Breaking into investment banking is one of the most competitive career goals for students and graduates. Top firms like Goldman Sachs, JPMorgan, and Morgan Stanley offer fast-paced environments, high earning potential, and the chance to work on major financial deals.

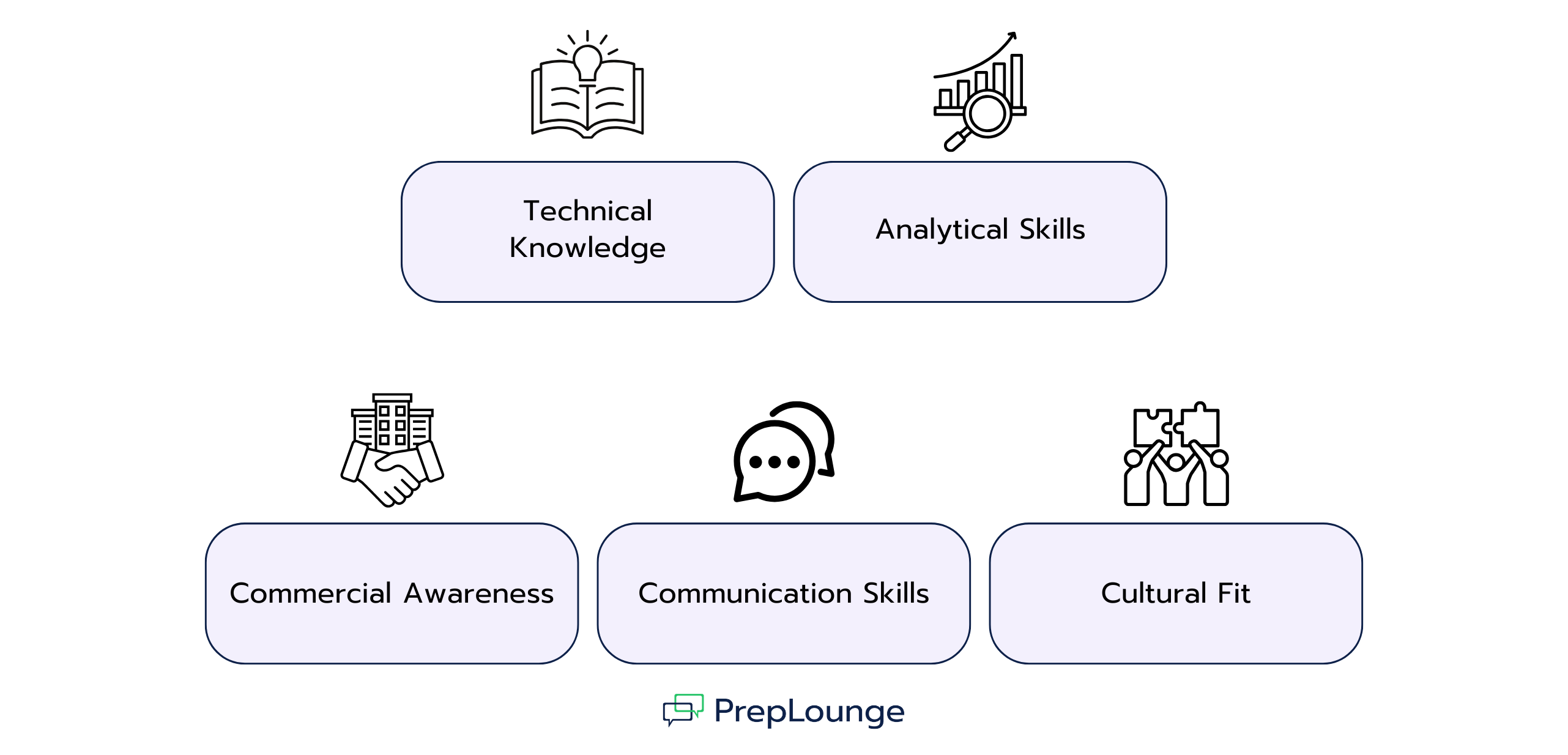

Landing a role, however, takes more than strong grades and a polished résumé. Investment banking interviews are rigorous, testing both technical knowledge and cultural fit. Good preparation can make the difference between getting overlooked and receiving an offer.

