A Leveraged Buyout (LBO) Model is a popular financial analysis tool for private equity firms, typically built in Excel. It’s used to assess whether a company is worth acquiring primarily with debt. In an LBO, private equity firms or investors purchase a company by combining equity, or their money, with debt. The model projects the target company's financial performance, including revenue, expenses, and cash flow, post-acquisition to show how its cash flow will be used to service and pay down the large amount of debt taken on.

The main purpose of building an LBO model is to determine the potential returns for the equity investors, like the private equity firm, by calculating metrics such as Internal Rate of Return (IRR) and Multiple on Invested Capital (MOIC) at the time of an eventual sale or exit. It also helps assess the company's ability to handle the debt burden.

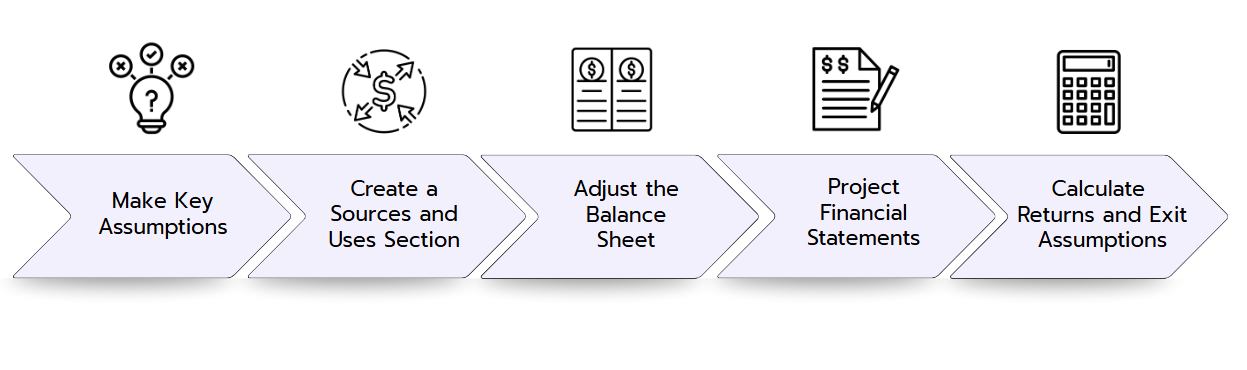

How to Build a Basic LBO Model

First, it's essential to understand the building blocks of the model and what each step aims to achieve. So let’s have a look at the key components of an LBO model:

Step 1: Make Key Assumptions

The first step of building an LBO model is to make assumptions about important factors like the following:

- Purchase Price: The total amount of money paid to acquire the target company. The purchase price is based on a valuation metric like Enterprise Value (EV), which represents the total value of the company, including debt and equity.

- Debt/Equity Ratio: This specifies the proportion of debt versus equity used to finance the purchase. A higher ratio indicates more leverage.

- Interest Rate on Debt: The cost of borrowing the debt, expressed as a percentage.

You also estimate operational metrics such as revenue growth and margins or profitability as a percentage of revenue. These assumptions provide the foundation for evaluating the feasibility and returns of the deal.

Step 2: Create a Sources and Uses Section

The next step is to build a sources and uses table, which outlines how the acquisition will be financed and where the money will go. Sources represent the capital used to fund the purchase, including equity and debt.

Uses show how this capital is allocated. These areas include the purchase price, transaction fees, and debt repayment. This section also calculates the equity contribution, or the amount of cash investors need to provide.

Step 3: Adjust the Balance Sheet

After determining financing, you modify the company’s balance sheet to reflect the new capital structure. This involves adding the newly acquired debt and equity to the liabilities and equity side, while balancing the assets side by including items like goodwill. That is the premium paid over the company’s book value. These adjustments ensure the balance sheet remains accurate post-transaction where:

- Assets = Liabilities + Equity

Step 4: Project Financial Statements

This step is all about forecasting the company’s future performance by projecting its income statement, balance sheet, and cash flow statement. Key components include estimating cash flows, accounting for interest payments (the cost of borrowing), and modeling debt repayment over time. Strong cash flow is essential for covering debt obligations and ensuring the transaction’s success.

Step 5: Calculate Returns and Exit Assumptions

The final step is to estimate the potential returns. You make assumptions about the exit strategy, such as selling the company after a few years at a multiple of its EBITDA (earnings before interest, taxes, depreciation, and amortization). Using these assumptions, you calculate metrics like the internal rate of return (IRR), which measures the profitability of the investment for equity holders.

Another profitability metric is Multiple on Invested Capital (MOIC) which calculates how many times the initial investment is returned. For example, a 2.0x MOIC means for every $1 invested, $2 was returned.

Common Leveraged Buyout (LBO) Model Interview Questions

To help you prepare, we’ve gathered some typical LBO interview questions. These examples will give you a good sense of what might come up and are a great way to practice and build confidence ahead of your interview.

1. What makes a company a good LBO candidate?

The most important criteria when checking if a target company is an ideal LBO candidate is stable cash flows. That’s because the acquiring company uses the free cash flows to pay down the debt principal and interest.

Other factors include:

- Having assets that can be used as debt collateral

- A low purchase price and low-risk industry

- Not have a huge need for ongoing or other investments such as CapEx

- Have opportunities to decrease costs and increase margins

2. What is the Internal Rate of Return (IRR) of the following investment?

A private equity firm acquires a company with $50 million in EBITDA at an 8x multiple, using 70% debt and 30% equity. By Year 4, the company’s EBITDA has grown to $80 million, but the exit multiple has dropped to 7x. Over the holding period, $150 million of the debt is repaid and there’s no extra cash on hand.

Let’s break it down step by step:

1. Purchase Price

EBITDA × Entry Multiple = $50 million × 8 = $400 million

2. Capital Structure at Entry

- Debt (70%) = $280 million

- Equity (30%) = $120 million

3. Exit Value

EBITDA × Exit Multiple = $80 million × 7 = $560 million

4. Equity Value at Exit

Remaining Debt = $280 million – $150 million = $130 million

Equity Value = Exit Value – Remaining Debt = $560 million – $130 million = $430 million

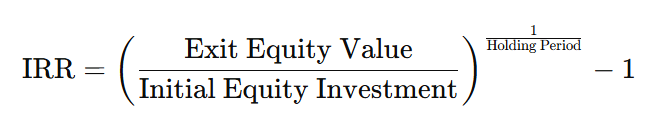

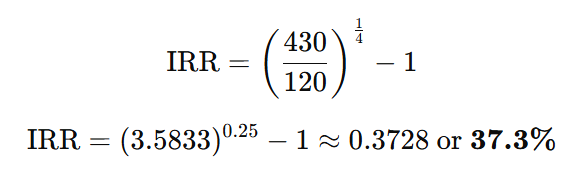

5. IRR Calculation

We use the standard IRR formula:

Plug in the numbers:

👉 In finance interviews, it’s not just about knowing the formulas – you should also be able to run quick calculations in your head with confidence. Check out our Mental Math Tool and sharpen your calculation skills!