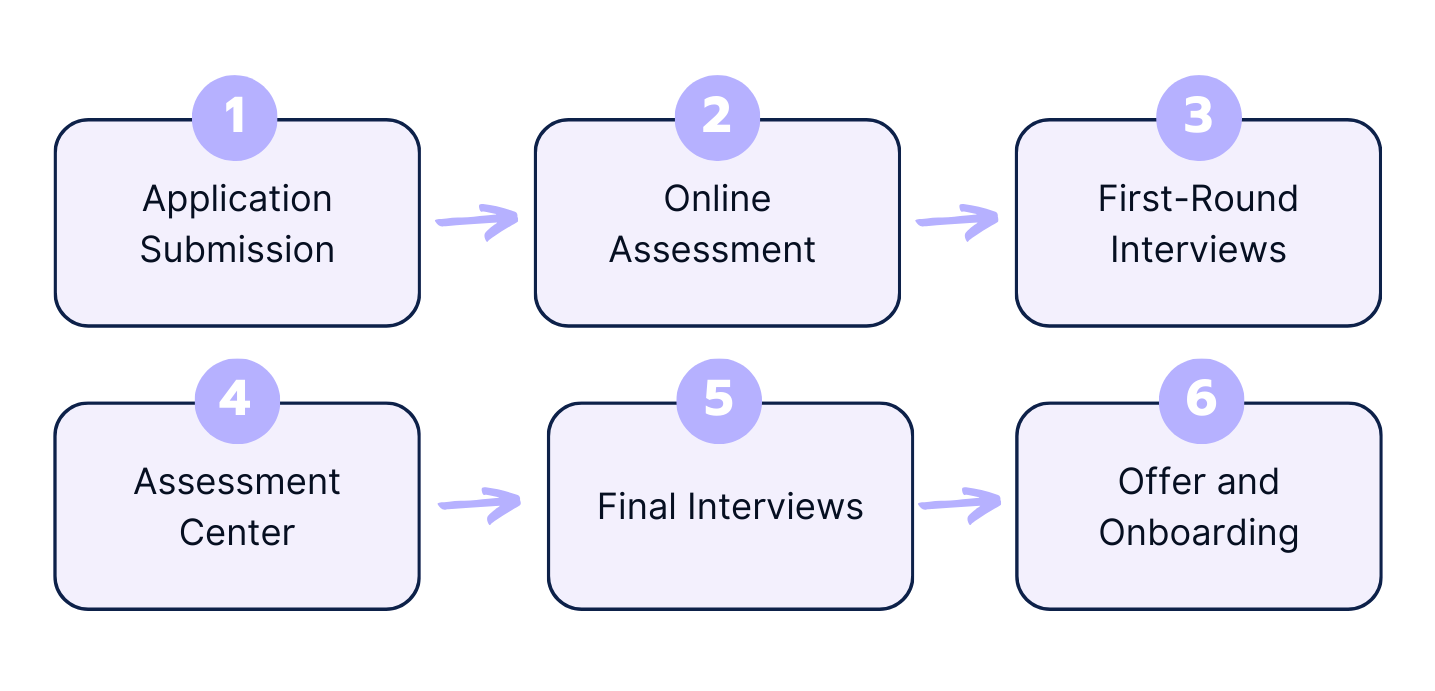

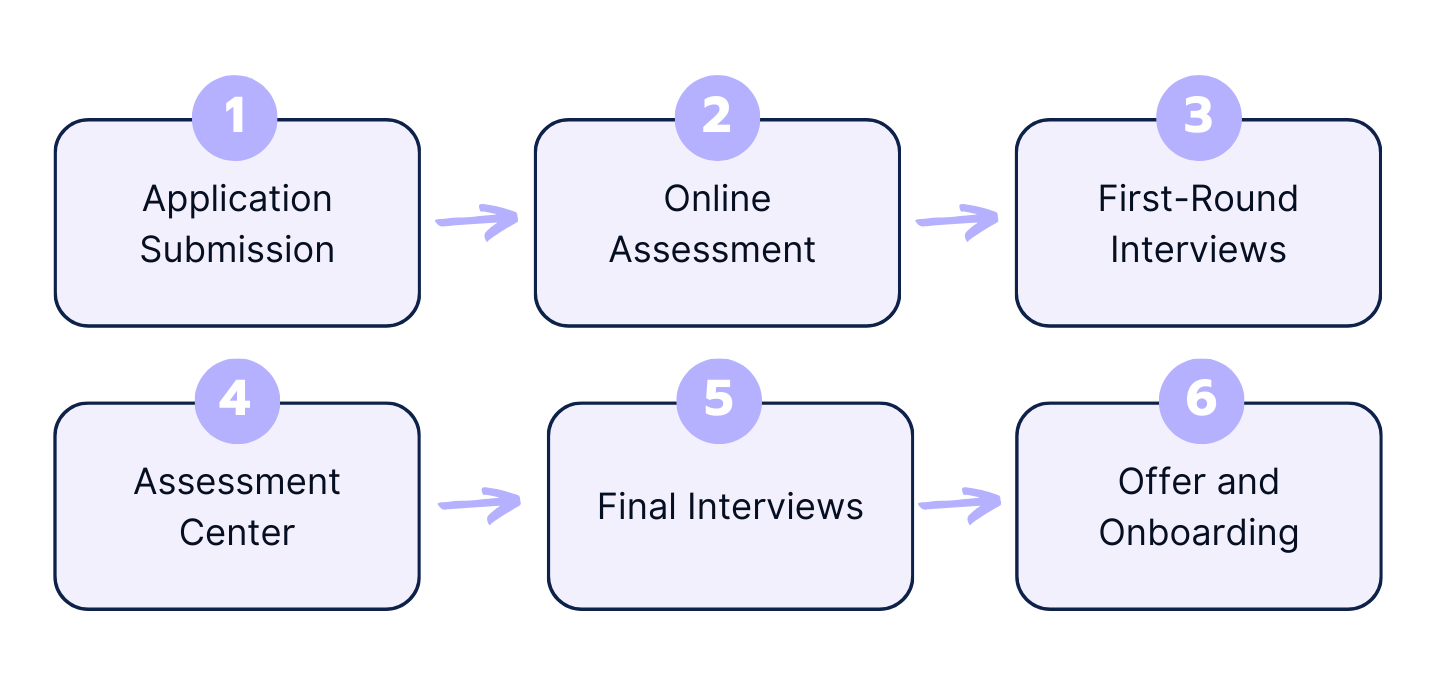

1. Application Submission

The first step is to go to the Morgan Stanley investment banking website, click Careers, and select “Students & Graduates”. Then, click “Search for Opportunities” > “Opportunities for Students & Graduates”. Here, select any of the open roles available that match your qualification, and click “Apply Now”.

Next, register with the Morgan Stanley job portal and fill in your personal details (name, contact, address, and upload a resume and sometimes a cover letter).

Now, recruiters will review your application to verify whether you meet the basic requirements for the role. If so, you will be asked to take an online assessment test (HireVue interview).

2. Online Assessment (HireVue)

In this stage, you’ll undergo an online test organized using the HireVue intelligent assessment service to evaluate your cognitive abilities, verbal reasoning, logic perception, and problem-solving skills.

You’ll be provided with a set of questions and have 30 seconds to prepare the answer and then another 2 minutes to record them. These tests often present scenarios that you might face on the job and ask you to choose the best course of action.

Based on online assessment results, the hiring managers may shortlist you for the first-round interviews.

3. First-Round Interviews at Morgan Stanley

If successful in the HireVue stage, you'll be invited to a first-round interview, which the Morgan Stanley recruiters conduct over the phone or via video conferencing. These interviews focus on what you’ve studied and learned based on the role you applied for in investment banking, along with the motivation for joining the firm.

4. Assessment Center

After clearing the first-round interviews, next up is to participate in an assessment center based on your role:

- Group Exercises: Participate in group sessions to demonstrate your leadership skills in investment banking, communication skills, and ability to work as a team to produce results.

- Case Studies: Analyze a business case in investment banking and present your findings.

- In-Person Interviews: Answer behavioral and financial questions to further analyze your fit for your role and company culture.

5. Morgan Stanley Final Interviews

After winning the assessment center round, you'll proceed to a round of final interviews. During these interviews, you’ll answer the same or somewhat different financial and fit questions in the earlier round while meeting with a panel of senior managers and executives.

They will test your knowledge of investment banking, any internships and training you might have gone through, or your proficiency in technology, including algorithms, data structures, operating systems, database management, networking, etc.

Clearing this stage almost cements your role as an investment banker at Morgan Stanley. But there’s still a formality left.

6. Offer and Onboarding

As a successful candidate, you receive a formal offer to join Morgan Stanley as a Summer Analyst, Intern, or Associate. This includes details on compensation, benefits, and other employment terms.

At the same time, Morgan Stanley conducts background checks, which may include internship verification, education verification, and criminal records.

After accepting the offer, the onboarding process begins, which involves training and orientation to help you adjust to the company's work environment.