When to Expect the Question "Why Investment Banking?" in Interviews

In most investment banking firms (i.e. Morgan Stanley, JPMorgan Chase or Deutsche Bank), you’ll get this question at the start of the interviews. This could be during phone screens, virtual interviews, or superday. You should also be ready to answer this question multiple times throughout the recruitment process, potentially with slight variations, as different interviewers may want to hear your perspective firsthand.

It often follows the introduction and initial questions about your background, such as "Walk me through your resume" or "Tell me about yourself." As such, it allows the interviewer to get an impression about your motivation, knowledge, and fit for the firm right from the start.

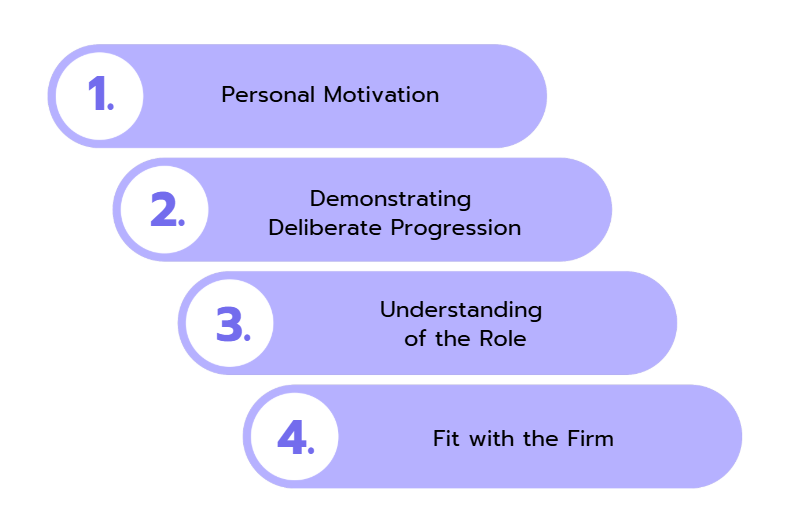

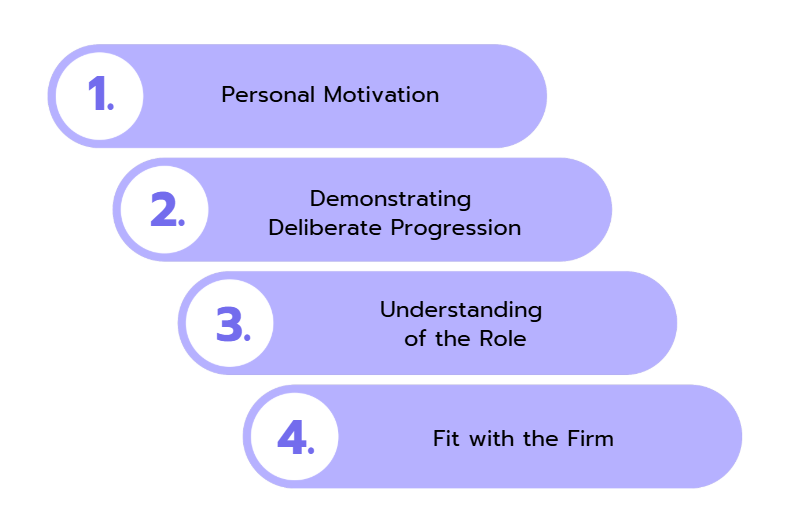

Key Elements of a Strong Answer

As we mentioned earlier, some answers will impress interviewers while others will be a redflag. At the same time, you shouldn’t rehearse a response since they can tell. You should instead use general but proven guidelines to craft convincing answers.

The key elements of a strong answer to “Why investment banking?” include an authentic catalyst for your interest, demonstrating intentionality, showing your understanding of the role and positioning yourself as a fit for the firm.

1. Personal Motivation

Your personal motivation is arguably one of the most important parts of your answer to "Why investment banking?" A strong response starts with a catalyst moment. This is a personal experience that sparked your interest in the field, not a generic aspiration. Such experiences may include:

- A specific finance course that revealed the complexity of corporate transactions.

- A conversation with a mentor who demonstrated how banking connects to real business outcomes.

- A student investment competition that ignited your passion for financial analysis.

- An internship where you glimpsed the tangible impact of advisory work.

