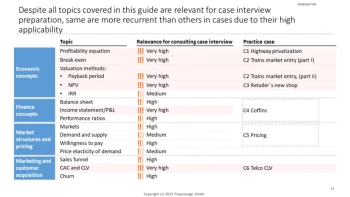

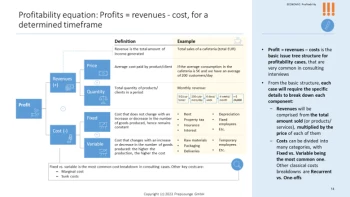

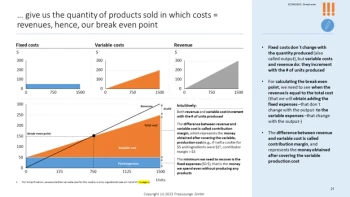

- Overview of consulting interviews and where economic and financial concepts are needed

- Guide’s methodology, with topics prioritization in terms of time for preparation

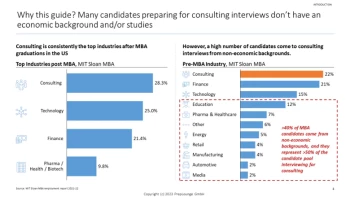

Many candidates preparing for consulting interviews don’t have an economic background, which makes the highly competitive case prep even more uphill. In fact, >40% of MBA candidates come from non-economic backgrounds, and they represent >50% of the candidate pool interviewing for consulting.

I myself was one of them: I went through my McKinsey interviews when I was in my last undergrad year in Architecture. I had no idea of what a break even point was, and the word EBIDTA was just a bunch of letters for me.

After +4 years of candidate coaching and university teaching, and after having seen hundreds of cases, I realized that the economic-related knowledge needed to master case interviews is not much, and not complex. However, you need to know where to focus! Hence, I created the guide that I wish I could have had, summarizing the most important economic and financial concepts needed to solve consulting cases, hoping to help candidates focus on what matters.