47th floor, Frankfurt’s financial district. You’re sitting across from a McKinsey Partner who’s been running case interviews for more than a decade. The success rate? Just 1.2%.

“Our client is an international luxury hotel group,” he starts promptly. “Annual revenue: €280 million. The problem? The EBITDA margin has dropped from 22% to 13% within two years which means a €25.2 million decline in profit at constant revenue. 847 hotels across 31 countries are affected.”

Then he leans back and asks: “How would you approach this situation?”

You take a deep breath. The next 45 minutes will decide your future in consulting.

A few months ago, this question would have thrown you off:

- “Revenue analysis or cost deep-dive - where do I even start?”

- “With 847 hotels, what type of segmentation makes sense?”

- “Should I ask for more data or jump straight into a hypothesis?”

But today, you immediately identify a classic profitability case. Revenues vs. costs. MECE structure. Hypothesis-driven approach. You’ve been training for this moment for months, using the PrepLounge Case Interview Examples.

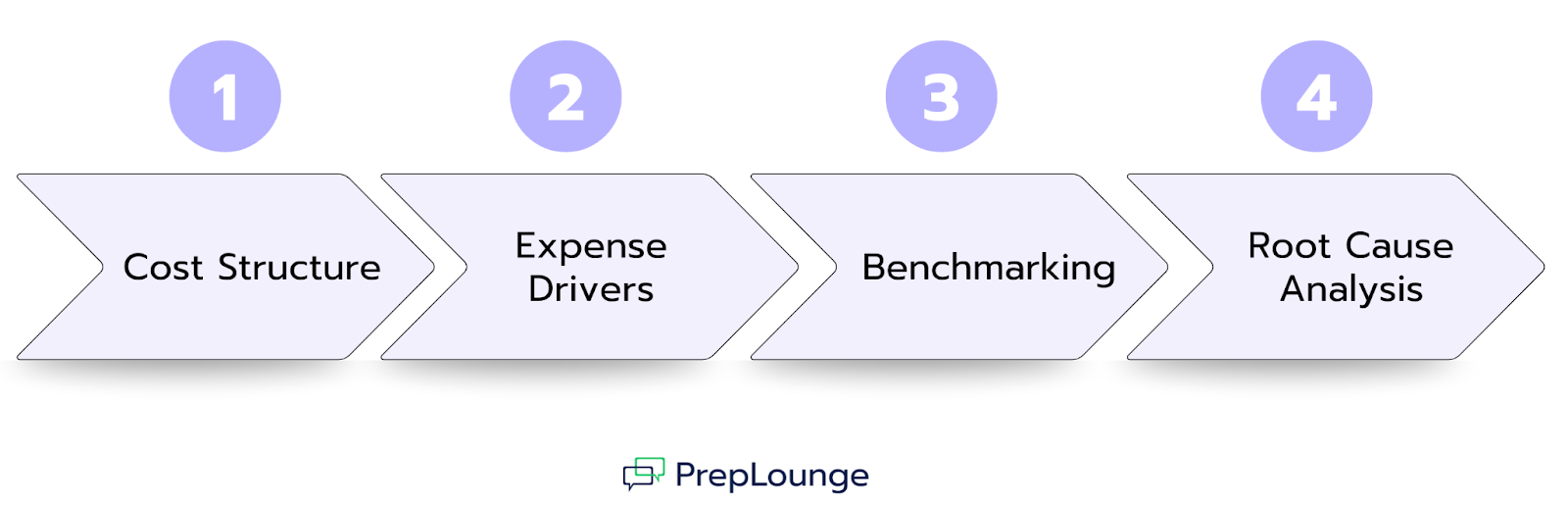

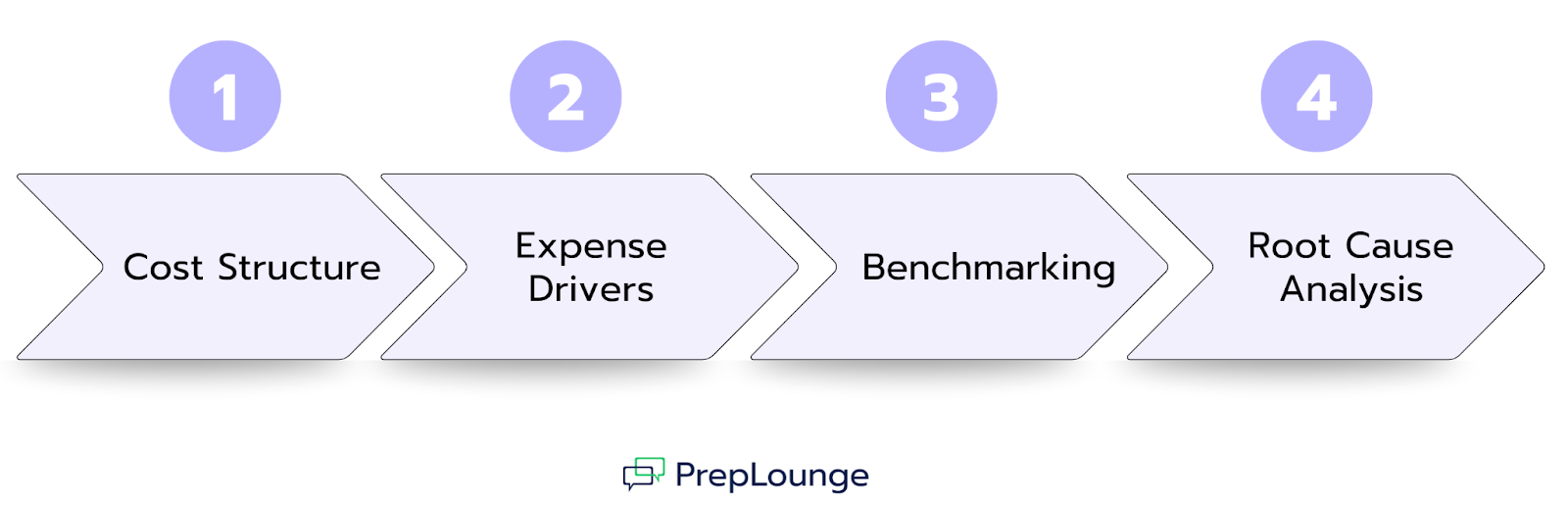

Your framework kicks in automatically: segment the cost structure, identify the largest expense drivers, benchmark against industry standards, perform a root cause analysis. This systematic approach is the result of dedicated, structured practice with PrepLounge’s Case Interview Examples.

The structure is already in your mind before you speak: Revenue analysis – 15 minutes. Cost deep-dive – 20 minutes. Synthesis & recommendation – 10 minutes. You’ve been working through dozens of Case Interview Examples for exactly this moment when even sophisticated business problems become routine, no matter the pressure.

Why Case Interview Examples Are Your Unfair Advantage

You want to break into consulting. Not just anywhere, but at McKinsey, Bain, or BCG. The fast track to an €80,000 average starting salary, international projects, and exclusive career opportunities.

The hard truth is that out of 10,000 applicants, only about 100 will make it through all interview sessions. The failure rate in the first round is at 99%.

So what sets the top 1% apart?

- Not their IQ

- Not their university

- Not their grades (most candidates have stellar transcripts)

It’s their structured preparation with Case Interview Examples.

