StyleScape responds to customer feedback (McKinsey final round)

Style Scape is a mid-sized retailer that sells clothing, accessories, and home goods through its physical stores and online platform. The business has been around for over a decade and has seen consistent growth in sales in its home market of the United States. Style Scape operates 30 stores nationwide, and its online platform is relatively new, having launched only two years ago.

Despite healthy growth, the company's leadership has noticed an alarming decline in customer satisfaction ratings and an increase in customer complaints. They are concerned that these issues will harm the company's reputation and negatively impact its bottom line. The CEO of Style Scape has requested your assistance in determining the root causes of these issues and developing recommendations to address them.

Case-Kommentare

Question 1: What are some of the reasons why customer satisfaction ratings may have declined?

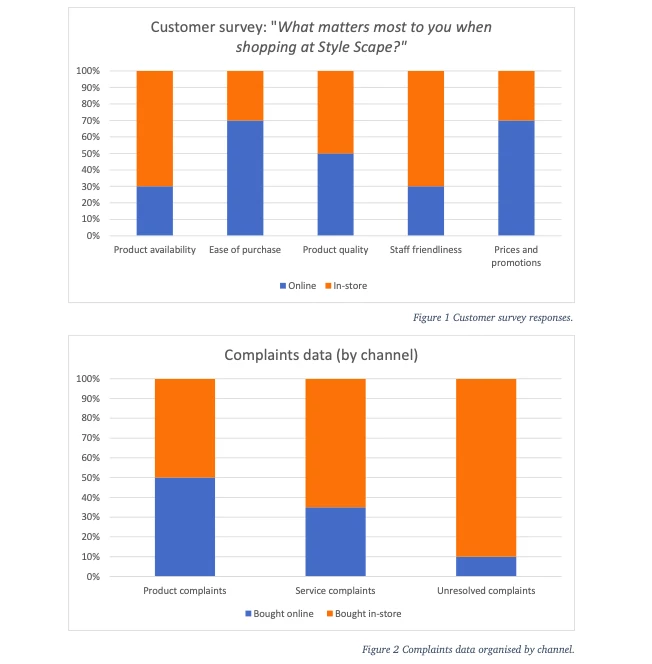

Question 2: Based on the following data, what do you think is happening, and what would you advise Style Scape?

Your team has gathered additional information about Style Scape customers and their complaints.

Question 3: By how many percentage points would customer satisfaction need to rise for the investment to make sense?

Now that we have a better understanding of what drives customer satisfaction, we want to learn more about the potential impact of developing a retraining program to help our staff better manage customer interaction. The team arrived at the following estimates:

- The training program would cost us $91k to develop

- We have 350 customer service staff across our business, each of them compensated at a rate of $15/hr

- It would take each staff member 16 hours to complete the training

By how many percentage points would customer satisfaction need to rise for the investment to make sense? You can assume that for each percentage increase, the business generates an additional $250k in revenue.

Question 4: What sort of risks do you think the client should be prepared for?

The client is pleased with your analysis and is considering an investment in the training programme. Now that we understand the financial implications better, what sort of risks do you think the client should be prepared for?