The Cost-Benefit Analysis is not only a powerful decision-making tool in business, economics, and public policy, but it also plays a significant role in case interviews, especially in consulting and strategic management scenarios. The Analysis helps candidates and interviewers alike to evaluate different strategies by comparing the financial and non-financial costs against the anticipated benefits.

🔍 The article deals with the application of cost-benefit analysis for decision-making, the consideration of quantitative and qualitative factors and the evaluation of the relative attractiveness of options. We also provide a specific application example.

A Thorough Cost-Benefit Analysis Guides Every Decision

In case interviews, forming and testing hypotheses is key. With several ideas on the table, cost-benefit analysis helps you choose the best option by assessing both its feasibility and relative attractiveness through comparison and benchmarking.

Feasibility Analysis: Quantitative vs. Qualitative Factors

- Quantitative factors: These involve calculating revenues, costs, and profitability. For instance, estimating customer numbers or prices provides a clearer view of the financial consequences of a decision.

- Qualitative factors: Though harder to quantify, these aspects (like company culture) are crucial in decision-making. While profitability remains a priority, qualitative insights often influence how effectively a decision can be implemented.

Evaluating Relative Attractiveness

It’s essential to compare options by analyzing their financial returns and risks. A cost-benefit analysis enables you to select the most financially attractive option, balancing both quantitative results and qualitative considerations.

For more precision, especially with uncertain future cash flows, use the discounting method to account for the time value of money. In such cases, calculating the net present value (NPV) of future income or costs provides a solid basis for making decisions.

Why Cost-Benefit Analysis is Effective in Case Interviews

In case interviews, effectively communicating your thought process is crucial. Here are some key reasons why this method is particularly effective:

- Informed Decision-Making: Cost-Benefit Analysis helps break down complex problems into manageable parts, providing a clear, structured approach that interviewers value.

- Risk Mitigation: By evaluating both low- and high-risk options, candidates demonstrate an understanding of risk assessment, a key skill in consulting.

- Strategic Clarity: This method allows candidates to compare options clearly, enabling them to articulate trade-offs and present well-organized solutions.

- Resource Optimization: Cost-Benefit Analysis showcases a candidate's ability to maximize a client’s resources, ensuring efficient use of financial, human, or other assets.

Apply Cost-Benefit Analysis in Decision-Making Scenarios

👉 Take a look at our case library. Here you will find cases on all these topics.