5 Underrated Benefits of Case Interview Examples That Help You Stand Out

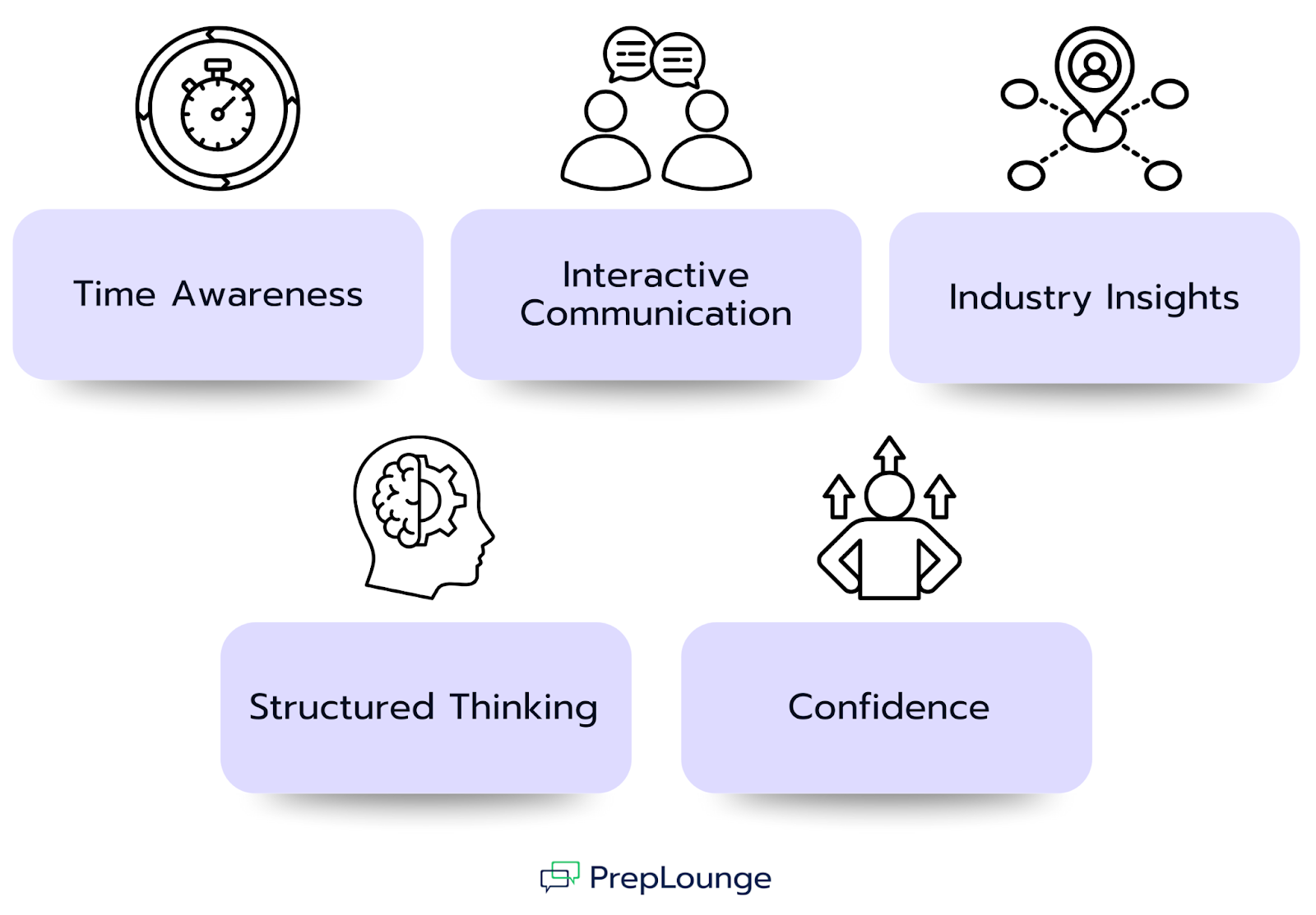

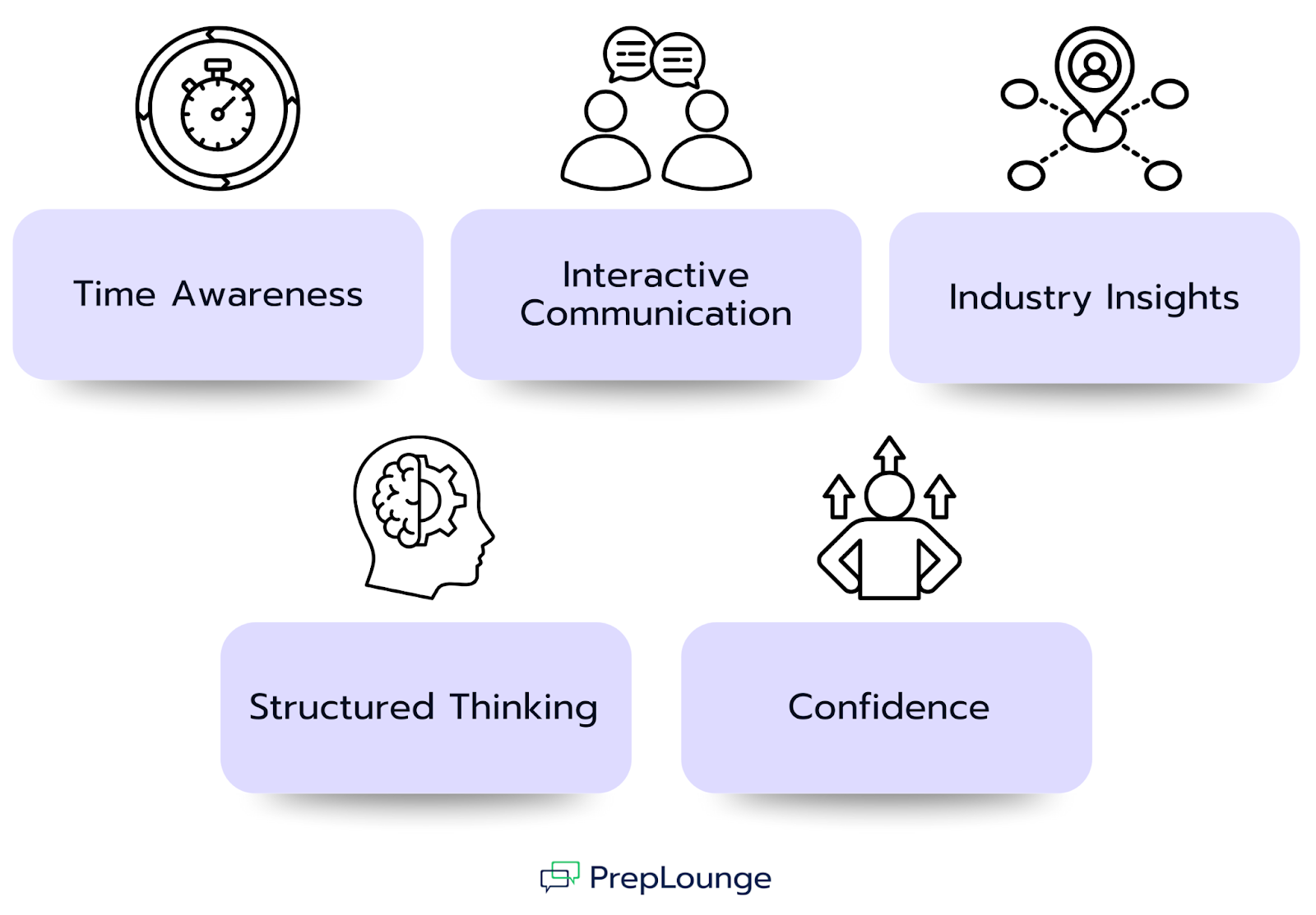

- You build time awareness: Consulting interviews are fast-paced, within 45 minutes you will have to solve problems that partners might work on for weeks. Case Interview Examples train you to quickly find structure, focus on what matters, and deliver a sound recommendation under pressure.

- You master interactive communication: A case interview isn’t a monologue. Case Interview Examples will teach you to think out loud, ask smart questions, and communicate clearly and confidently in a dialogue-driven conversation.

- You gain real industry insights: From FinTech and Healthcare to Industrial Goods, Case Interview Examples cover every major industry. With consistent practice, you’ll understand the key business models and start speaking with the perspective of an experienced consultant.

- You develop automatical structured thinking: After 50+ Cases, frameworks become second nature. Your brain starts recognizing patterns: Profitability Case → Revenue vs. Costs. Market Entry → Attractiveness vs. Capabilities. This automatic thinking helps you stay calm and focused under pressure.

- You grow your confidence: Every solved Case is a small win that builds your confidence. Interviewers can sense when you believe in your own approach and often decide emotionally if they see you on their team.

With PrepLounge, you won’t just practice Cases but you will experience real interview conditions through training live with partners from the community. It’s the most effective way to get ready for the real thing.

