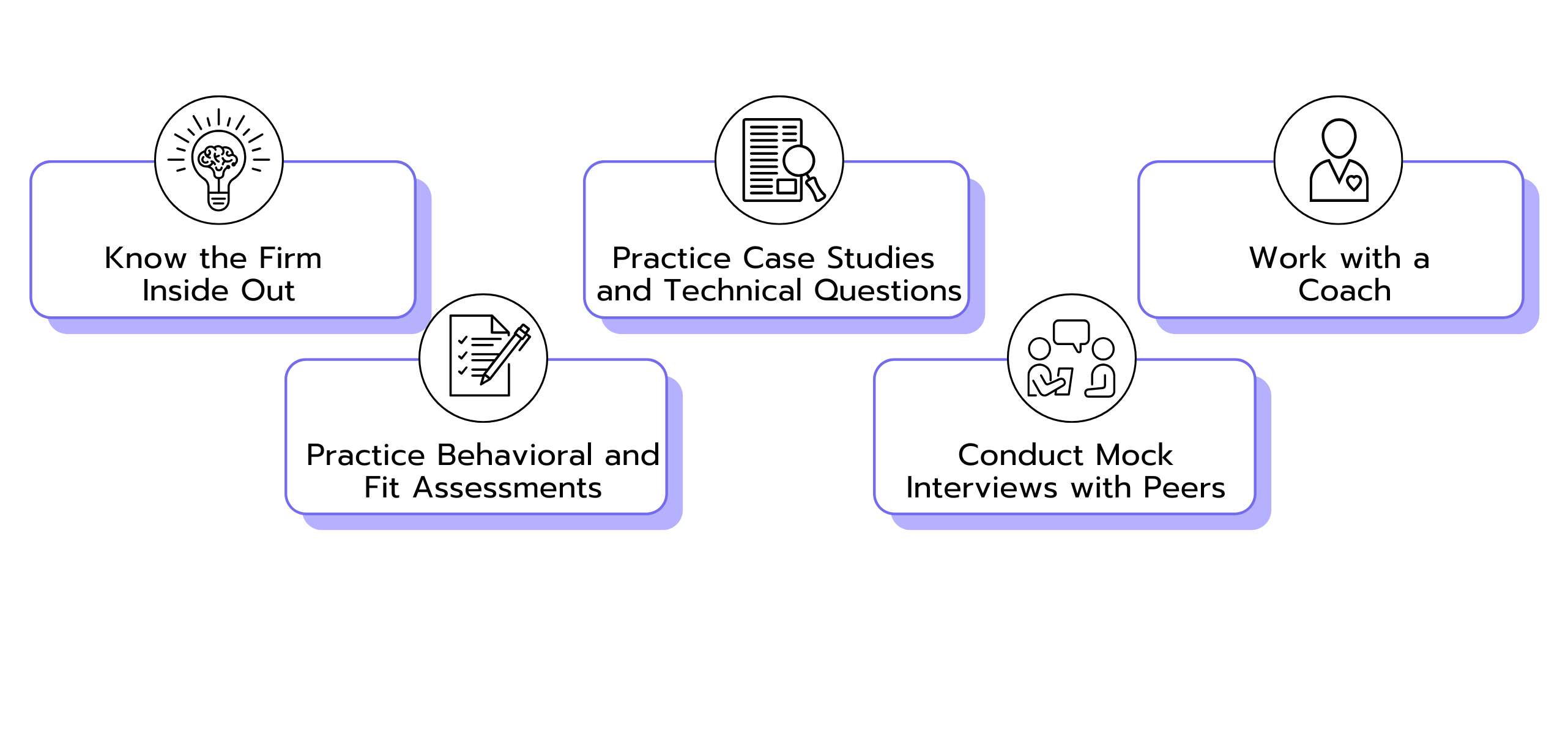

Know the Firm Inside Out

Study Deutsche Bank's recent major deals, focusing on their strengths in specific sectors and geographical regions. Pay particular attention to their European market leadership, especially in Germany, and their strategic focus areas like M&A advisory, debt capital markets, and restructuring services.

