Any time they ask how many units of a product should they sell to achieve X (can be a new profit target or costs target etc..) is this always a breakeven calculation?

should you just try to find the contribution margin per unit approach here?

Any time they ask how many units of a product should they sell to achieve X (can be a new profit target or costs target etc..) is this always a breakeven calculation?

should you just try to find the contribution margin per unit approach here?

Hi there,

I try to avoid blanket statements, but yes, if they want you to figure out how many x you need for y, that's pretty much always a breakeven.

Sometimes you'll have to calculate based on margins. Other times on price and costs. Etc. Ultimately, you need to figure out what x has to equal to get to that profit.

If you post a breakeven question you've seen we can better help you!

Breakeven

Breakeven is tough as there are so many scenarios! Just remember, all breakeven is, is solving for x, where x is some number to figure out how much of something we need.

The formula you create is specific to the case. So, we may say: We make $20 profit per shoe, and we spent $1,000 to create the shoe stand. How many shoes do we need to breakeven?

In this case, the formula is 1,000 = $20 x ====> x = 50 shoes

Understood? Feel free to message if you'd like to go through multiple examples/scenarios!

Hi there,

1) Any time they ask how many units of a product should they sell to achieve X (can be a new profit target or costs target etc..) is this always a breakeven calculation?

By definition, breakeven refers to the situation where total revenues are equal to total costs. Most likely, the question they ask when they want that you use a breakeven formula is “How many units should the client sell to reach breakeven”.

2) Should you just try to find the contribution margin per unit approach here?

