- Bulge Brackets and Elite Boutiques are among the world’s leading investment banks and top entry points for IB careers.

- Global reach and a strong deal track record set these firms apart in major transactions.

- Thorough preparation for applications and interviews is essential to break into these top banks.

The Best Investment Banks at a Glance

Key Takeaways

Are you looking to break into investment banking? If so, it is worth taking an early look at the major players in the industry. The world’s leading investment banks offer the opportunity to work alongside experienced bankers, contribute to major deals, and gain experience that can open many doors across the finance industry later on.

In this section, you will learn how key investment banking hubs differ around the world, which banks are particularly strong in each location, and how Bulge Brackets, Elite Boutiques, middle market firms, and specialist boutiques compare.

An Overview of the Most Important Types of Investment Banks

In investment banking, there are many different types of banks. Depending on where you start, your day to day work can look completely different. Some firms are large global players, while others are intentionally small and highly specialized.

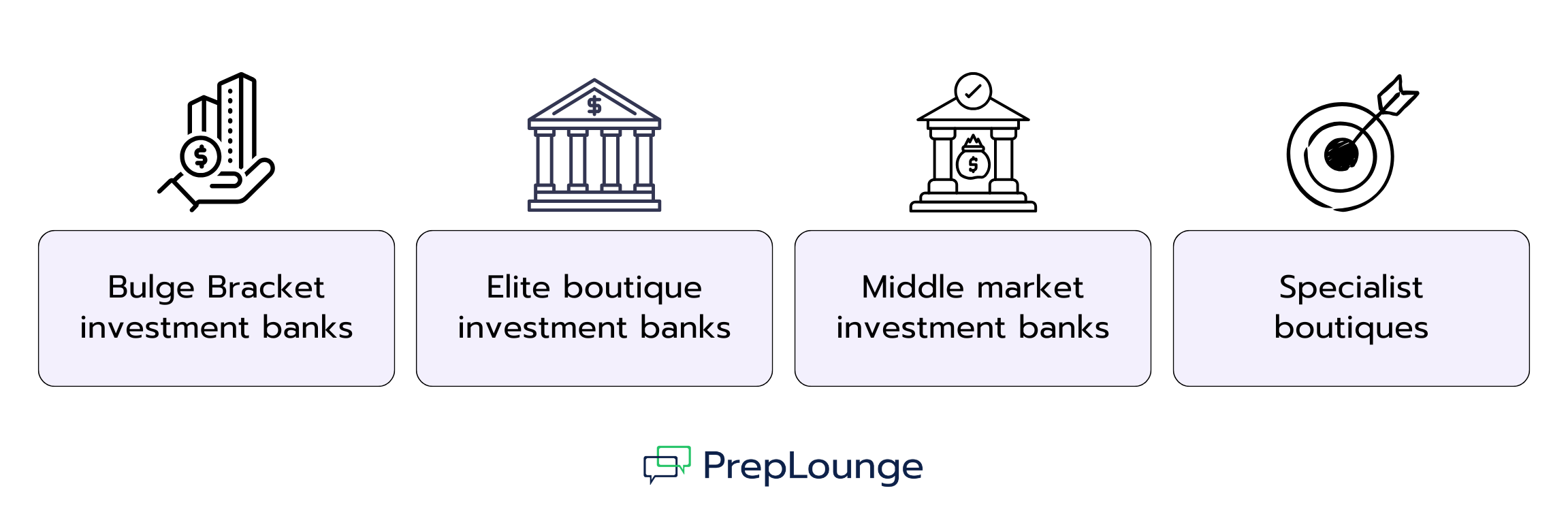

- Bulge Bracket investment banks: The largest global universal banks, offering a broad range of services and working on large scale transactions.

- Elite boutique investment banks: Independent M&A specialists with small teams and a focus on high profile mandates.

- Middle market investment banks: Primarily advise mid sized companies and work on medium sized deals.

- Specialist boutiques: Focus on specific industries or topics such as technology, healthcare, or restructuring.

Top Articles About Types of Investment Banks

Learn More About These Firms

Top Bulge Bracket Investment Banks (BBs)

Bulge Bracket banks are the largest and most well known global investment banks. They offer an extremely broad product portfolio, ranging from M&A advisory and capital markets to trading and research.

For early career professionals, this means large teams, international projects, highly structured career paths, and exposure to the largest deals worldwide. These banks often advise on multi billion dollar transactions and work with leading corporations and governments. As a result, both the prestige and the competition in the application process are very high.

Our Top Articles on Bulge Bracket Banks

More Articles on Top Investment Banks

Top Elite Boutique Investment Banks (EBs)

Elite boutiques are independent advisory firms that focus almost exclusively on M&A and strategic financial advisory. They deliberately avoid large trading or retail divisions, allowing them to fully concentrate on complex, high profile transactions.

For students, this is particularly attractive due to smaller, close knit teams, which often means earlier responsibility, a steep learning curve, and intensive client exposure. These banks enjoy an excellent reputation and in many cases work on deals that are just as large or prestigious as those of Bulge Brackets, but with greater focus and less hierarchy.

Our Top Articles on Elite Boutiques

More Articles on Top Investment Banks

What Are the Top Investment Banks in Your Region?

While the leading global banks offer largely comparable services, their performance and market share vary significantly by region. Some regional banks that do not appear in global rankings often gain market share and dominate the industry in specific areas.

For this reason, it is a good idea to look at the top investment banks by region or country.

Top Articles on Investment Banks by Region

How Do Interviews Differ Across Investment Banks?

Investment banking interviews follow a broadly similar core structure worldwide. Banks want to assess whether you think analytically, handle numbers with confidence, and communicate clearly under pressure. The process typically includes several interview rounds that test both your technical fundamentals as well as your motivation and working style.

That said, interview processes differ noticeably from one bank to another. Bulge Brackets, Elite Boutiques, and middle market banks each place emphasis on different aspects, whether in the type of questions, the level of technical depth, or the focus on personal fit. The interviewers’ style can also vary significantly between firms.

To help you understand what to expect at your target bank, you will find clear and structured interview guides here for many leading investment banks, including typical processes and practical preparation tips.

Top IB Interview Guides for Your Preparation

Continue to Learn