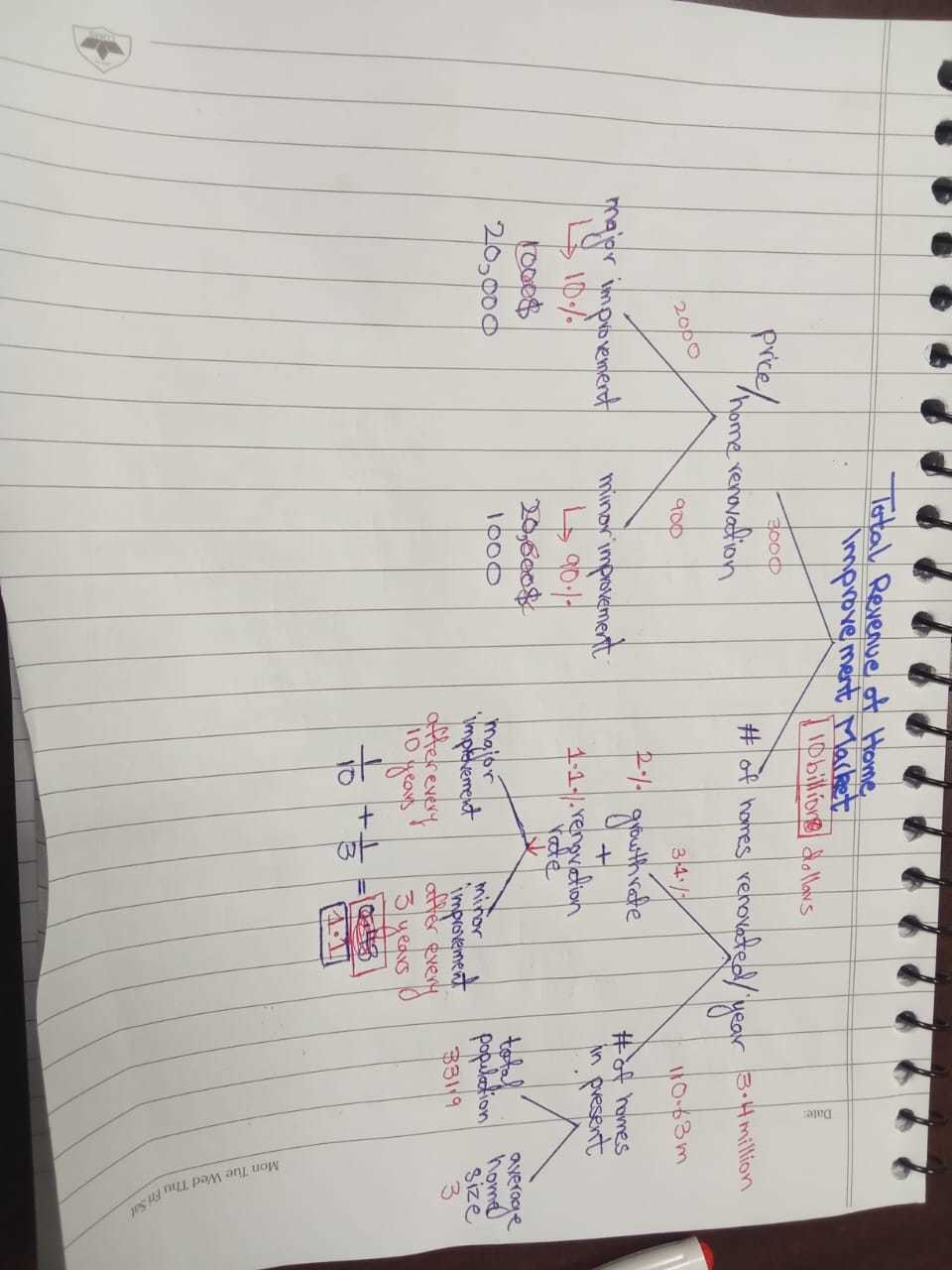

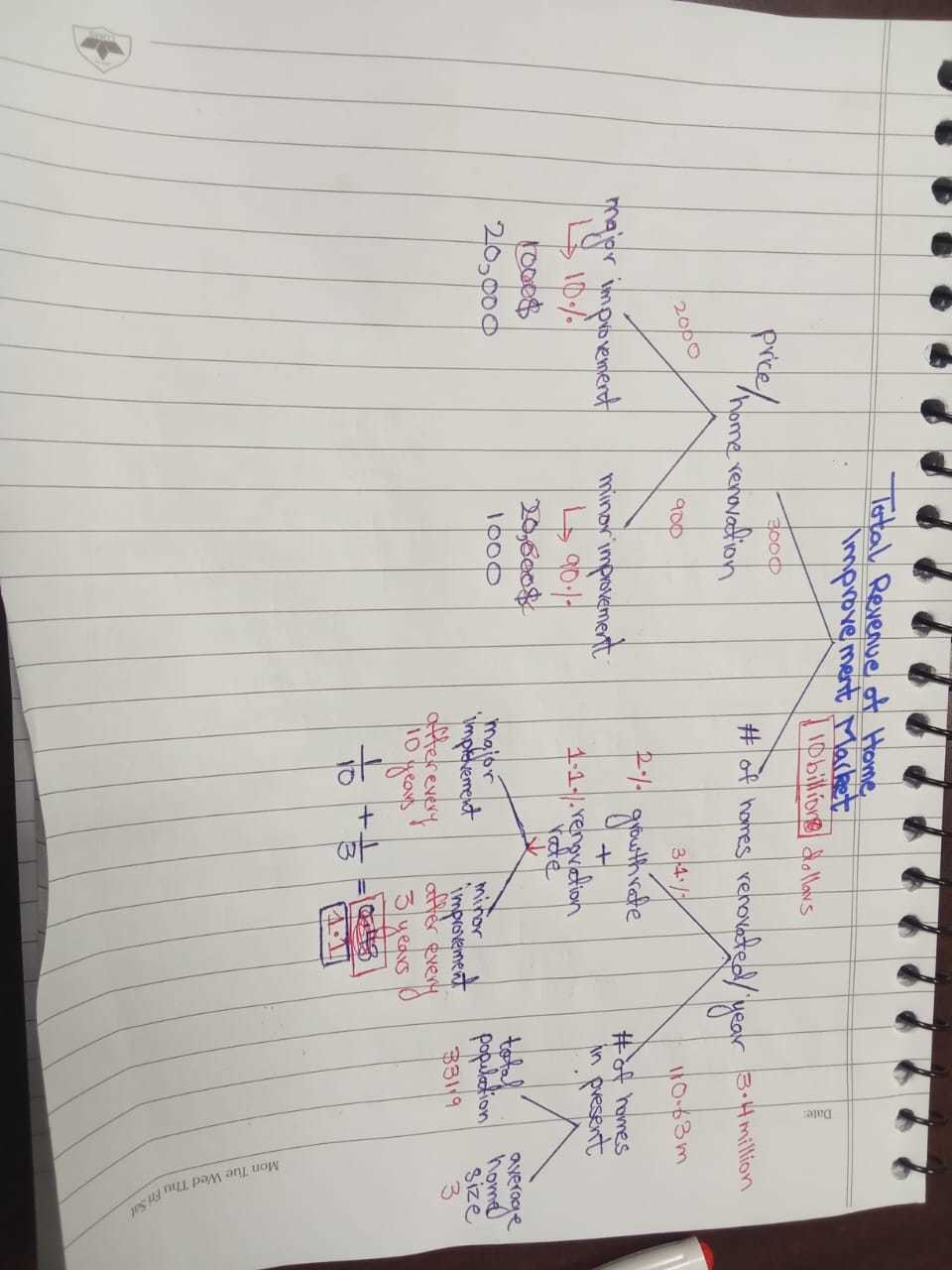

I came up with an answer of 10billion dollars home renovation market per year. But, I think I have done something wrong because numbers is very small. I think assumptions are off. Someone can help please

I came up with an answer of 10billion dollars home renovation market per year. But, I think I have done something wrong because numbers is very small. I think assumptions are off. Someone can help please

Sorry to tell you, there are plenty of mistakes in there.

Other than that, the values you have for large and small renovations are low - but the values you use here will depend on the frequency of renovation you chose.

An alternative approach would be to consider a certain “use period” for the house components and thinking how much % of them is “used per year”. Paint may last 10 years (10% per year). But floor, hardware (e.g. cabinets), appliances, maybe last 20 (5% per year); electrical, plumbing, ceramics… maybe 50 (2% per year). Estimate their cost and apply the % and you get to your target value.

Hi there,

I actually have a super cheap market sizing video course that you can use to practice your market sizing - definitely consider it to improve!

Market Sizing Analysis: Approaches, Techniques, and Exercises (preplounge.com)

First of all, my neck is sore from having to look horizontally at the image :)

Fully agree with Pedro's approach.

Aside from this, I do appreciate the structure that you used, in the sense of approaching it like an issue tree. Typically, you either go for an issue tree or a linear set of filters and you made a good choice in this case.

Best,

Cristian

Sorry. Actually I tried horizontal

(edited)

Learn more about Market Sizing Questions and how to approach them in Case Interviews. The Case Interview Basics at PrepLounge offer you everything you need!

Hi! Thankyou