Our client, Soy Technologies specializes in soy production and processing.

The client harvests their soybean crops and processes the soybeans to extract the protein and create soybean meals that are later used for animal feed.

Since the demand for soy protein has been steadily increasing in recent years, our client has been looking at more profitable alternatives to create different soybean products, but our client is unsure about the next steps since they would have to entirely change the current processing operations.

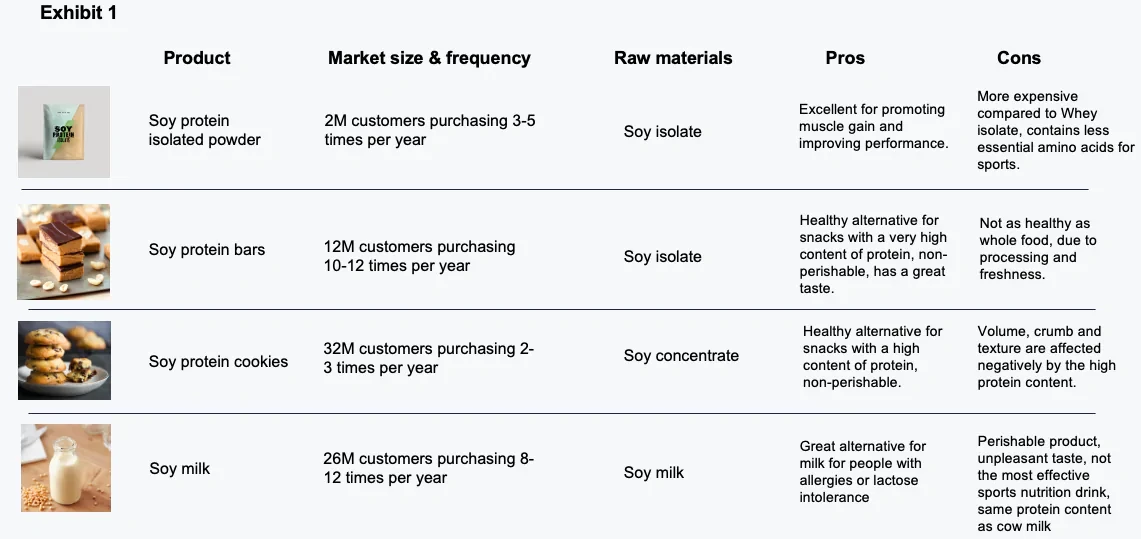

The alternatives that our client is currently considering are:

- Producing soy milk which requires 45% of the extracted protein.

- Producing soy concentrate which requires 70% of the extracted protein.

- Producing soy isolate which requires 90% of the extracted protein.

Our team has been asked to assist them in deciding which option would be best.

MBB first round - Soy Technologies

i