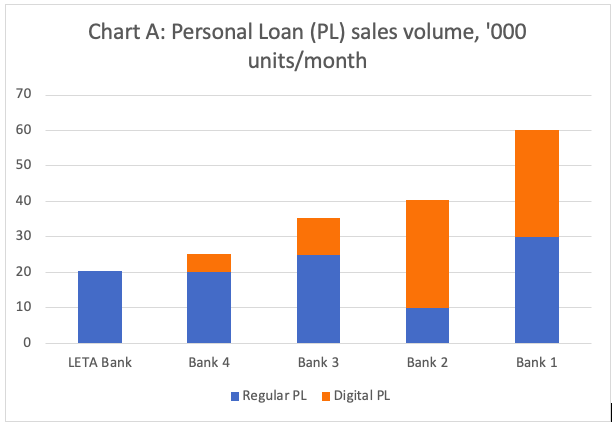

Let’s assume our client is LETA Bank, a large Central European bank with around 3M customers and within the top five banks in the mid-sized European country where it is operating. In a recent benchmarking exercise led by the European banking group that owns the bank, LETA Bank appears to be underperforming relative to competitors in terms of its personal loan sales. Our objective is to support LETA Bank in identifying the root cause of its underperformance and to develop a strategy for addressing it.

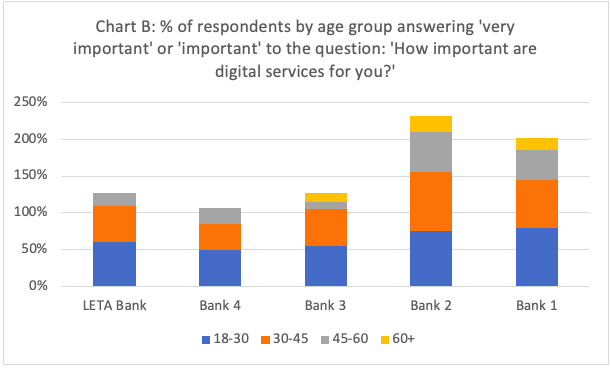

The bank recently hired a new CTO who is excited about working with us and whose hypothesis is that the bank is currently lagging behind in terms of its digital assets and products, which makes it fall short of customer expectations, thus leading to lower sales across its product groups and especially in its most popular lending product – the personal loans.

Digital Lab at LETA Bank (McK/BCG Digital)

i