Context: Am preparing for McKinsey Final Round w/ Partners (who probably care about nitty grittyies of MECE, buckets, etc)

A sample case I did had a question of "Bank Sees A Decline In Profits And Wants To Reverse It.. How Would You Go About Doing This"

Naturally, I did 3 buckets: 1) Ways to increase Revenues, 2) Ways to decrease Costs, and 3) why not have a catch-all bucket about "Understanding the Decline" reasons wherein I would go into Customers, Market, Competitors.

Asked an Ex-McKinsey mentor and they said I didn't even need bucket #3. I just need to stick to the pure profitability framework and never mix frameworks (e.g mix profitability + CCC frameworks)... I think he was also worried that Market, Consumer, etc would not be Mutually Exclusive with my ideas on increasing revenues/decreasing costs

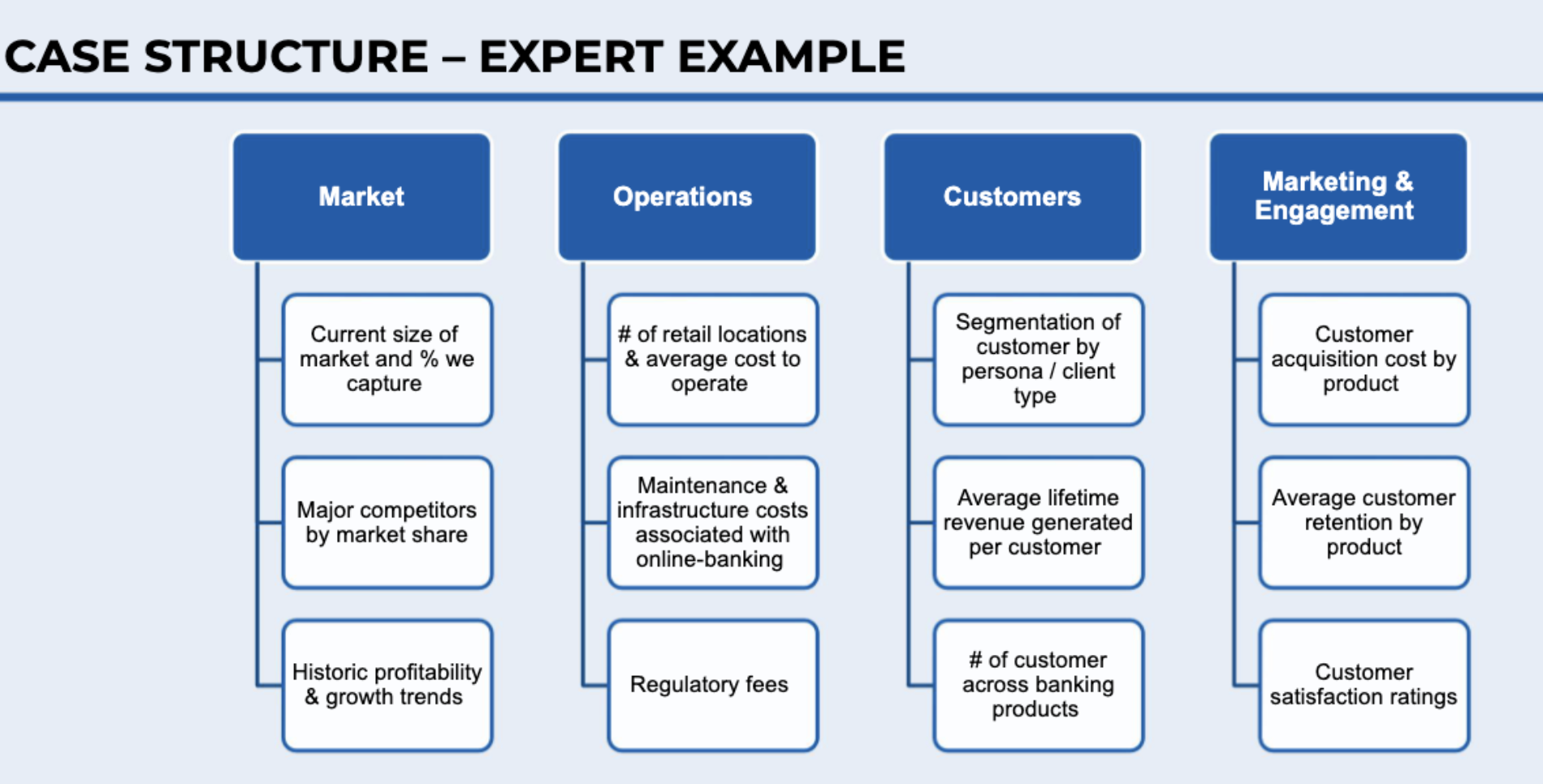

Moreover, sample answer below doesnt even have Revenue and Costs(weird!) My mentor said this sample answer below is wrong.. To be honest my own answer was completely different focused on ways to logical/creative ways to increase Revenues and decreasing Costs... Unless the words "How Would You Go About Doing This" have some sort of specific meaning, my approach should be equally correct

So my question to everyone: To keep things collectively exhaustive and show im creative/considering major factors, should I try to bring in "market", "customers", "competitor" buckets into Profitability cases like this (as long as I ensure no mutual overlap with Revenues/Costs buckets)? Also, should I try to be super creative and have buckets like "Societal Impacts", etc or only do those when extremely relevant