Russell University, located in the United Kingdom, is one of the oldest and most prestigious universities in the world. They have been educating students for more than two centuries and provide a variety of undergraduate and graduate STEM-focused courses.

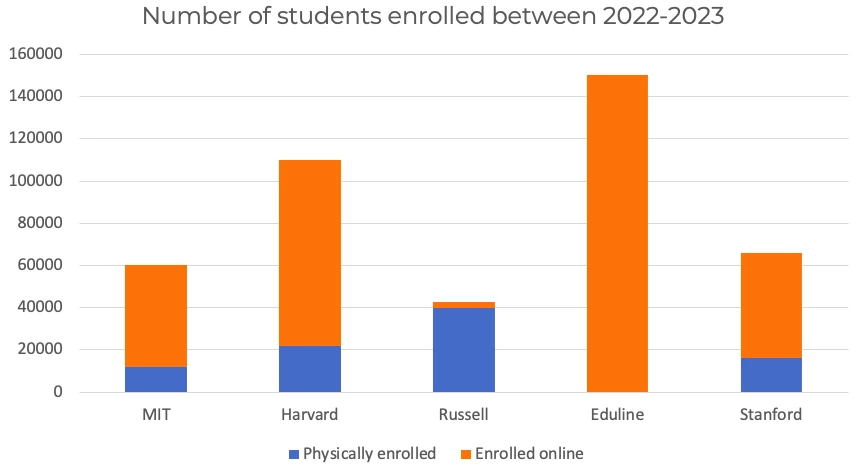

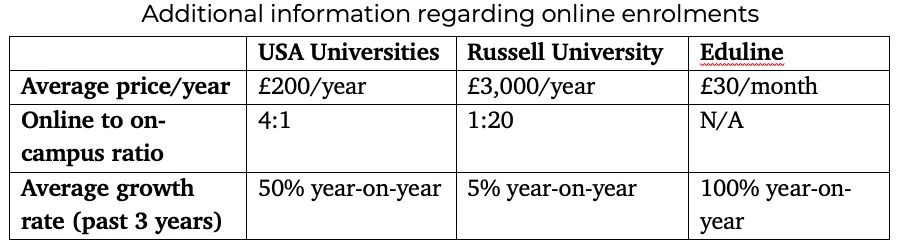

In an effort to increase revenues and expand their reach, the university has recently begun offering three online postgraduate qualifications. Despite the quality of teaching and effort spent in developing these courses, the response from students in terms of sign-up rates has been modest. Russel University executives believe they are acting too slowly since other prestigious universities, particularly in the US, have successfully leveraged their brand to offer short and affordable online courses to a variety of people.

Russell University has hired us to determine whether they should acquire Eduline, a well-established platform that offers STEM-related short courses to its subscribers. The university intends to use Eduline to offer courses on a subscription basis and will then issue online certificates to individuals who successfully complete its courses.

Russell University - Fresh Attacker on the Online Education Market (McKinsey 1st round)

i