Your client, Virgin Mobile, is interested in offering telematics services to vehicles in the USA with a new brand: Carmatics.

Should they enter this new market? If yes, how should they do it?

Your client, Virgin Mobile, is interested in offering telematics services to vehicles in the USA with a new brand: Carmatics.

Should they enter this new market? If yes, how should they do it?

The following framework/structure would be a good approach for the problem at hand.

Suggestion: You should share the structure with the interviewee after the introduction of the case (after the discussion of the problem definition and a quick brainstorming of the candidate).

If the interviewee inquires information about the technology, you can tell him this information:

Telematics are services that connect the vehicle to the external world. This can be used for sending information from the car to the external world (e.g. emergency call) or also to retrieve information from the external world (internet or other simpler satellite communication channels).

Concerning the market situation you can tell the following:

There are two main segments in the market: personal vehicles and commercial vehicles – trucks, busses, vans, and company cars. The personal vehicle market has been shrinking 2% per year in the last 3 years and is expected to have no growth next year. The commercial vehicle market has been growing 3 to 4% per year in the last couple of years. However, it is expected to grow about 10% next year and keep this growth for the next years. The market has been until now very profitable: around 15% EBIT. No product substitutes are expected to appear any time soon.

The client should then ask about the size of the market in Dollars. You should as interviewer ask the interviewee to estimate it. At first, the market should be divided into commercial and private vehicles.

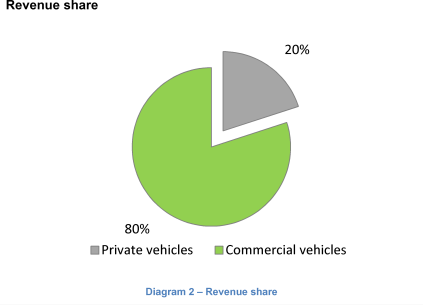

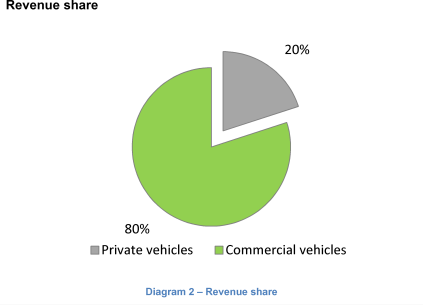

If the interviewee inquires information about the market share, you can share diagram 2 with the revenue share.

As next step, the amount of vehicles and the revenue per vehicle should be estimated. One practical and quick way of doing the second estimate (as this is not the focus of the case) is by putting yourself in the place of the personal vehicle customer. How much would you be ready to pay per year for such a service?

Then, the following assumptions can be shared:

The number of private vehicles is 2 Million. The number of commercial vehicles is 4 Million. The possible revenue per private vehicle is 300 Dollars.

At first the interviewee should make sure he is familiar with the idea of the telematics technology:

Since the number of personal vehicles is half the number of commercial vehicles (2 million against 4 million) but the personal vehicle market in sales is a fourth of the commercial vehicle market (20% against 80% as stated in section “Available information”), then the expenses per commercial vehicle must be 600 Dollars.

Total market = $ 300 * 2m + $ 600 * 4m = $ 3b

The total telematics market is estimated to be about 3 billion dollars per year.

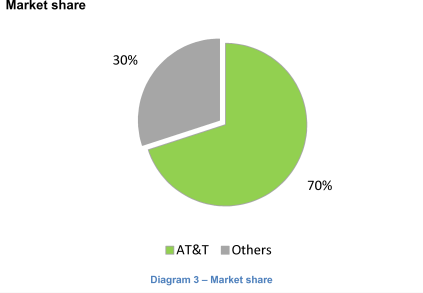

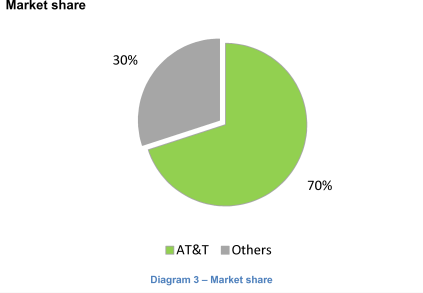

If the interviewee inquires information, you can also share diagram 3 with an overview of the market.

If the interviewee requires information, you can tell the following:

No significant barriers to entry, however renting satellites are a very high cost (the biggest cost block). It should be easier to steal market share from these fragmented competitors than from the 70% that AT&T holds (AT&T is established in the market and successfully held 70% of the market in the last years). The market is a quasi-monopoly. AT&T has held 70% of the market share for the last years. There is a lawsuit that should finish this monopoly in the next 3 years: AT&T will be most likely lose the case and be obliged to sell at least 21% of its business resulting in a market-share less than 50%. The rest 30% market share is spread across 10 competitors that, differently from AT&T, are not cellphone providers.

At this stage, the interviewee should shift gears to analyze the competitors.

If the interviewee requires information, you can tell the following:

Virgin Mobile has a vast network of digital cellphone antennas that could cover vehicles on average 95% of the time in the USA (vehicles traveling could be eventually out of reach). Cellphone antennas can be relatively easily adapted to enable the telematics technology, so satellites are NOT always needed. (This is one of the keys to cracking the case). Virgin could reach tens of millions of potential customers for the telematics service by taking advantage of their extensive cellphone customer base.

This is the point where the case should be cracked. The market is promising as it is big and growing considerably. On the other hand, the monopoly of AT&T is discouraging.

The main conclusions the interviewee should come to are then:

The candidate should weigh all the data he gathered throughout the case and stand for a clear decision whether Virgin Mobile should enter the telematics market or not. One possible conclusion for this case could be:

After all the investigation is done, I believe that Virgin should go ahead with Carmatics and enter the telematics market. This should be done for two main reasons:

Suppose Virgin launches Carmatics at the beginning of next year. It aims to make revenues of 44 million with Carmatics in the first year of activity.

Suppose also that they started only in the segment commercial vehicles using selling to vehicle manufacturers (not to the retail).

They count for 16% of the whole market.

How much market share in this specific segment (manufacturer and commercial vehicles) should they gain in order to reach their revenue goals (100% means all the segments would belong to Carmatics)?

Suppose also that the total market has been this year of 3 billion dollars.

More questions to be added by you, interviewer!

At the end of the case, you will have the opportunity to suggest challenging questions about this case (to be asked for instance if the next interviewees solve the case very fast).

Suppose Virgin launches Carmatics at the beginning of next year. It aims to make revenues of 44 million with Carmatics in the first year of activity.

Suppose also that they started only in the segment commercial vehicles using selling to vehicle manufacturers (not to the retail).

They count for 16% of the whole market.

How much market share in this specific segment (manufacturer and commercial vehicles) should they gain in order to reach their revenue goals (100% means all the segments would belong to Carmatics)?

Suppose also that the total market has been this year of 3 billion dollars.

More questions to be added by you, interviewer!

At the end of the case, you will have the opportunity to suggest challenging questions about this case (to be asked for instance if the next interviewees solve the case very fast).

Suggested answer:

This question might seem complicated but it can be solved in a very simple way. It is very important that the interviewee does not forget that the commercial vehicle market will grow next year by about 10%.

Considering the total market this year at 3 billion Dollars and that the segment “manufacturer and commercial vehicles” is equivalent to 16% of the total market, we have a market of 480 million dollars.

Next year with the 10% growth this market will become 528 million Dollars. 44 million Dollars is exactly 1/12 of this market, that is, Carmatics would have to have about 8.3% market share of this segment.

Carmatics

i