What Is the Timeline for the Recruiting Process at the Bank of America?

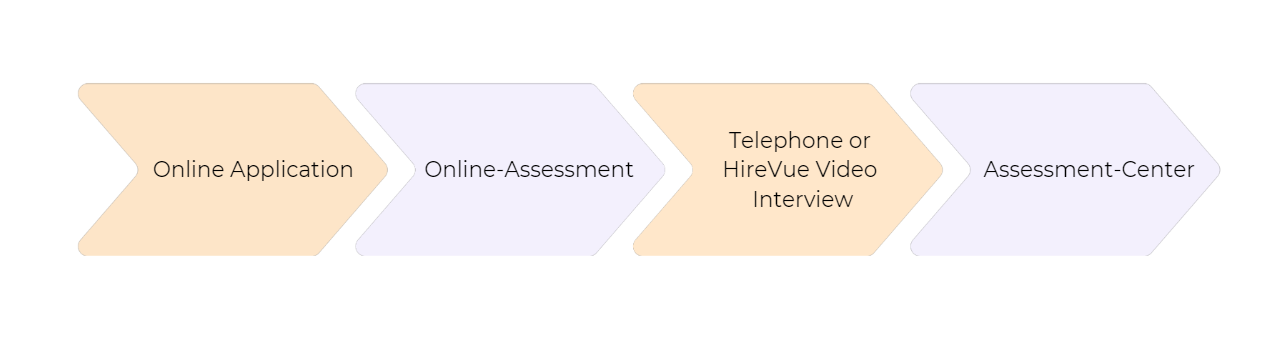

The recruiting process at the Bank of America typically spans between 6 to 12 weeks, though it can vary with the number of candidates applying for investment banking roles.

- Application Submission: The process starts when you submit your application online, and it can take anywhere from a few minutes to a couple of hours.

- Initial Screening: After submitting your application, it usually takes 1-2 weeks for Bank of America to conduct an initial screening.

- Phone or Video Interview: If your application passes the initial screening, you'll be invited to a phone or video interview within 1-2 weeks.

- Assessment Center (In-Person or Panel Interview): Following a successful phone or HireVue interview, you’ll get an invitation in 2-4 weeks to an assessment center for in-person interviews and a meeting with senior management.

Once you clear the final interviews at the assessment center, Bank of America will run a thorough background check on you, which can take 2-4 weeks. Afterward, you’ll get the offer letter and move on to the onboarding process.

What Questions Can You Expect In the Assessments and Interviews?

The questions you’ll be asked in the online assessment, telephone or video interview, and the assessment center during Bank of America’s hiring process are designed to test your confidence, intelligence, and skill level in different investment banking roles.

Below are some examples of what to expect in each round of interviews:

Online Assessment

The online assessment, or you may call it initial screening, has three rounds of questionnaires. Here is an example of each assessment:

Aptitude (Numerical Reasoning): A company’s revenue is divided between three departments in the ratio 3:5:7. If the total revenue for the year was $3 million, how much did the department receiving the largest share get?

A) $1 million

B) $1.2 million

C) $1.4 million

D) $1.6 million

Answer:

Solution:

Total ratio = 3 + 5 + 7 = 15.

Largest share ratio = 7.

Revenue for largest share = (7/15) × 3 million = $1.4 million.

- Aptitude (Verbal Reasoning):

Passage: "Bank of America has seen a rapid shift in consumer preferences toward digital banking. As a result, the bank has invested heavily in its mobile banking platform, which now accounts for nearly 70% of all transactions. This shift has led to a reduction in physical branch visits, prompting the bank to close some underperforming branches. However, customer satisfaction has remained high, indicating that the convenience of digital services outweighs the loss of in-person banking."

Question: Which of the following can be inferred from the passage?

A) Bank of America has experienced a decline in customer satisfaction.

B) Physical branches are no longer important for Bank of America’s operations.

C) Bank of America’s customers prefer mobile banking over in-person services.

D) The number of transactions has decreased due to branch closures.

Answer: C

- Aptitude (Logical Reasoning): All analysts at the Bank of America are required to complete a financial modeling course. John is an analyst at Bank of America. Therefore, __________.

Answer Choices:

A) John has completed a financial modeling course.

B) John has not completed a financial modeling course.

C) John might complete a financial modeling course.

