Hi all,

I used two ways to calculate break-even units and got two different answers! can you help me figure out what went wrong? Thank you!

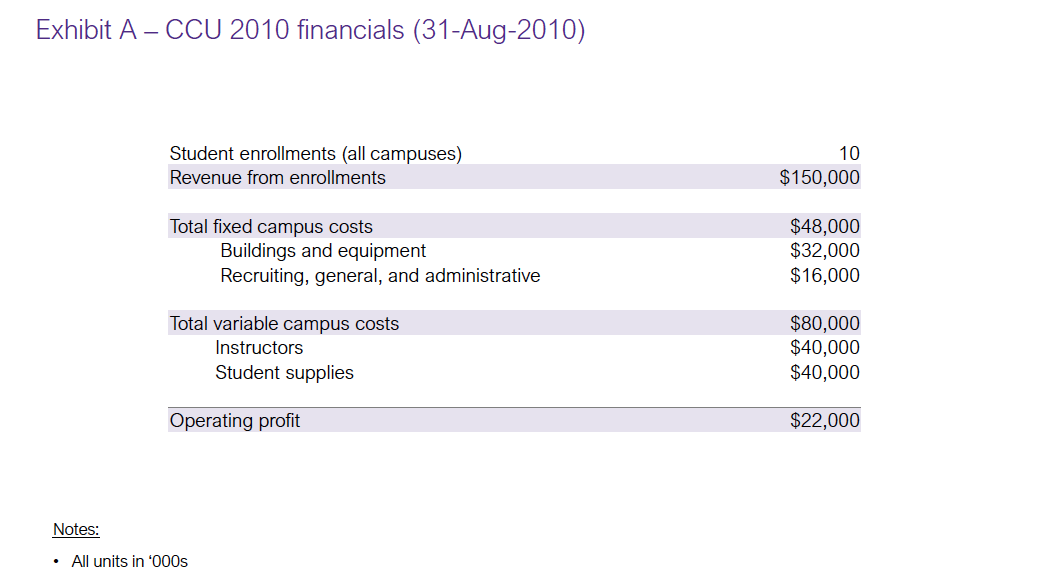

Our client is a for-profit, specialty college named Chic Cosmetology University (CCU). Founded in 2005, CCU is a program for high school graduates seeking their professional cosmetology license. CCU is currently the market leader for cosmetology education with campuses in ten major metropolitan areas in the US.

CCU has capital to invest in a new campus and is considering Chicagoland as a location –should they do it? the investment initial Chicagoland campus cost is $4.5M in initial building costs to renovate its chosen site. These costs can be amortized evenly over a three year period. Assume fixed costs remain flat per year.

How many students will CCU need to break-even in year 1?

Approach 1: break even units = fixed cost/contributing margin per unit. fixed cost= 4.8M+1.5M= 6.3M contributing margin per unit= 15,000(revenue per student) - 8000 (variable cost per student)= 7000. so breakeven units = 6.3M/7000=900

Approach 2: breakeven units * revenue per student = total costs

breakeven units*15,000= 4.8M+1.5M+8M, so breakeven units= 953