For instance: "I knew I wanted to work in finance, hence my course choice. But my interest in investment banking specifically sparked during my strategic finance project with a manufacturing startup, where I saw how capital raising decisions directly impacted the company's ability to scale their operations."

Such an answer shows you want to have an impact in IB not thinking about what banking can do for you. It’s about serving not just getting served.

2. Demonstrating Deliberate Progression

Remember we said interviewers want to see how your interests connect to what you have done? That’s what differentiates someone who is just about talks vs a candidate who knows how to demonstrate what the interviewer wants to hear. In short, have you taken any steps to show genuine interest?

So, proceed to show them your path to investment banking has been intentional by highlighting:

- Concrete steps you've taken to deepen your understanding (for instance relevant coursework, internships, certifications, market updates)

- How you've tested your interest through related experiences

- The thoughtful consideration behind choosing investment banking over other finance fields

Illustrating a logical progression rather than a sudden interest tells the interviewers you have done introspection and made an informed career decision, not merely chasing prestige or compensation.

A strong answer to the question "Why investment banking?" could be something like this:

"Following that startup project, I deliberately pursued opportunities to build relevant skills. I completed the Financial Modeling & Valuation certification, joined my university's Investment Club where I led a team analyzing potential acquisition targets in the tech sector, and secured an internship with a boutique advisory firm where I assisted in creating pitch books for middle-market transactions. Each experience confirmed my interest in analytical and strategic thinking that investment banking demands."

3. Understanding of the Role

A compelling answer should also show you understand what investment banking entails day-to-day. This should resonate with the specific role you’re interviewing for whether that’s a summer internship or a full-time analyst position.

It’s also important that your response shows aspects that are specific to IB. Otherwise they may ask follow up questions that leave you blank. For instance, they can tell you that you can develop financial models in another finance career. But if your example references investment banking areas like M&A advisory, capital raising, and restructuring, you’ll have done well.

This is how you could continue your answer:

"My experience supporting that startup's fundraising efforts showed me the impact of sound financial analysis. While helping draft their investor presentation, I recognized how investment bankers serve as the crucial link between companies seeking capital and the financial markets. I'm drawn to this intermediary role and the opportunity to apply analytical skills to help clients achieve their strategic objectives. During my internship, I observed how junior bankers developed critical thinking abilities by evaluating different financing scenarios and presenting recommendations based on market conditions."

4. Fit with the Firm

Even if the interviewer hasn’t asked “Why our firm?”, it’s advisable to say something about it in this question. It’s especially great if time hasn’t run out, and it shows you've chosen this specific firm deliberately, not as just another name on your application list. Of course they know you have probably applied to many IB firms but they don’t want it to be obvious.

Continuing with our example, your answer might sound like this:

"What specifically attracts me to Goldman Sachs is your unparalleled strength in the technology sector, which aligns perfectly with my background and interests. Your firm's leading role in advising on Salesforce's acquisition of Slack demonstrated the type of transformative deals I aspire to work on.

During your recent campus presentation, I was impressed by how your analysts described the firm's commitment to professional development and the collaborative approach to solving complex client challenges. My experience leading valuation projects in my university's investment club has prepared me to contribute to your team's analytical muscle while my communication skills from presenting financial recommendations to startup executives will help me effectively support your client-facing work."

How to Answer the Question “Why Investment Banking?"

To bring it all together, answer the “Why investment banking?” question by starting with what first got you interested, walk through how you’ve built on that interest over time, and end with something that shows you really get what the job and the firm is all about.

You will not need to memorize scripted responses if you follow this formula. That’s important because interviewers can tell how relaxed you are and calling you out can throw you off balance.

If you’re a non-finance major pursuing investment banking, you’ll still follow the same steps. However, you will need to defend why you didn’t opt for finance. You can choose a pivotal moment in whichever industry you’re in and start your journey there then show the proactive steps taken. Mentioning experience and specific actions taken is very important in IB interviews rather than just narrating theory.

Our sample response is long because we wanted to give you a complete picture. But keep it short during the interview, up to one minute at most. Keep in mind the following don’ts of answering this question:

- Don’t give generic motivations like wanting to "learn a lot" or "work in a fast-paced environment".

- Don’t use inappropriate reasons like "I want to make money" or “I want great exit opportunities".

- Don’t give unrealistic expectations by glamorizing the role or industry.

