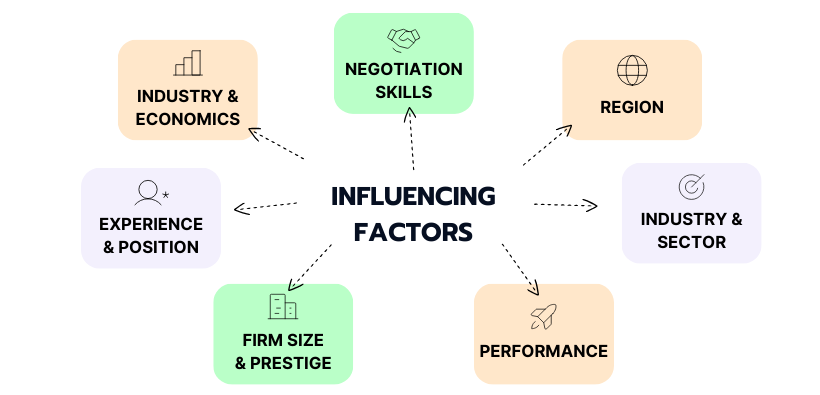

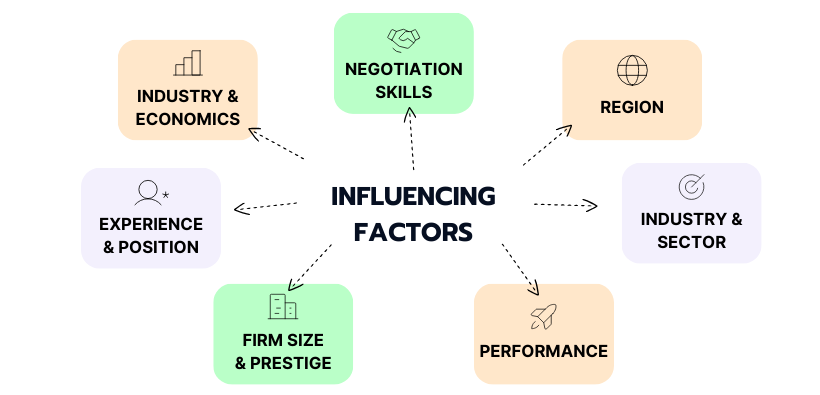

Industry Condition & Global Economics

The state of global economics and the finance industry affects deal flow and the revenue a firm gains from the various investment banking services. Rising cost of debt drives demand for IPOs and other equity issuances while geopolitical uncertainties lead to lower megadeals and a languishing M&A market.

Restructuring services are highly sought after during economic recovery times, boosting issuances and advisory revenue. So, when there’s good deal flow and a rise in overall revenue, investment banking salaries and bonuses tend to be higher. But when market conditions are more challenging, as seen in 2023, compensation levels can decrease, especially for bonuses.

Experience & Position

Working in IB means committing to a hierarchical culture. The base pay range and bonus percentages rise as you scale up the ladder. An investment banking analyst earns an average salary of €115,000 per year while an associate bags €120,000 over the same period. Depending on the bonus levels for each category, the additional pay can significantly widen the total pay.

If you have more experience and a track record of results, you’re likely to get promotions and hence pay raises. Firms are always looking to hire and retain star talent to drive their market share and achieve a stronger deal pipeline.

Firm Size & Prestige

Larger, well-established firms, often referred to as bulge bracket banks (Goldman Sachs, JPMorgan, Morgan Stanley), typically offer higher base salaries compared to smaller, regional firms. These banks have access to a higher volume of deals and larger transaction sizes due to their reputation and partnerships, which can lead to more substantial bonuses.

However, some boutique firms are rising when it comes to salary competitions. It’s now not uncommon to find top mid-market boutiques banks executing high profile deals and offering total pays closer to or even higher than the bulge bracket firms. But for smaller mid size banks, the pay is less as they typically don't have high profile deals.

Performance

The investment banking industry rewards performance. If an investment banker brings more financial benefits to the company consistently, the firm will be willing to give them more perks to retain the talent. Also, if the firm overall performs well in a year, the end-year bonuses are often great. Likewise, low performance at an individual and firm level leads to lower compensation.

Industry & Sector

Some industries and sectors offer more competitive packages than others. If you specialize in high-demand sectors such as technology, healthcare, or energy, you may get higher salaries due to the complexity and value of the transactions involved.

The deals you work on in investment banking can make a difference in your paycheck. First, successful deal closures often lead to substantial bonuses. If you consistently close significant deals and generate profits for your bank, your total compensation might rise dramatically.

Second, the complexity and size of the deals also matter. Investment bankers involved in larger transactions or those that require specialized knowledge may receive higher compensation due to the increased risk and effort involved in managing these deals.

Region

Working in major financial hubs results in higher compensation because of various factors. First, there’s a demand for hiring and retaining top talent in such areas because of the high concentration of financial firms. Second, the cost of living is often higher in such areas.

In the case of Germany, Frankfurt is the most prominent financial hub with a concentration of investment banks. It is the center for most investment banking activity in the country, with bulge bracket banks like Goldman Sachs, JPMorgan, and Morgan Stanley having large teams that handle major German deals.

Negotiation Skills

This one is much in your control and it’s highly impactful. The amount you’ll be offered of the €69,000 - €100,000 investment banking analyst pay range can be affected by your negotiation skills. Every firm would be glad to cut talent costs while hiring the best. So, you must know your worth in the market.

The key to negotiating a hire investment banking analyst salary is to understand industry benchmarks. Research the typical salary ranges for your role, location, qualifications, and experience. Once you know your worth in the industry, you can negotiate with realistic expectations, anticipate objections, and sell yourself favorably.