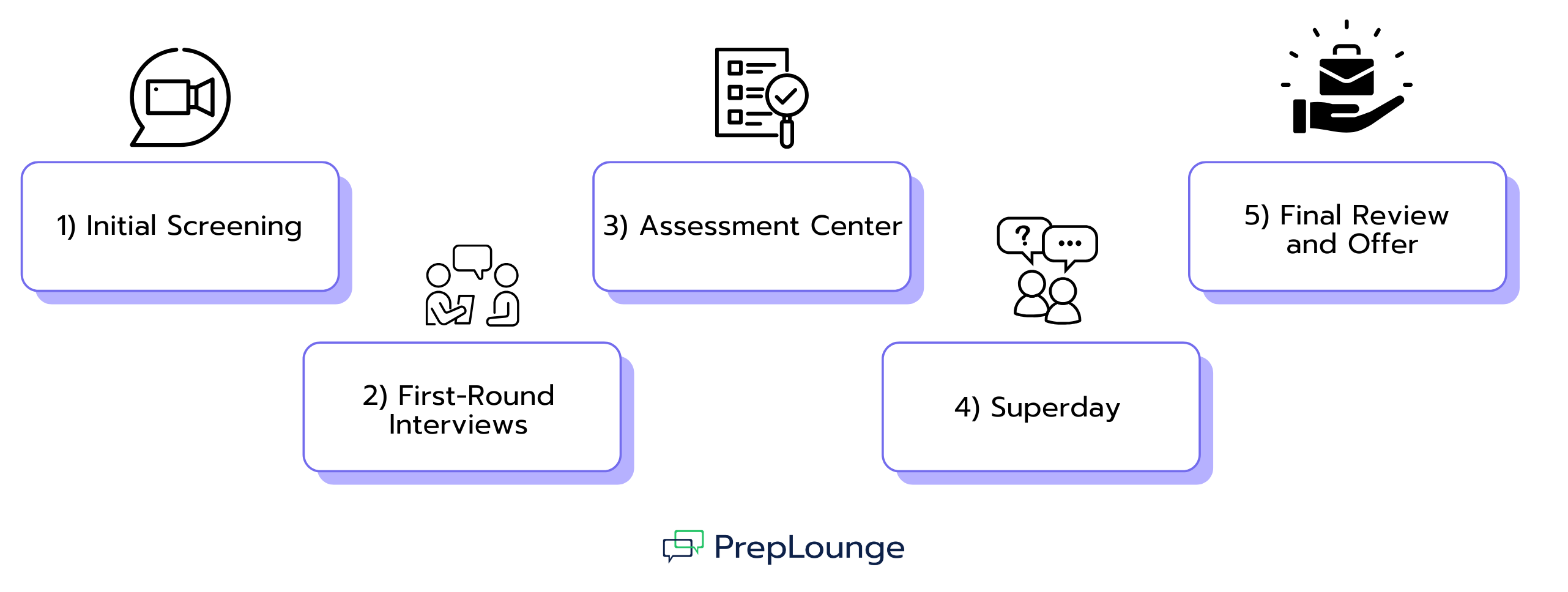

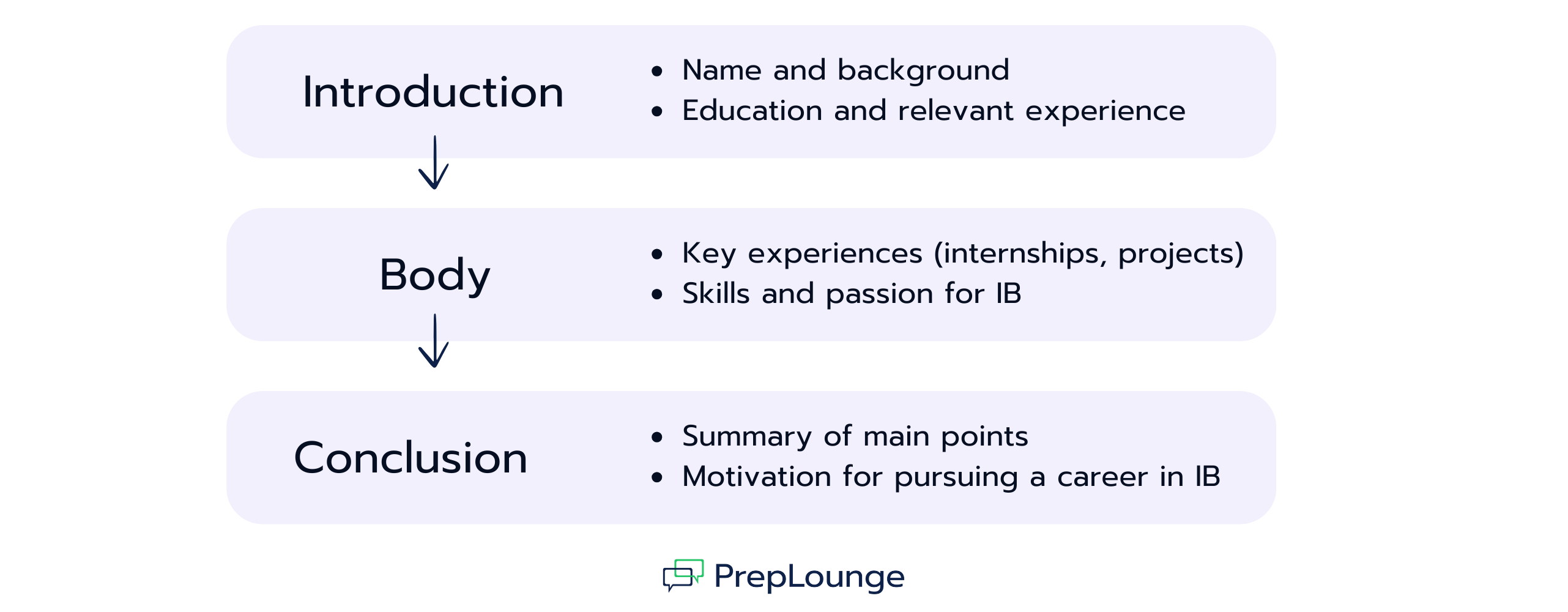

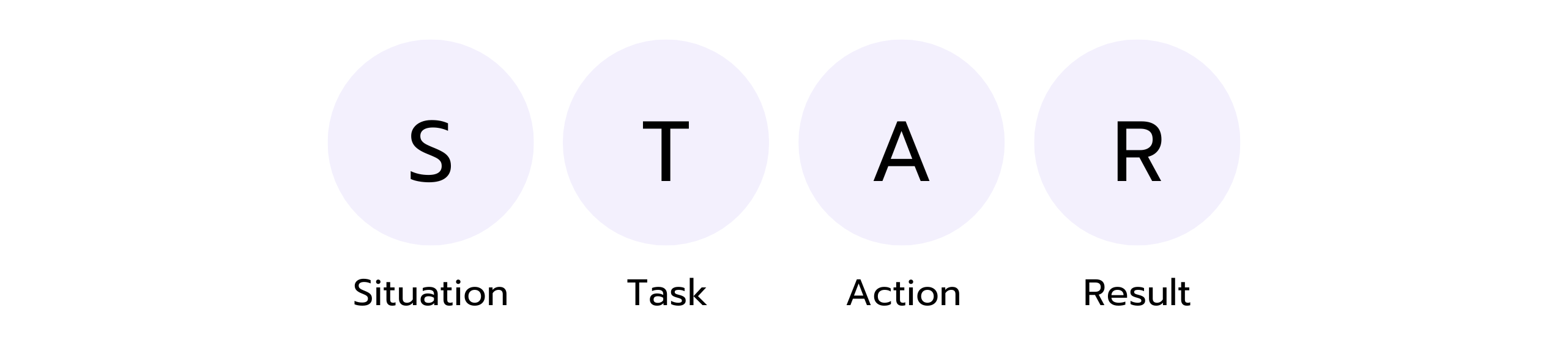

This guide walks you through the recruiting process from the first screening to the final Superday. You’ll learn what interviewers look for, how to prepare effectively, and how storytelling can be just as important as technical skills. We’ll also review sample questions and show you how to structure confident answers.

By the end, you’ll know how to prep for the toughest questions and stand out as a strong candidate.