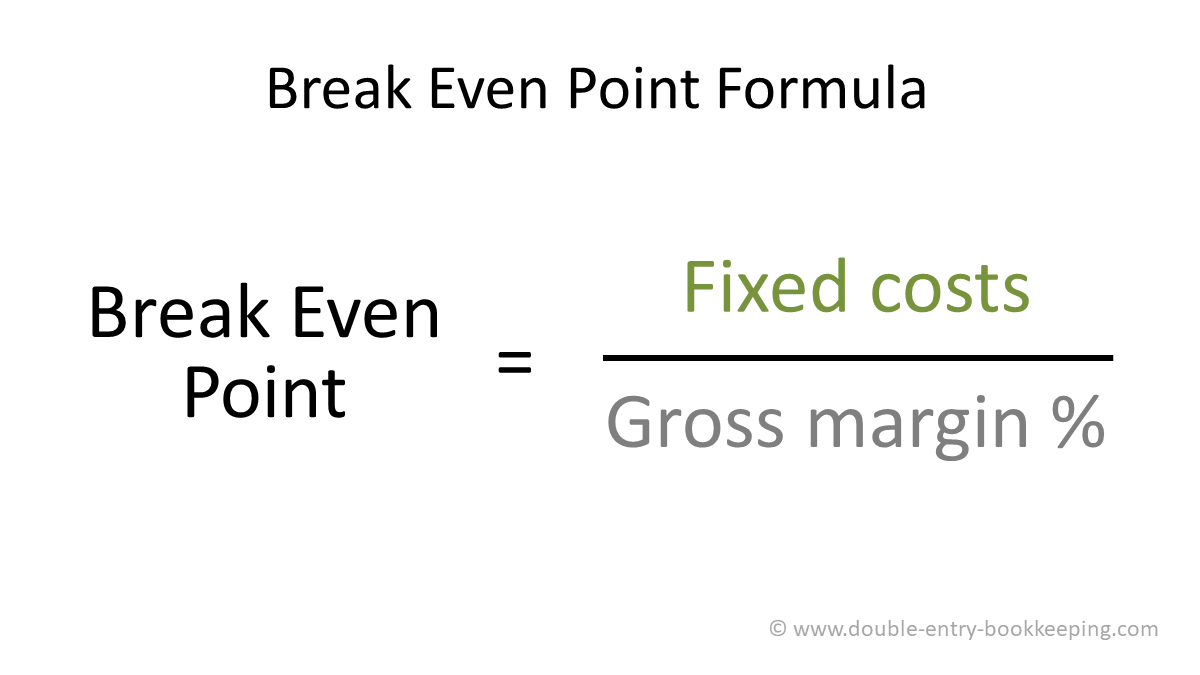

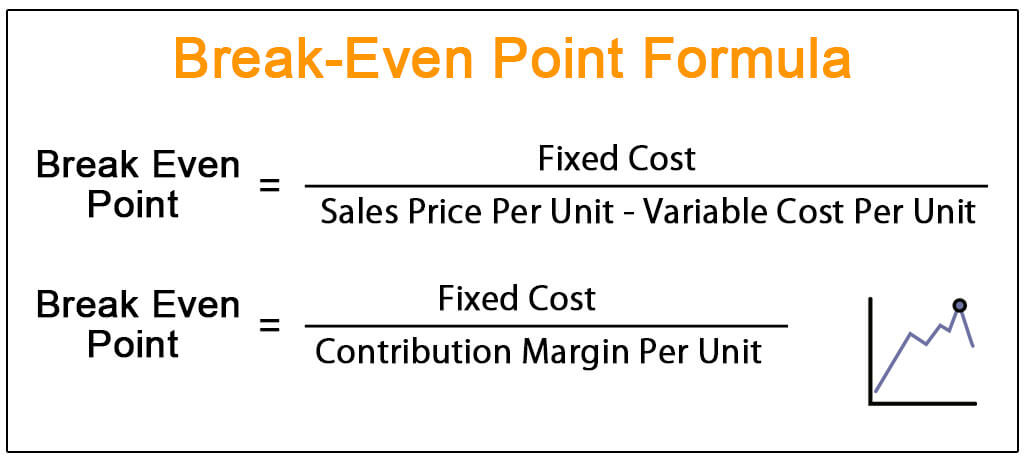

In terms of the formula, let’s assume your goal is to find the quantity to reach breakeven.

You can rearrange the breakeven formula, which is the following:

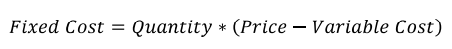

R-VC-FC=0

⇔ p*q-c*q-FC=0

Where

To calculate the quantity, you can rearrange it as follows:

p*q-c*q-FC=0

⇔ q=FC/(p-c)

Hope this helps,

Francesco

Hi there,

This is indeed an interesting question which is probably relevant for quite a lot of users, so I am happy to provide my perspective on it:

In case you want a more detailed discussion on the quantitative questions parts of case studies, please feel free to contact me directly.

I hope this helps,

Hagen

Hello!

Precisely for the high amount of questions (1) asked by my coachees and students and (2) present in this Q&A, I created the “Economic and Financial concepts for MBB interviews”, recently published in PrepLounge’s shop (https://www.preplounge.com/en/shop/prep-guide/economic_and_financial_concepts_for_mbb_interviews).

After +5 years of candidate coaching and university teaching, and after having seen hundreds of cases, I realized that the economic-related knowledge needed to master case interviews is not much, and not complex. However, you need to know where to focus! Hence, I created the guide that I wish I could have had, summarizing the most important economic and financial concepts needed to solve consulting cases, combining key concepts theorical reviews and a hands-on methodology with examples and ad-hoc practice cases.

It focuses on 4 core topics, divided in chapters (each of them ranked in scale of importance, to help you maximize your time in short preparations):

Feel free to PM me for disccount codes for the guide, and I hope it helps you rock your interviews!

If you are not solving for zero, it's not a breakeven calculation, although it's similar to a breakeven calculation.

1. So for breakeven you have:

Q = Fixed Costs / (Price - Variable Cost)

2. For a profitability target of X (absolute value), you would have:

Q = (Fixed Costs + X) / (Price - Variable Cost)

3. For a target margin of X% you would have

Q = Fixed Costs / [(Price * (1-X%)) - Variable Cost]

Hope this was helpful,

Pedro