Real-World Case Examples

RWE Consulting Case: Floating Wind in Japan (Level: Beginner)

The situation:

An energy company is exploring whether to invest in floating wind farms in Japan. Your task: analyze market size, growth potential, profitability, and the competitive landscape.

Why this case is great for beginners:

At first glance, it seems technical and comprehensive but it actually trains one of the most fundamental consulting skills: evaluating markets systematically. You’ll learn the golden frameworks:

- Market Attractiveness: Size, Growth, Profitability

- Competitive Landscape: Players, Market Share, Barriers

- Company Capabilities: Resources, Experience, Strategic Fit

What it really teaches you:

How to make structured assumptions with incomplete data. This is the key difference between consultants and other business professionals, and between beginners and experienced candidates.

Typical pitfall:

Getting lost in technical details instead of focusing on the business logic.

Bain Case: Transforming a Family Winery (Level: Advanced)

The situation:

A traditional winery is facing declining sales, even though demand for premium wines is rising. Your task: develop growth strategies that combine tradition and innovation.

Why this is the ideal Case for advanced candidates:

This case pushes you to think strategically as cutting costs won’t be enough. You need to identify real growth opportunities that create lasting value.

What you’ll learn:

You’ll practice going beyond the “cut costs, increase revenue” basics and learn how to craft sustainable strategies. Where does long-term value come from? Which measures are quick fixes, and which are driving sustainable transformation? How do you balance competing stakeholder interests?

It’s a masterclass in training a key skill for senior consultants: distinguishing between operational quick wins and strategic change.

Common pitfall:

Jumping into tactics too early without clarifying the strategic positioning.

BCG Platinion Case: Digital Transformation (Level: Expert)

The situation:

A global corporation needs to completely modernize its IT architecture. Your job is to define priorities, allocate the budget, and manage the change process.

Why it’s perfect for experts:

This case simulates maximum complexity, i.e. multiple stakeholders, conflicting goals, and massive investments. Digitalization isn’t a side project anymore; it’s business-critical. You’ll need to create clarity and structure amid a maze of technologies, processes, and opinions.

What you’ll learn:

You’ll train the skills real partners use daily: simplifying complexity, making tough decisions and setting clear priorities even when there’s no perfect answer.

Common pitfall:

Getting lost in technical buzzwords instead of focusing on strategic priorities.

Your Path to the Top 1%

Reading Cases isn’t enough. Successful candidates excel through systematic training.

Time-pressure training:

- 45 minutes per case, with no extensions

- Develop frameworks quickly and logically

- Summarize recommendations clearly

- Handle mental math under pressure

Partner rotation:

- Different personalities mean different interview styles

- Unpredictable reactions build flexibility

- Live interactions simulate real interviews

- Get feedback from multiple perspectives

Structured feedback:

- Identify clear weaknesses instead of giving vague impressions

- Track your improvement in framework speed and clarity

- Spot blind spots in communication

- Track your progress week by week

Key Takeaways

Anyone aiming for a career in consulting needs to understand the 1% reality. Out of roughly 10,000 applicants at McKinsey, Bain, or BCG, only about 100 candidates make it through the entire selection process. Success is rarely about raw talent alone. It comes from dedicated preparation with Case Interview Examples and consistent practice under realistic interview conditions.

Practice beats theory. Framework knowledge on its own tends to break down under interview pressure. Candidates who have solved dozens of profitability cases immediately recognize the underlying patterns, while those who have repeatedly applied market entry frameworks instinctively structure their analysis around market attractiveness and company capabilities. This level of confidence cannot be learned from books. It only develops through hands-on practice.

This is where many candidates fall short. Working through a few isolated cases or watching YouTube videos is not enough. What successful candidates need is a combination of structured training, a live practice community, and expert feedback. PrepLounge brings all of these elements together in one platform, offering more than 180 cases, access to over 500,000 practice partners, guidance from ex-MBB coaches, and measurable progress tracking.

With systematic training using Case Interview Examples, the difference becomes clear. What once felt stressful turns into routine, complex case interviews become manageable, and structured thinking comes naturally. This is how candidates move into the top 1% and walk into interviews truly prepared.

Most Asked Questions About Case Examples