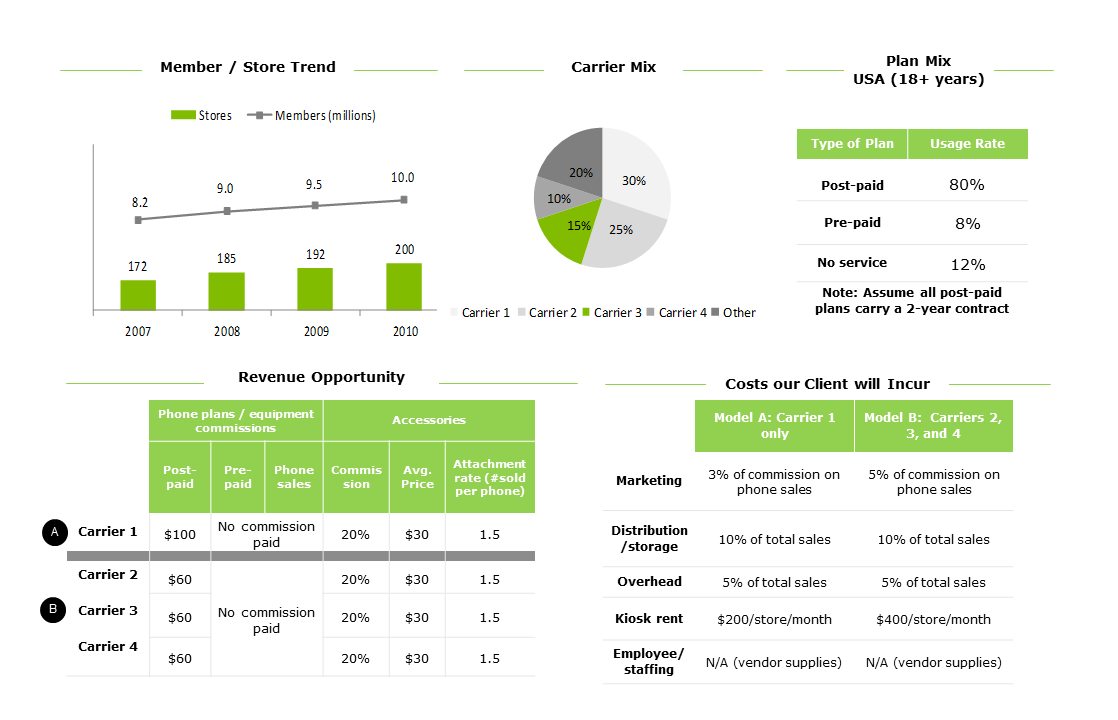

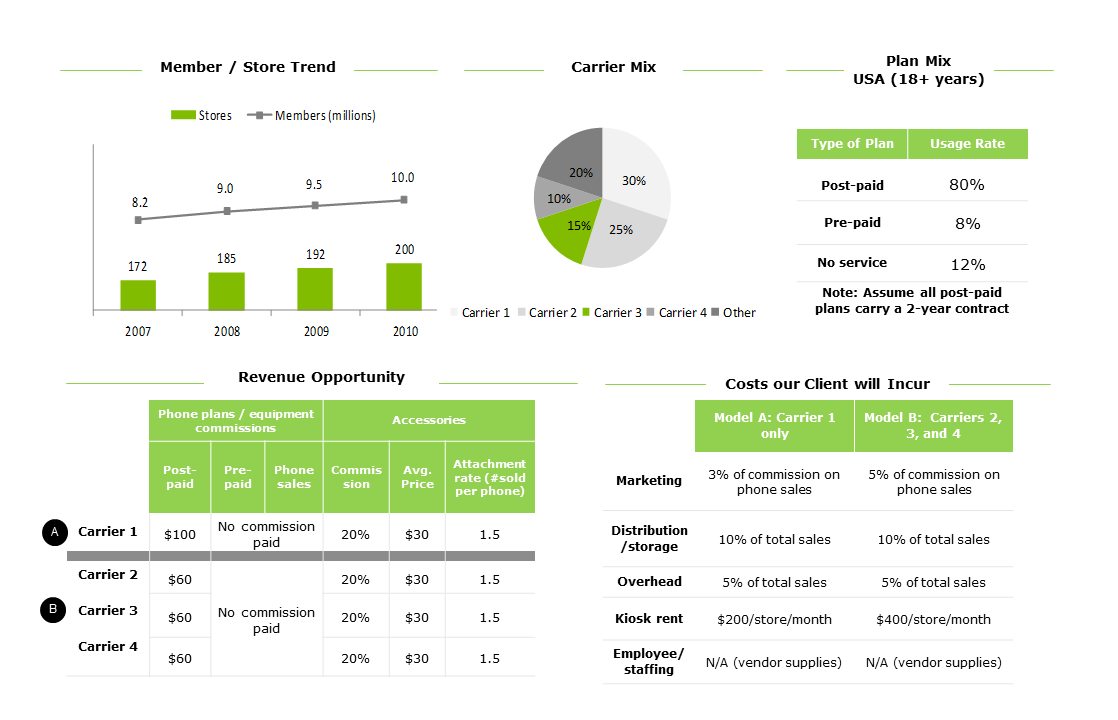

Using the provided data, model a P&L for both business model options (Model A and Model B) for year one. Calculate operating profit (ignore interest, taxes, and depreciation) and round dollar amounts to the nearest $100K.

(edited)

Using the provided data, model a P&L for both business model options (Model A and Model B) for year one. Calculate operating profit (ignore interest, taxes, and depreciation) and round dollar amounts to the nearest $100K.

(edited)

Hi TR!

So, this looks quite intimidating but actually it not very difficult to do - you just need to break the information down.

I'm not sure about the format they want your answer presented in, but if this is a P&L statement here is how I would format the information:

All revenue and cost streams form the headings for the rows (group revenue together first, then add a totals row, then list the costs below and a total row for costs below, and finally a profit column at the bottom), the four different carriers as column headings (and a totals column at the end). Then start filling in.

Your revenue streams are: Post-paid phone commission, accessories commision (per attachment, so multiply by attachment rate per phone), average price.

Your costs are: marketing, distribution/storage, overhead, kiosk rent, employee/staffing.

Separate them for the two type of plans (I am assuming this is what they refer to when asking for two business model options).

The last step is to fill in your worksheet(s). You'll need to use different graphs for the different costs/revenues, but overall doesn't look difficult - just a fair amount of work.

Good luck! Any more questions, just ask.

Model A is the model for carrier 1

Model B is Carriers 2-4

Ah, you’re right! That makes sense.

Thank you!