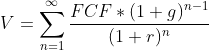

In this case, the NPV is calculated as profit/(discount rate-growth rate)-investment. Isn't NPV=FV/(1+i)^n?

Caribbean Island – MBB Final Round

4,6

17,1k mal gelöst

Fortgeschritten

Candidate-led