Case Prompt

A global foods maker and marketer, which is based in the US, is contemplating a strategic acquisition of a smaller British confectionery company to bolster its presence in emerging markets and establish a footprint in additional businesses, such as gum and candy. They've hired our team to help them evaluate this potential acquisition and help the senior leadership make a decision. Which key pieces of analysis would you look at to guide them?

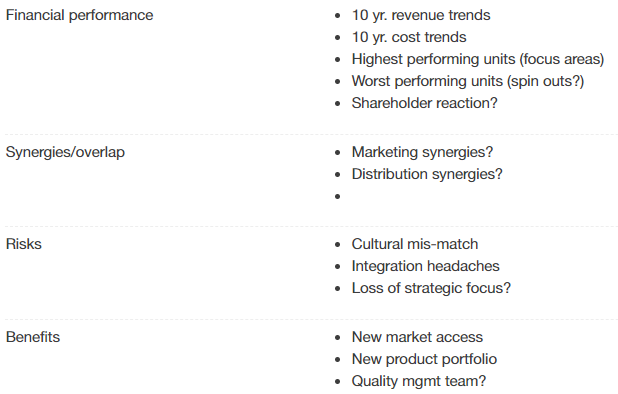

Structure 1 (Specific)

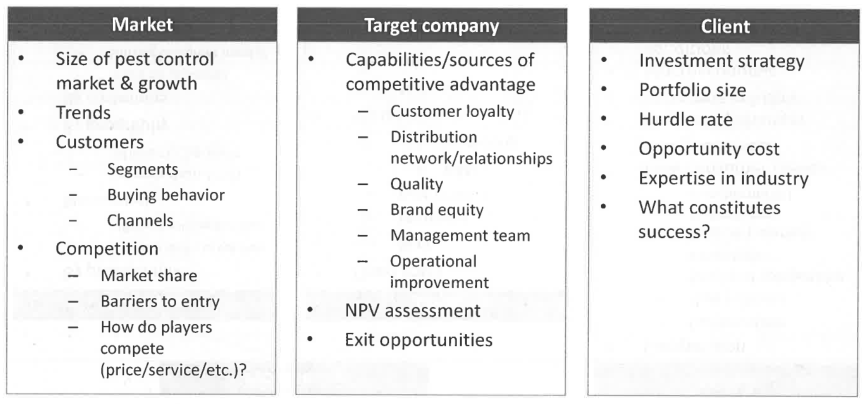

Structure 2 (Broad)

Which of the case structures above would an interviewer prefer?

(edited)