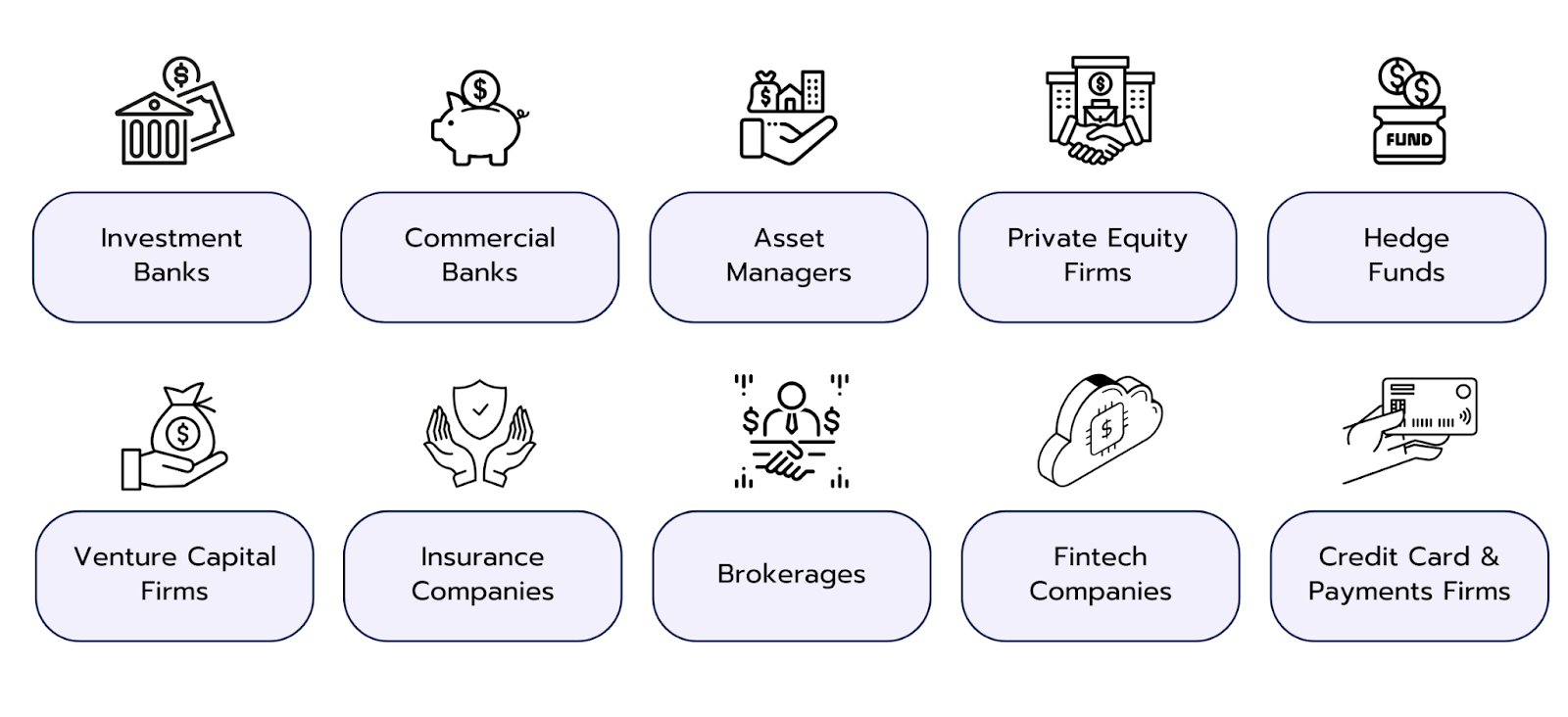

If you’re interested in pursuing a career in finance, starting with the world's top financial institutions can open doors to exceptional opportunities. These prestigious firms in finance offer exposure to complex deals, prestigious client networks, and mentorship from some of the brightest minds in the field.

In this guide, we’ll explore the types of finance firms available, discuss what makes some “top”, and list the best ones you can work for. Read on as we will also guide you on how to choose the best firm for you.