Example: Ice Cream Truck Business Decision

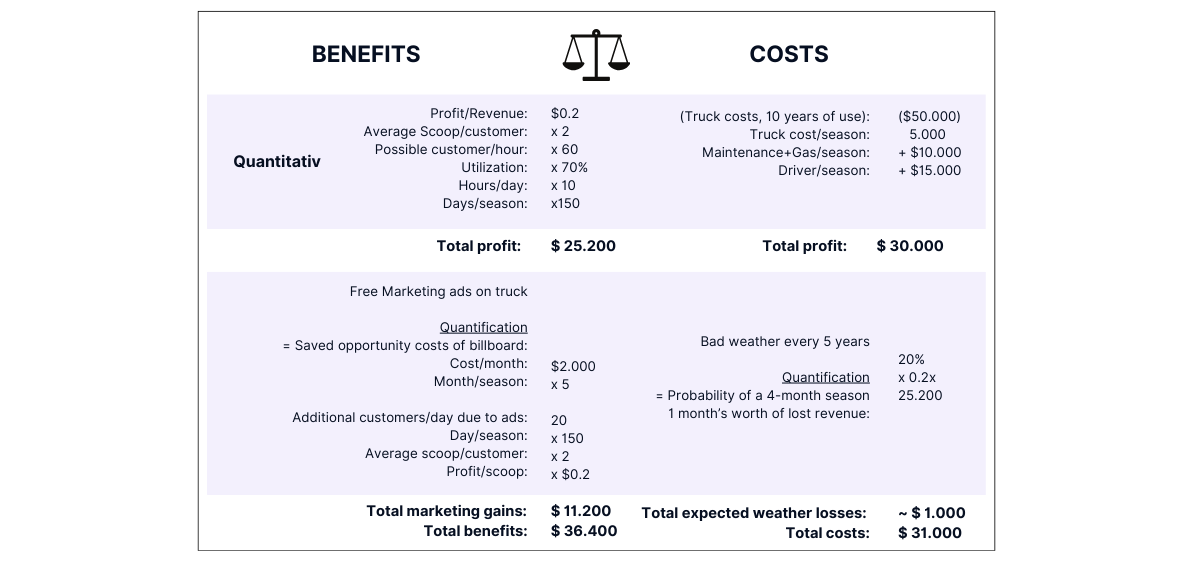

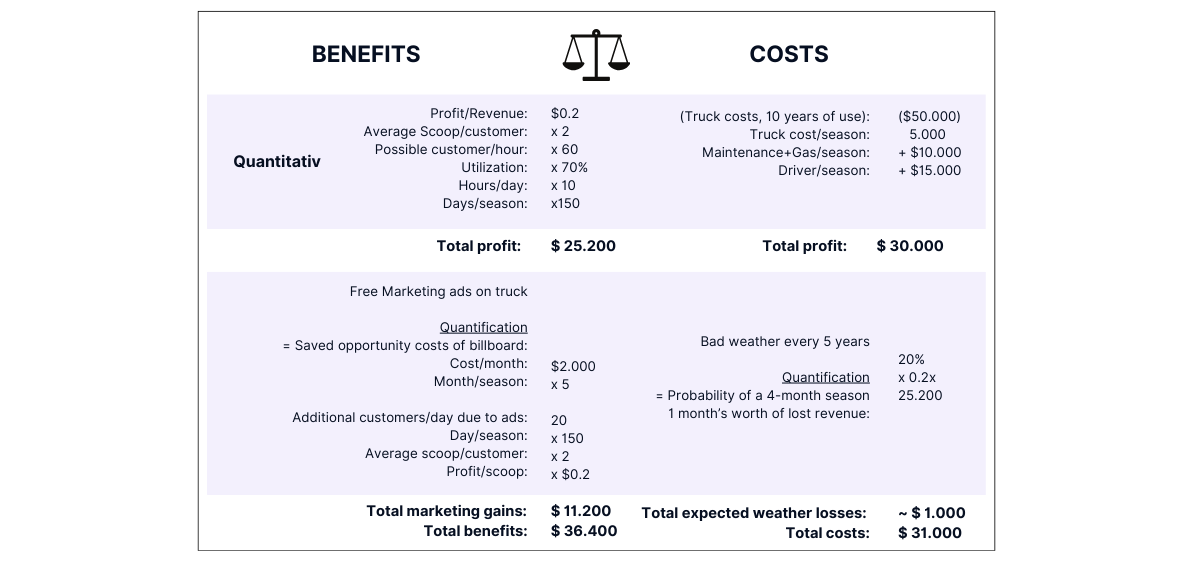

Imagine you own an ice cream shop and are considering expanding with a mobile ice cream truck for the summer season (150 days). A cost-benefit analysis helps evaluate whether this option is financially viable compared to others.

Let's take a look at the cost-benefit analysis for this scenario:

The cost-benefit analysis for expanding the ice cream shop with a mobile ice cream truck shows that total revenues of $36,400 significantly exceed the total costs of $31,000, leading to a positive net benefit. Despite weather-related losses of $1,000, the investment remains financially viable, with an expected profit of $5,400.

Key Takeaways - Using the Cost-Benefit Analysis

- Cost-benefit analysis helps you assess feasibility and compare different strategic options.

- Demonstrating an understanding of both quantitative and qualitative factors by considering them equally is essential.

- Strengthen your analysis by quantifying qualitative data whenever possible.

- Mastering cost-benefit analysis enables you to show analytical skills and strategic thinking in case interviews.

- Applying this method gives you a competitive edge by demonstrating a deep understanding of the business landscape.