When preparing for a finance interview, your first thoughts are probably about technical questions on valuation, financial statements, or key performance indicators. But increasingly, banks, investment funds, and corporates are using a different format: the case study.

Although often associated with consulting, case studies are now a common part of finance recruiting, especially when the goal is to assess your strategic thinking, analytical approach, and understanding of business dynamics.

What Exactly Is a Case Study?

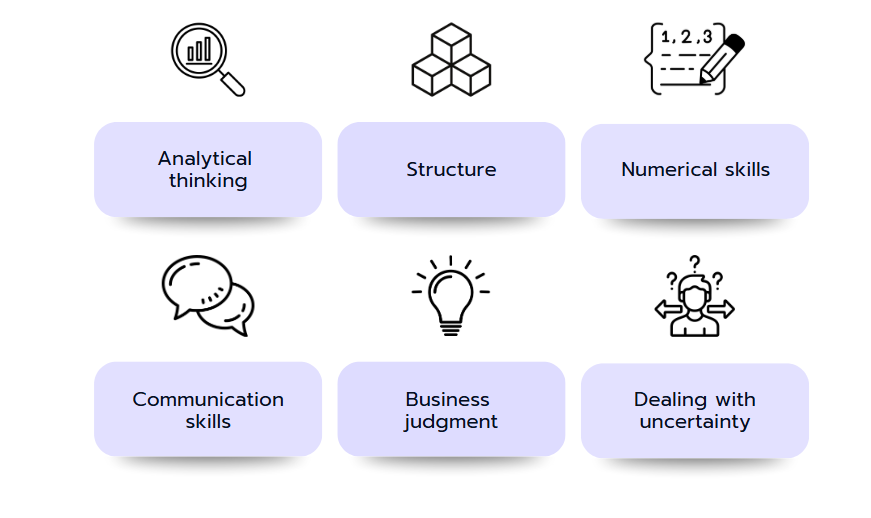

A case study is a realistic business scenario that you’re asked to analyze and solve in a structured way during the interview. The goal is to see how you approach complex problems: Do you think logically? Can you stay structured? Are you comfortable working with numbers and understanding business contexts? And most importantly – can you communicate your thoughts clearly and effectively?

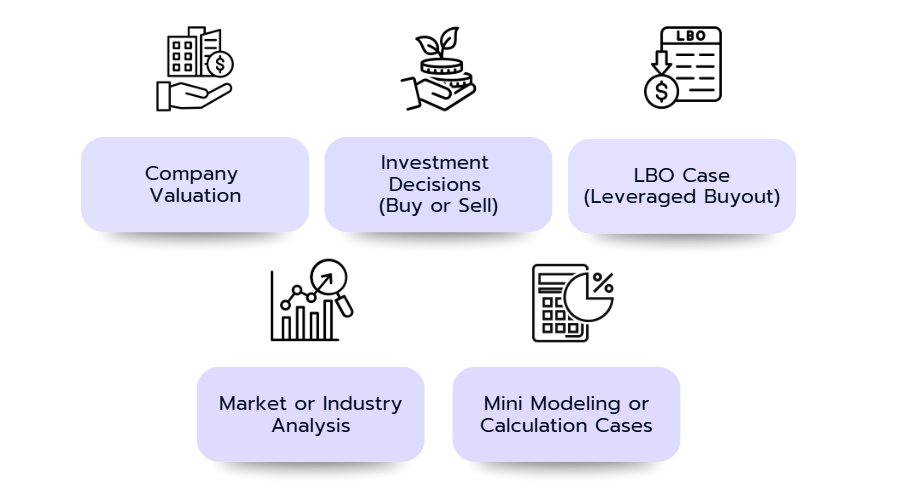

In a finance context, it’s usually not about creative brainstorming or endless strategy proposals. Instead, these case studies focus on number-driven decisions with clear business implications. You might be given a short company profile, some market data or financial metrics, and then be asked to evaluate whether an investment is profitable, how much a company is worth, or where financial risks may lie.

One important thing to keep in mind is that there is usually no single correct answer. What truly matters is how you approach the problem. Interviewers focus on your reasoning, your ability to work with numbers, and how clearly and methodically you think under pressure.

👉 Looking for examples? Our Case Library offers a wide range of finance-focused cases to help you prepare effectively!