The case promt involves comparing four countries to determine which one would be best for acquiring a bakery chain from view of an PE investor.

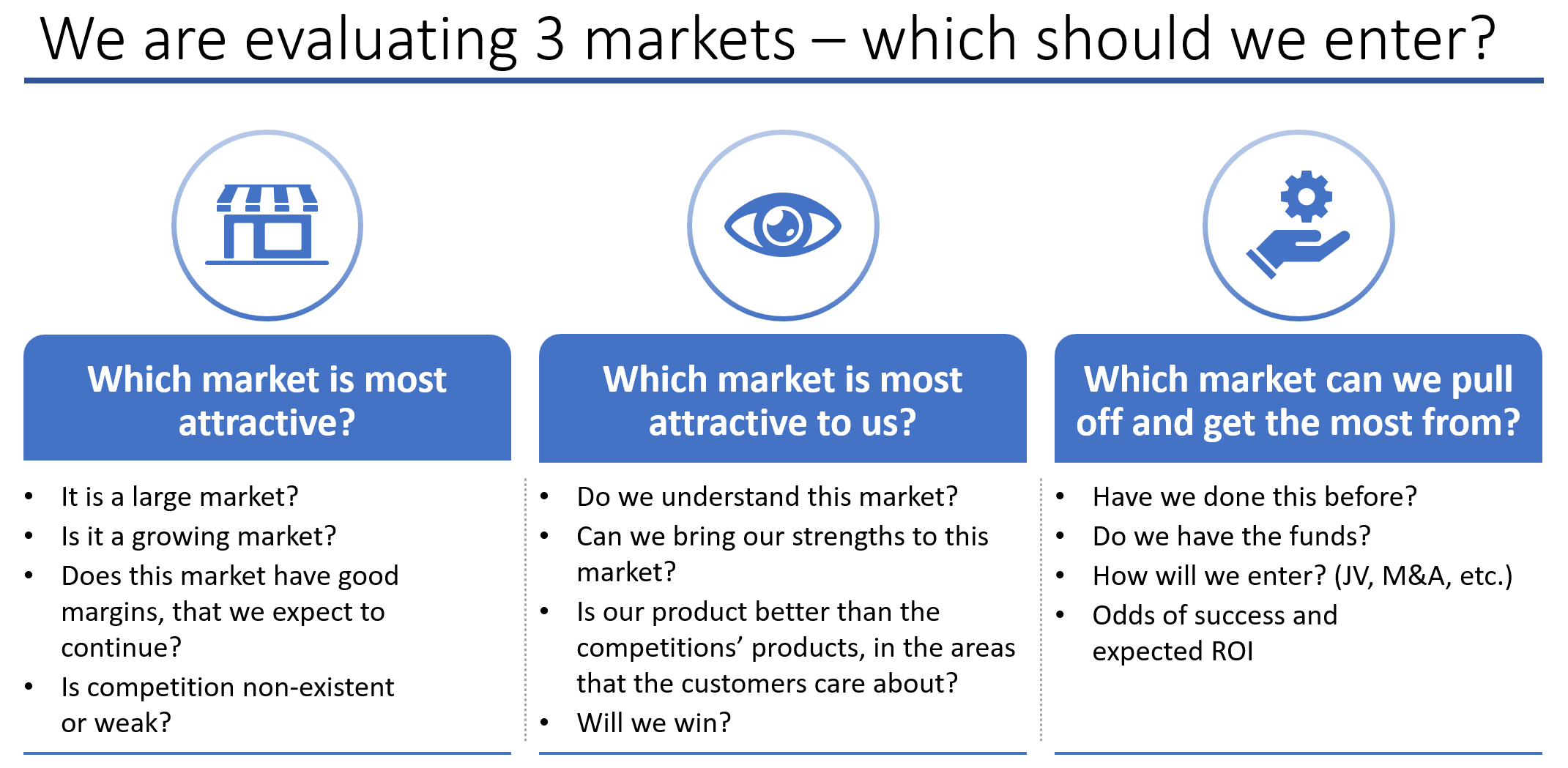

The framework I came up with so far consists of several factors which I would use to rank each country (1-4) and make a recommendation.

- The first set of factors focuses on the market itself:

- Market size

- Market growth potential (market maturity)

- Average profitability

- The second set of factors looks at the provider landscape:

- Number of players in the market

- Market shares of each player

- Degree of competition

- Additional factors I think to consider include:

- Trends in customer behavior and demographics

- Market segmentation based on different customer groups (premium, middle, and mainstream)

- Availability of potential target companies

- Regulatory environment (including taxes and other relevant laws)

The challenge is to create a framework that is MECE and easy to present. I am very thankful for any input on this.