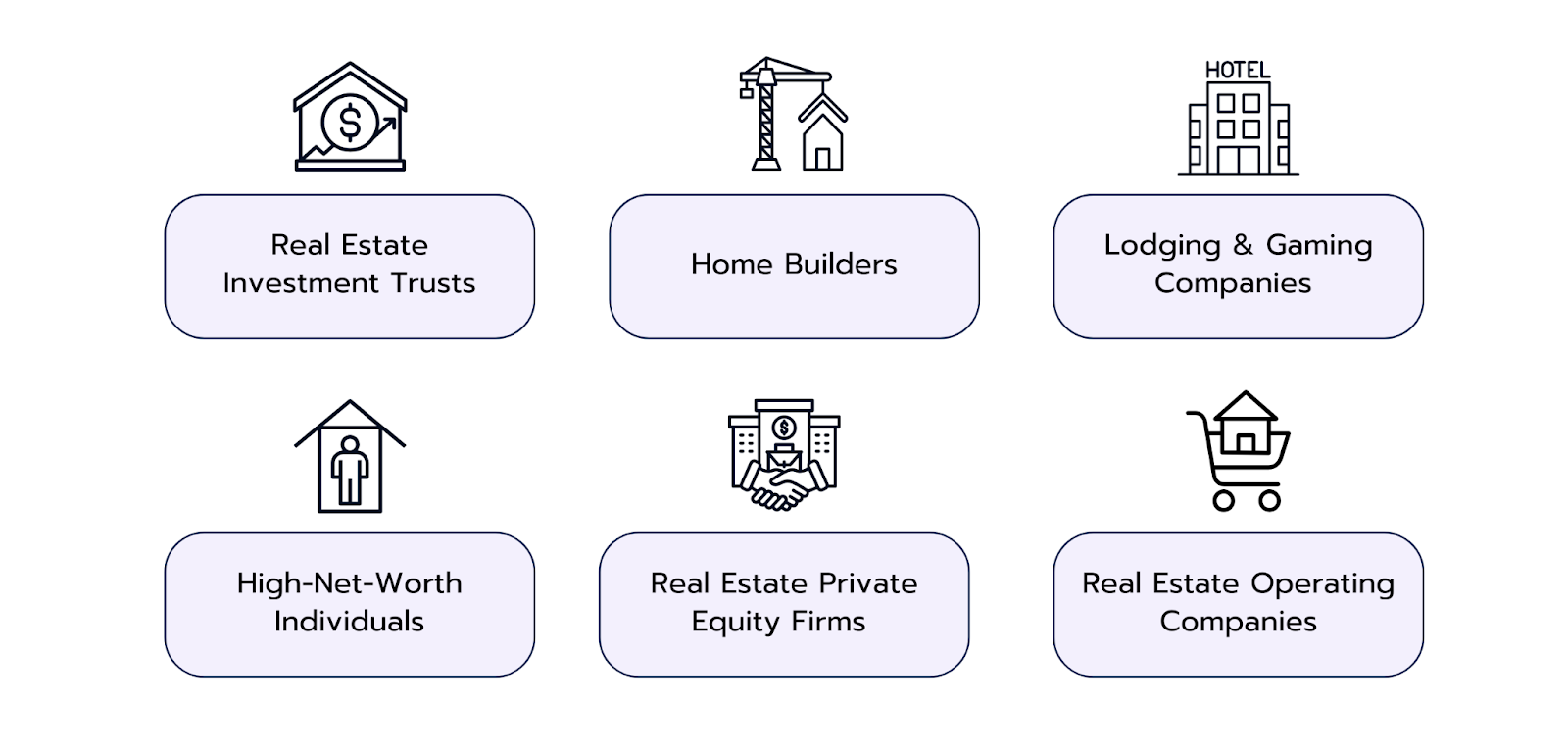

Are you thinking of getting into real estate investment banking? It might sound like something completely different from the typical IB, but it's more of an industry group. You’ll see it listed alongside other investment banking industry groups like Technology, Healthcare, Energy, Financial Institutions Group (FIG), Industrials, and more.

However, joining an industry group impacts the type of deals you’ll work on, technical skills required, and even exit opportunities. This guide will cover the ins and outs of real estate investment banking to help you understand if it’s the right career path for you.