D) John is exempt from completing a financial modeling course.

Correct Answer: A

- Fit (Personality) Questions: In the second round of the online assessment, recruiters will ask you questions about your personality for the cultural fit. Some of them can be:

How do you typically approach your daily tasks?

How do you handle conflicts with coworkers?

What motivates you to perform well at work?

- Situational Judgement: You are an analyst in the Investment Banking division at the Bank of America. Your team is working on a critical deal with a tight deadline. The Managing Director has asked you to prepare a financial model, but you’re also responsible for gathering market data for a client presentation the next morning. You realize that completing both tasks on time will be challenging. What would you do?

Answer Choices:

A) Prioritize the financial model since it was directly requested by the Managing Director, and inform your team that the market data may be delayed.

B) Speak to your team or direct supervisor to explain the situation and ask for assistance completing both tasks on time.

C) Work extra hours to ensure that both tasks are completed, even if it means sacrificing sleep.

D) Complete the market data for the presentation first, as it’s time-sensitive, and then work on the financial model.

Best Answer: B

Telephone or Video Interview

The Bank of America telephone interview is solely based on your CV and what motivates your personality. Here are a couple of examples:

- What’s your motivation for pursuing a career in investment banking, and why you chose Bank of America specifically?

- Describe a time when you had to work under pressure to meet a tight deadline. How did you handle it?

Bank of America may choose you for a video (HireVue) interview rather than a telephone conversation. In that case, the questions will be the same, but they’ll be in batches of 3-5 questions, which you’ll have to answer within 2 minutes.

Assessment Center

As discussed above, if you make it to the Bank of America’s assessment center, you will participate in a group and role play exercise, as well as give a presentation:

Group Exercise:

Your group is tasked with evaluating a potential acquisition target for the Bank of America.

Task: As a team, you'll need to:

- Analyze the target company's financial statements and market position.

- Recognize potential synergies and risks linked to the acquisition.

- Develop a preliminary valuation of the target company.

- Present your findings and recommendations to a panel of assessors.

Presentation:

Scenario: Your group is tasked with evaluating the potential impact of a new regulatory change on the investment banking industry.

Presentation Task:

- Understand the key provisions of the new regulation and its potential implications for investment banks.

- Evaluate how the regulation may affect different areas of investment banking, such as M&A, debt financing, and equity underwriting.

- Discuss the benefits and drawbacks of the regulation for investment banks.

- Propose strategies that investment banks can adopt to adapt to the new regulatory environment.

Role Play:

Scenario: You are a junior analyst at the Bank of America. Your client, a large multinational corporation, is considering a major acquisition.

Role Playing Task:

- Participate in a meeting with your client (interviewer) to discuss the potential acquisition.

- Ask questions to gather information about the target company, its industry, and the rationale for the acquisition.

- Prepare a brief analysis based on the information gathered during the meeting.

- Present your findings and recommendations.

How Can You Prepare for Interviews at the Bank of America?

From the online assessment to participation in the assessment center, every interview stage in the Bank of America’s recruitment process demands your attention. Here are a few points to keep in mind:

- Thoroughly research the Bank of America's culture, values, and recent developments. Understand the firm's history, key business areas, and notable transactions.

- Brush up your technical skills in investment banking, such as DCF, LBO, and merger models. Study comparable company analysis and precedent transactions and refresh your knowledge of accounting principles, including the three financial statements and key ratios.

- Use the STAR method (situation, task, action, and result) to structure your responses for the fit questions.

- Do mock interviews with friends, mentors, or coaches to simulate the interview experience.

- Dress professionally rather than casually to show your seriousness for the role.

- Reach the assessment center 15 to 30 minutes before to calm down your nerves.

- Try to answer the questions or engage with the interviewer at a slow pace. Don’t rush in or reply fast.

- Keep the conversation short without misleading the interviewer.

- Don’t use slang words.

Key Takeaways

Securing a role at the Bank of America as a student or fresh graduate is tough but doable by preparing for each stage of the interview process.

For this, you must understand the required skills and practice your communication and problem-solving abilities. You also need to show your motivation for the role and why you’re drawn to the Bank of America specifically.

With diligence, confidence, and the help of this guide, you can position yourself as a strong candidate ready to contribute to one of the world’s leading financial institutions.