You can also track Deutsche Bank's quarterly earnings reports, current CEO's strategic vision, bank structure, and recent organizational changes. Also, understand their competitive position against other bulge bracket banks, their unique cultural aspects stemming from the German heritage, and their post-2019 transformation strategy focusing on core investment banking strengths. All this information is available on the official website, and will help you show your interest in the company.

Practice Behavioral and Fit Assessments

Behavioral and fit assessments play a crucial role in the recruitment process for nearly all top investment banks, including Deutsche Bank. That’s why thorough practice is essential. Situational judgment tests often assess how you would handle scenarios like client interactions, team conflicts, or ethical dilemmas.

To stand out, use the STAR method to craft clear and memorable answers that highlight your leadership, teamwork, and problem-solving skills, tailored specifically to the investment banking environment. Be prepared to articulate your motivation for pursuing a career in investment banking and explain why Deutsche Bank is your top choice.

Additionally, Deutsche Bank’s recruitment process includes ability tests, so it’s important to practice quick mental math, market sizing problems, and logical reasoning exercises to build your confidence.

👉 Try our Stress-Question-Tool and practice tackling the behavioral and fit assessments!

Practice Case Studies and Technical Questions

Investment banking case studies at Deutsche Bank usually focus on valuation, M&A analysis, and leveraged buyout scenarios. You might be asked to value a company using comparable analysis, calculate accretion/dilution in a merger, or determine the optimal capital structure for a leveraged buyout. Example: "How would you value a private European manufacturing company?"

Technical questions focus on core investment banking concepts. Expect detailed questions about DCF analysis, trading comparables, and transaction experience. For example: "Walk me through the impact of depreciation increase on three financial statements" or "What's the difference between enterprise value and equity value?".

👉 Check out our case library and prepare yourself for success in your case interviews!

Conduct Mock Interviews with Peers

Mock interviews simulate the actual Deutsche Bank interview environment. So, having effective sessions can help you manage stress and improve the quality of your responses. You can do mock interviews with peers, friends, or family. Participating in multiple mock sessions with different interviewers can help you practice handling various interviewing styles and unexpected questions typical in investment banking interviews.

You can also record your mock interviews to analyze your body language, tone, and response structure. The people you practice with should be able to give helpful feedback, but it's a good idea to also observe yourself and spot anything they missed.

👉 Find peers at our meeting board to practice your interviews together?

Work with a Coach

If you really want to save prep time, receive expert feedback, and increase your odds of acing the interview, consider working with an IB interview coach. An experienced investment banking interview coach provides insider knowledge of Deutsche Bank's specific interview process and culture. They can identify gaps in your technical knowledge, refine your answers to common questions, and provide real-time feedback on your interview performance that you can't get from self-study or non-experts.

Your coach will help tailor your story to Deutsche Bank's expectations, strengthen your financial modeling skills, and prepare you for the intensity of the Super Day. They can also provide industry insights and help you understand the nuances of different investment banking roles within Deutsche Bank to improve your interview success rate.

👉 Explore our coach overview to find an expert who will help you excel in your Case-Interview!

Key Takeaways

Breaking into Deutsche Bank’s investment banking division is tough, but with focused preparation, you can stand out.

Start by thoroughly understanding Deutsche Bank’s structure, values, and recent deals—this shows genuine interest. Prepare for the behavioral assessments with STAR-method responses that highlight leadership, teamwork, and problem-solving.

Brush up your technical skills on topics like DCF analysis, valuation, and financial modeling, and practice case studies to handle challenging questions. Mock interviews with peers can help you to refine your answers and build confidence, but consider working with an IB coach if you want expert guidance.

With the right strategy and persistence, you’ll significantly boost your chances of landing the job. We wish you best of luck! 🚀