Hello,

A logistics company has to choose between "standard trucks"(ST) and "hybrid trucks"(HT) and has the following data:

----------------------------------ST------------------------HT

1. Purchase price: ____$100k___________$150k

2. Maintenance/Yr: _____$5k_____________$8k

3. Insurance/Yr:________$2k_____________$3k

4. Fuel/Yr:______________$18k____________$9k

5. Lifespan: ____________10 Yrs__________10 Yrs

6. Depreciation/Yr: _____$10k____________$15k

So far:

operating costs = $35k/Yr for both ST & HT (maintenance + insurance + fuel + depreciation)

op costs for 10 yrs = $350k for the 10Y lifespan

In this case, depreciation is the annualized cost (used value of the asset) which after the 10Y period will be less than the initial price.

100k in Year1 > 10k from Y1 to Y10, so depreciation cannot include financing/loan premiums.

How do we include the full purchase price (initial investment or financing fees) in the total investment required while still having the depreciation in mind?

Thank you for answering, cheers!

LE:

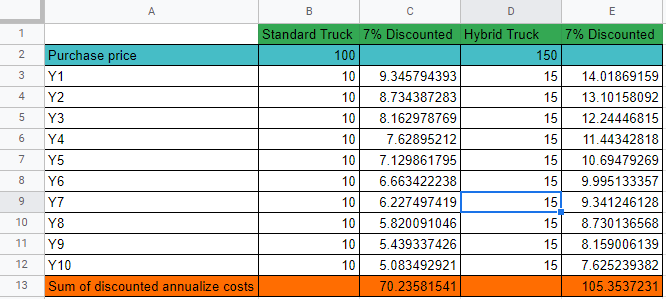

So basically, the depreciation accounts for way less than the purchase price (assuming a 7% discount rate for future cash flows)

Does total investment include also purchase price and depreciation?

Hi there!

Agree with other comments and would approach it also from a cash flow point of view.

In any case, the math of a typical MBB case is not this long and more straightforward.

Cheers,

Clara

The depreciation is the annualized cost for the upfront investment, so if you add the yearly costs including depreciation, you have the upfront costs included already. Adding them would be double-counting.

And because the total depreciation over 10 years is equal to the total investment, you also don't need to consider any salvage value at the end of the investment horizon.

Hi,

You will have an initial upfront investment of $100K and then annual depreciation of $10K as well as other annual costs. Based on that you calculate the cash flows, discount them and compare between the two options

Best

i would consider this as a cashflow problem.

will the $50 in extra capex ($150-100) eventually pay off over the investment horizon?

assuming 33% tax rate:

ST outlays:18+2+5-3,3(tax shield from depreciation): ~22

HT outlays:9+3+8-5=~15

you would have a net gain of ~7 if you go for HT per year. depending on the client's wacc, it would make sense the extra invstment :)

Hi Mihai,

Just to add to the other answers, here the clear decision point is around time value of money AND cashflows.

Cashflow is super important for companies (and often overlooked). So, you need to recognize that, while these seem like "equal" decisions, ST is the better one as you do not have $50k tied up in cash over this time period (both limiting total cashflow AND sitting there earning 0% returns)