- Don’t recite answers that sound rehearsed.

Common Mistakes to Avoid When Answering Fit-Questions in IB-Interviews

“Why investment banking?” is just one of the several behavioral and fit questions you’ll get during IB interviews. To ace them all, avoid the following common mistakes.

1. Using "We" Instead of "I".

One of the most frequent mistakes candidates make is using "we" when discussing their experiences instead of "I." This can make it seem like you are not taking personal responsibility for your achievements or contributions. Always focus on your individual role and impact in your stories.

2. Lack of Structure.

Failing to structure your answers can lead to rambling and unclear responses. It's important to leverage the STAR (Situation, Task, Action, Result) methodology to provide a clear and concise narrative. It helps you articulate your experiences effectively and keeps the interviewer engaged.

3. Being Too Generic.

Generic answers that lack specificity can make you seem unprepared or disinterested. Avoid clichés and instead provide detailed, personal anecdotes that illustrate your motivations and experiences. Tailor your responses to reflect your unique journey and insights into the industry.

4. Not Demonstrating Industry Knowledge.

When answering fit questions, it's essential to show that you understand the investment banking industry and the specific role you are applying for. Failing to demonstrate this knowledge can raise doubts about your commitment and suitability for the position.

5. Ignoring the Firm's Culture.

Not aligning your answers with the firm's culture and values can be a significant oversight. Research the firm beforehand and incorporate elements that resonate with its mission and work environment into your responses. This shows that you are genuinely interested in the firm and have done your homework.

6. Overly Personal or Inappropriate Responses.

While it's important to be authentic, avoid sharing overly personal information or discussing topics that are not relevant to the interview. Keep your answers professional and focused on your qualifications and experiences related to the role.

How to Prepare for Fit Questions in Investment Banking Interviews?

You can prepare for fit questions in investment banking by doing self study, practising with mock interviews, and hiring an interview coach. Here’s how to go about each of these interview preparation tips.

Do Self Study.

Block some time to prepare for fit questions. During these sessions, look up all the common fit and behavioral questions in investment banking. Then study the STAR method (Situation, Task, Action, Result) which is helpful in answering them.

As you prepare during the STAR method, you’ll have sessions to reflect on your authentic story. It will include creating a personal inventory of your key experiences, achievements, and challenges that shaped your interest in banking. You’ll also develop a "story bank" of 10-15 specific examples that demonstrate your analytical abilities, leadership, teamwork, and resilience under pressure. All these will help you craft concise, compelling answers that highlight your unique value proposition.

The self study time is also an ideal moment to research your target firms' recent deals, culture, and competitive positioning.

👉 With our Stress Question Tool, you can practice many more examples and prepare yourself perfectly.

Practice Common Fit Questions with Mock Interviews.

After doing enough preparation alone, consider doing mock interviews with peers to test your delivery. Record these sessions to identify areas for improvement in your content, delivery, and body language.

You should also request specific feedback on whether your answers sound authentic, succinct, and demonstrative of banking-relevant competencies. Simulate high-pressure environments by practicing with strangers or in formal attire to build comfort with interview stress.

👉 Use our Meeting Board to connect and practice with like-minded peers!

Hire an Interview Coach.

As you get more comfortable with your self study sessions and mock interviews, consider hiring an interview coach. An experienced interview coach provides invaluable specialized guidance that general resources cannot match. They offer personalized feedback tailored to your specific background and target firms, and identify blind spots in your preparation that self-study might miss.

Banking industry coaches understand the subtle cultural nuances of different fiirms and can help you align your narrative accordingly. They can also simulate realistic interview conditions, including stress-testing your responses to challenging follow-up questions. This investment typically yields significant returns through improved interview performance, greater confidence, and ultimately higher conversion rates from interviews to offers.

👉 Check out our Coach Directory and find the right expert for your interview preparation!

Key Takeaways

“Why investment banking?” is one of the most common questions in IB interviews. Interviewers use it because it helps them understand your commitment capabilities, personal motivations, long-term career goals, and fit for the role early on.

To answer this question impressively, share a defining moment that sparked your interest, detail the actions you took afterwards, and demonstrate you understand the role and the firm. Some of the best tips for preparing for fit questions in investment banking are having self study sessions, conducting mock interviews, and working with interview coaches.