How Does the Associate Role Compare to the Analyst?

In the IB career path, associates are one rank above analysts, and are seen as mid-level professionals. But generally, analysts and associates are considered as junior bankers while VPs, Directors, and MDs are the senior bankers.

If you look keenly, you'll see that most of the duties of an associate are similar to those of analysts. So the difference between analysts and associates in investment banking isn't much about completely different tasks, but about complexity, responsibility, and management scope.

Analysts often spend 80-90% of their time doing the groundwork like building financial models, creating presentations, and conducting detailed research. As an associate, instead of doing these tasks yourself, you'll be checking the analyst's work, refining it, and presenting the insights to more senior team members.

Also, analysts normally don’t engage with clients as their work is mostly internal to support the team’s efforts. However, as an associate you might find yourself in meetings or even leading them.

While both roles demand long hours, analysts have more tight schedules, sometimes working over 80 hours a week during busy periods compared to associates’ 65 to 80 hours weekly load.

For more insights into everyday life as an analyst, take a look at the following article:

👉 What Does an Investment Banking Analyst Do?

How Does the Associate Role Compare to the VP?

The position after an investment banking associate is vice president. So, the associate role prepares you for the VP position if you plan to stay in the field for the long term. But if you're not interested in IB in the long-term, there are good associate exit opportunities especially in private equity and corporate finance.

The difference between IB associates and vice presidents is that the VCs don't do the groundwork. Instead, they oversee deal execution whether it's raising capital for a client or helping them buy another company, manage client relationships, and lead the team. VPs often focus on closing deals and building long-term client connections while associates focus on execution and support tasks.

So, going from an associate to a VP position is a shift from managing tasks to managing relationships. This also changes the level of responsibility. The investment banking associate role normally lasts three to four years.

What Can You Expect to Earn as an Associate in Investment Banking?

The highest paid investment banking associate can get an average total pay of $555K/yr while the lowest paid ones can get about $309K in the United States.

The average base pay of IB associates in the US is $159,918 per year and the estimated additional annual pay is $248,095. 💰

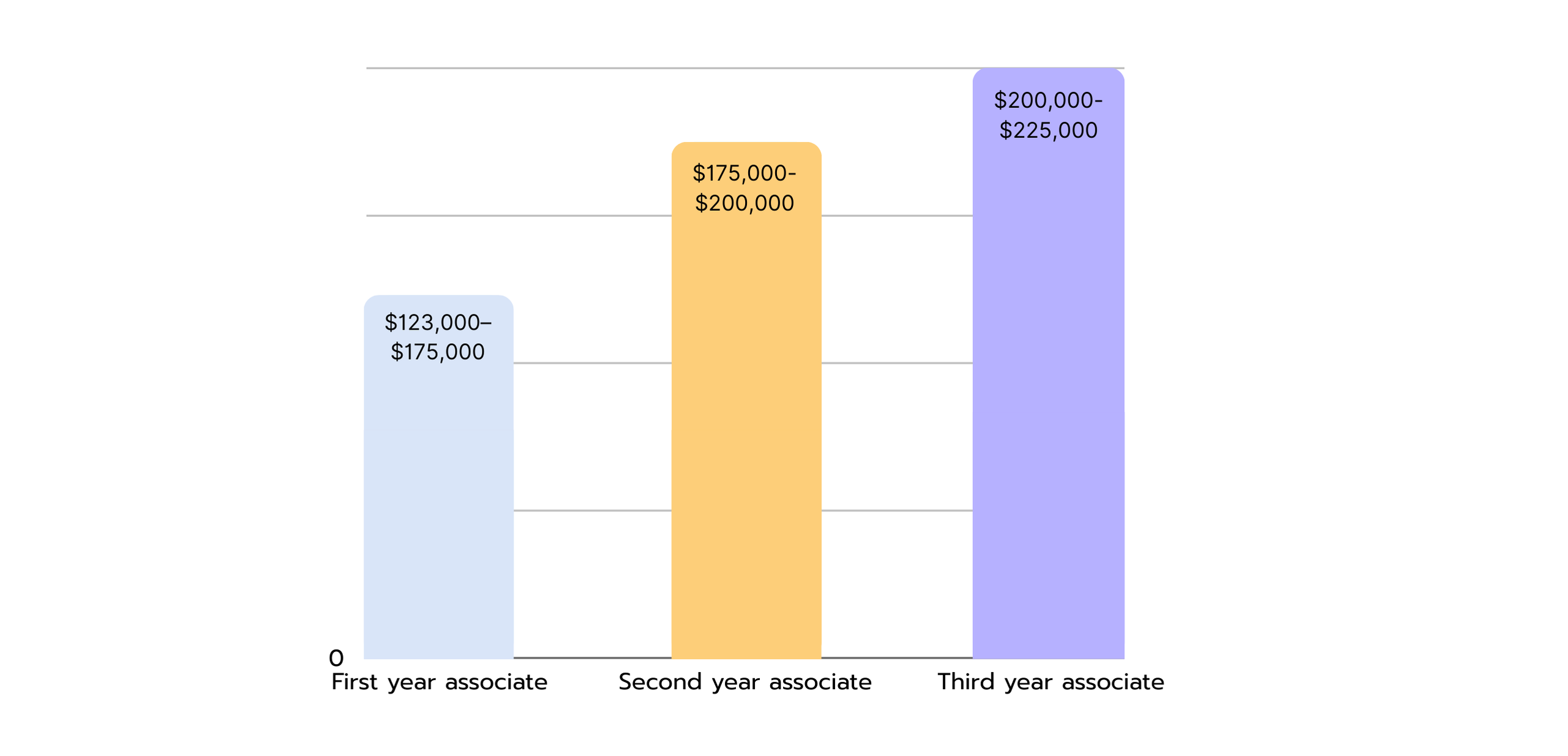

However, the salary for an investment banking associate can vary depending on the years of experience, the firm's size, and the location. For instance, here's how the associate base salaries might look like, depending on experience:

- First year associate: $123,000–$175,000

- Second year associate: $175,000–$200,000

- Third year associate: $200,000–$225,000