and a clear sense of whether this path fits your long-term goals.