EBITDA stands for Earnings Before Interest, Taxes, Depreciation, and Amortization. It reflects a company’s earnings before taking into account interest payments, tax expenses, and non-cash items like depreciation and amortization. You can think of it as an extended version of EBIT that excludes all depreciation-related costs.

The idea behind this: depreciation and amortization are non-cash expenses and often influenced by accounting methods, assumptions, or company policies. By stripping them out, EBITDA aims to provide a clearer picture of a company’s ongoing operational performance, regardless of how much has been invested or how assets are accounted for.

How EBITDA Is Used in Practice

EBITDA is commonly used as an indicator of operating performance before investment and financing effects come into play. It helps to:

- Compare companies of different sizes, industries, or regions.

- Assess how much profit is generated from core operations (before interest, taxes, or capex).

- Serve as a base for valuation metrics such as the EV/EBITDA multiple.

- Analyze the profitability of business models (especially in capital-intensive industries).

An example: Imagine two companies each report €100 million in EBIT. One of them has €50 million in annual depreciation (due to heavy investments in machinery), while the other only has €10 million. Based on EBITDA, both companies appear equally profitable because depreciation is ignored. This can be both an advantage and a risk: EBITDA shows "adjusted" profitability, but also leaves out real costs.

That’s why in private equity and investment banking, EBITDA is often used as a starting point for valuation models. Just keep in mind: EBITDA is a purely accounting-based figure and not an actual cash flow metric!

Where to Find EBITDA in Financial Statements?

EBITDA, like EBIT, is not always directly listed in the income statement. However, many companies (especially publicly traded ones) disclose it in the notes or the management analysis or discussion.

If you want to calculate it yourself, here's how:

- Start with the operating profit (this is usually shown in the income statement).

- Add back interest and tax expenses to arrive at EBIT.

- Then add back depreciation and amortization, including:

- Depreciation of tangible assets

- Amortization of intangible assets

You’ll often find the necessary figures in the notes to the income statement or in the cash flow statement. Look for terms like "Depreciation", "Amortization", or "D&A".

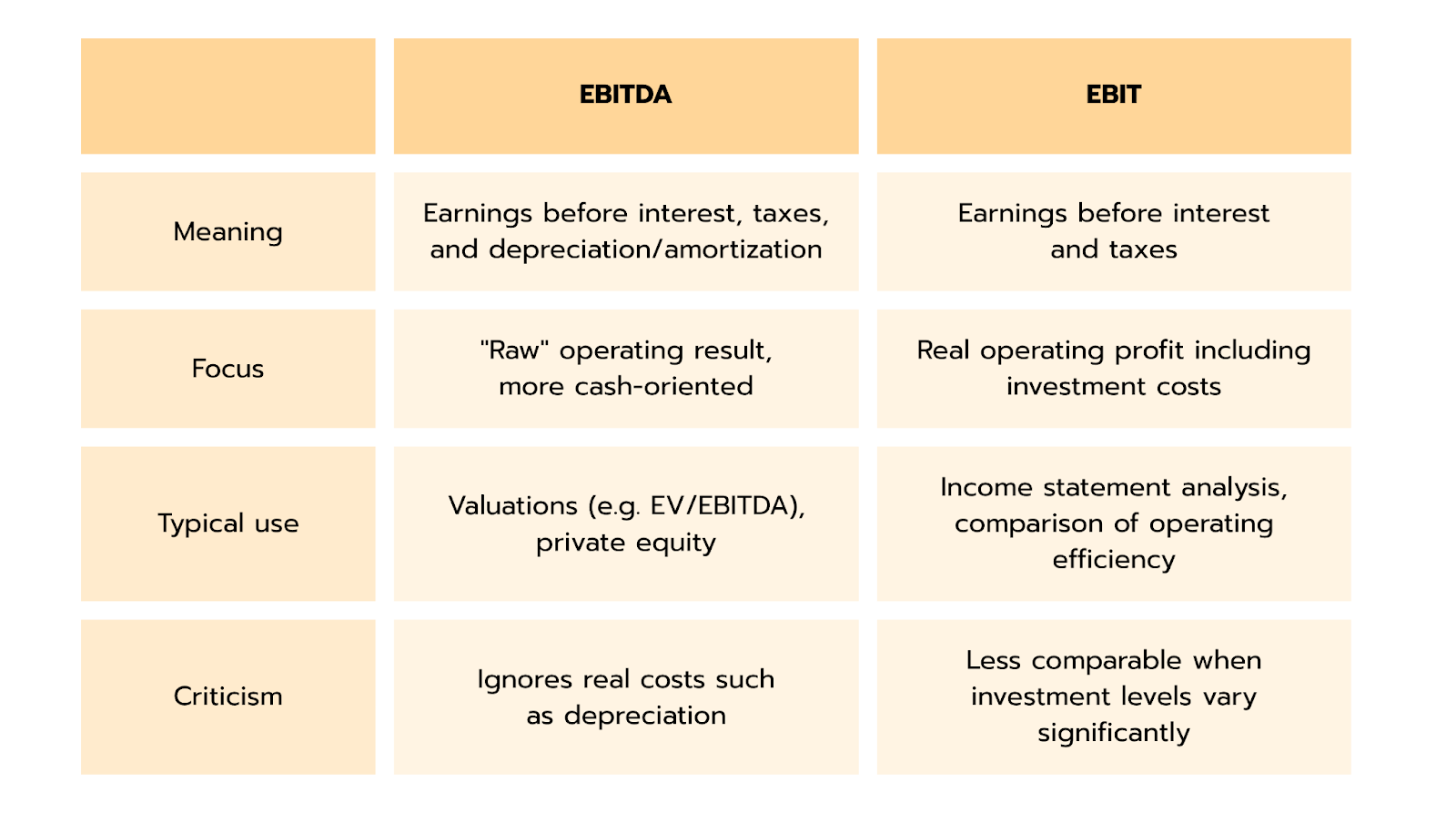

What’s the Difference Between EBIT and EBITDA?

As you now know, EBITDA shows how much a company earns from its core business before interest, taxes, and depreciation. EBIT, on the other hand, already includes depreciation and amortization, so it reflects a more realistic view of the actual operating profit after accounting for investment-related costs.

EBITDA is great when you want a quick, comparable view of operational strength, especially across companies with different investment levels or accounting treatments. But if you want to understand the true profitability, taking into account the wear and tear of assets and other investment costs, EBIT gives you a more complete picture.

To make the comparison even easier, we’ve summarized the key differences in this table:

Common EBITDA Questions in Finance Interviews

If you’re preparing for finance interviews, make sure you understand what EBITDA means, how to calculate it, and where its limitations lie. Typical interview questions include:

- What’s the difference between EBIT and EBITDA?

- Why is EBITDA not a true cash flow metric?

- When is an EBITDA multiple useful and when is it not?

How does IFRS 16 affect EBITDA?

👉 You can practice these questions with our case question sets. Check them out!