Experience

This section is the meat of your resume. It showcases your practical skills and achievements. Focus on:

- Job title

- Company name

- Dates of employment (month/year)

- Bullet points detailing your responsibilities and accomplishments

Using bullet points to list your responsibilities and achievements makes your resume easier to read and allows recruiters to quickly identify key information. However, these bullets should not be formulated without care. Make sure to really showcase your achievements and make a strong impression.

Start by using powerful action verbs like "analyzed," "led," "developed," and "executed" to clearly define your role and contributions. Always aim to quantify your accomplishments with specific numbers and percentages. For example, instead of saying "worked on financial models," you could say "developed financial models for M&A transactions worth over $500 million." This not only highlights your analytical skills but also demonstrates the scale of your work.

Focus on the impact of your actions—did you streamline a process, increase revenue, or secure client buy-in for major projects? Including these details turns generic job duties into impressive achievements that capture a recruiter’s attention and demonstrate your value to potential employers. Additionally, tailor each bullet to align with the specific skills and experiences that the job description emphasizes, ensuring your resume is highly relevant to the investment banking role you’re targeting.

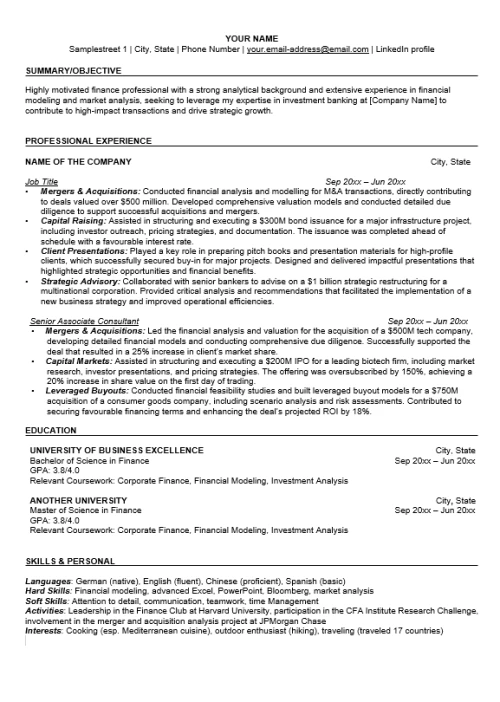

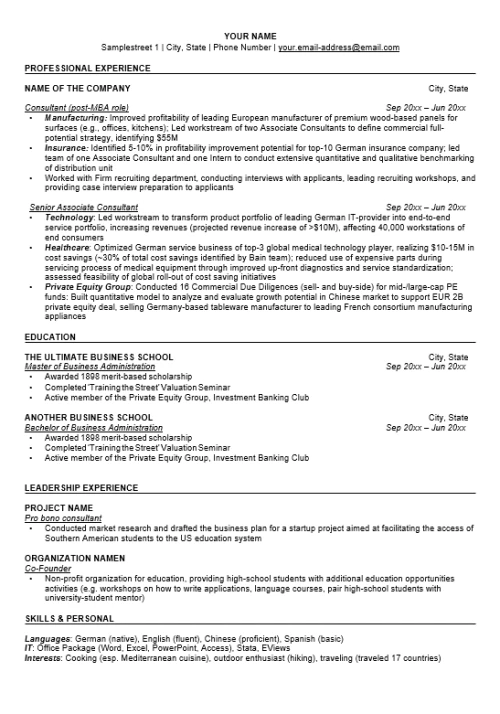

Example:

Summer Analyst, Global Bank Inc.

May 2023 – August 2023

- Conducted financial analysis and modeling for M&A transactions, directly contributing to deals valued over $500 million.

- Played a key role in preparing pitch books and presentation materials that successfully secured client buy-in for major projects.

- Collaborated with senior analysts to evaluate investment opportunities, leading to a 15% increase in client engagements and securing new business partnerships.

Skills, Activities and Interests

The Skills, Activities, and Interests section of your investment banking resume is your opportunity to showcase unique abilities and personal interests that can make you stand out as a well-rounded candidate.

For skills, focus on both hard and soft skills essential for investment banking.

Hard skills should be tailored to the investment banking industry. Highlight technical skills like financial modeling, advanced Excel, PowerPoint, Bloomberg, and market analysis. Certifications like CFA Level 1 can also be a significant plus.

Soft skills should demonstrate your ability to work in a high-pressure environment. These can include aspects like attention to detail, communication, teamwork, and time management.

Activities can include leadership roles in finance clubs, participation in relevant competitions, or involvement in significant projects that show initiative and engagement with the field.

Interests, while optional, can add a personal touch if they’re unique or relevant to the job. For example, interests in economic research, investment strategies, or even high-stakes team sports can illustrate your analytical mindset and team-oriented approach. This section helps paint a fuller picture of you as a candidate, beyond just your academic and professional achievements, making you more memorable to recruiters.

👉 Looking for a head start? Our CV templates ensure you cover all the essentials, helping you create a polished and professional application in no time!