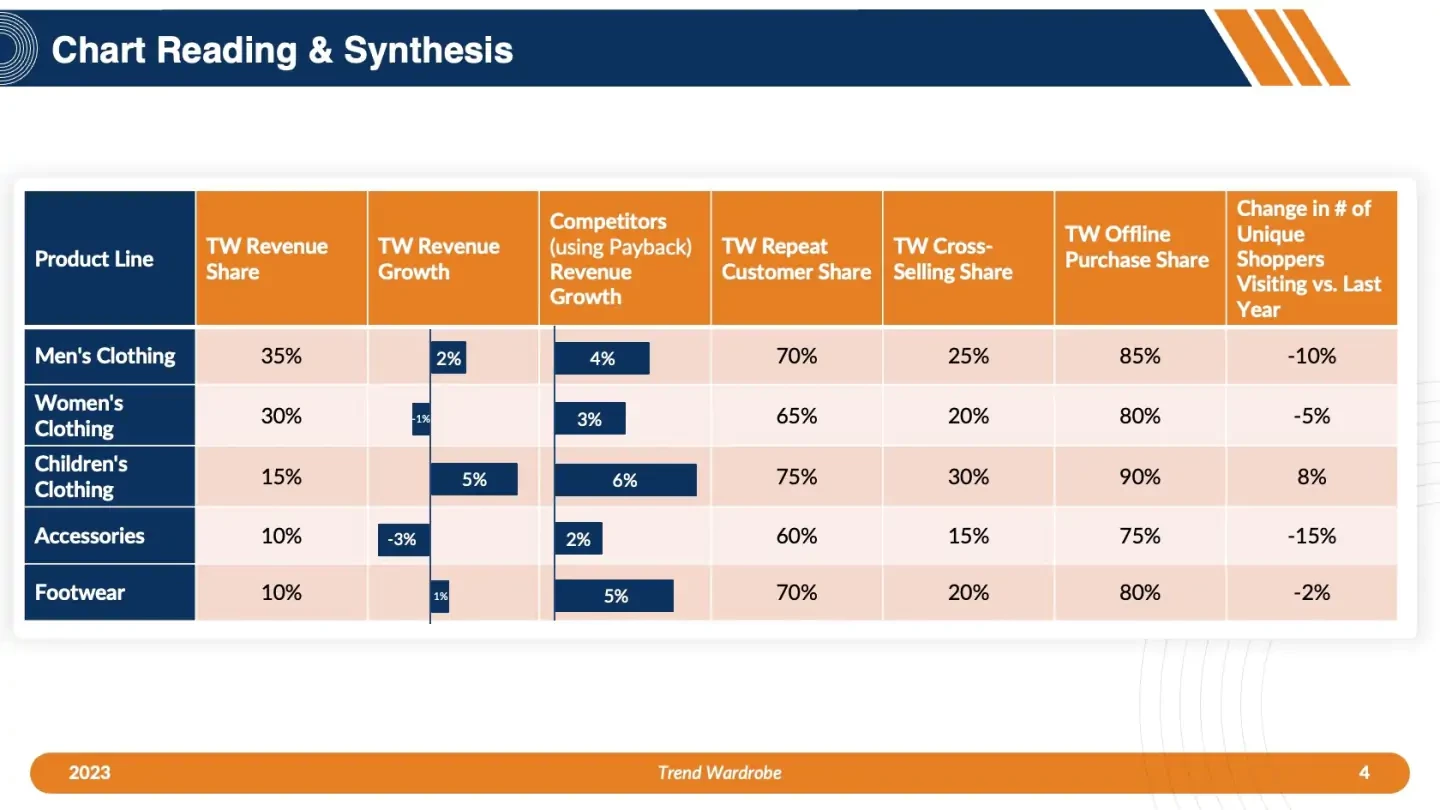

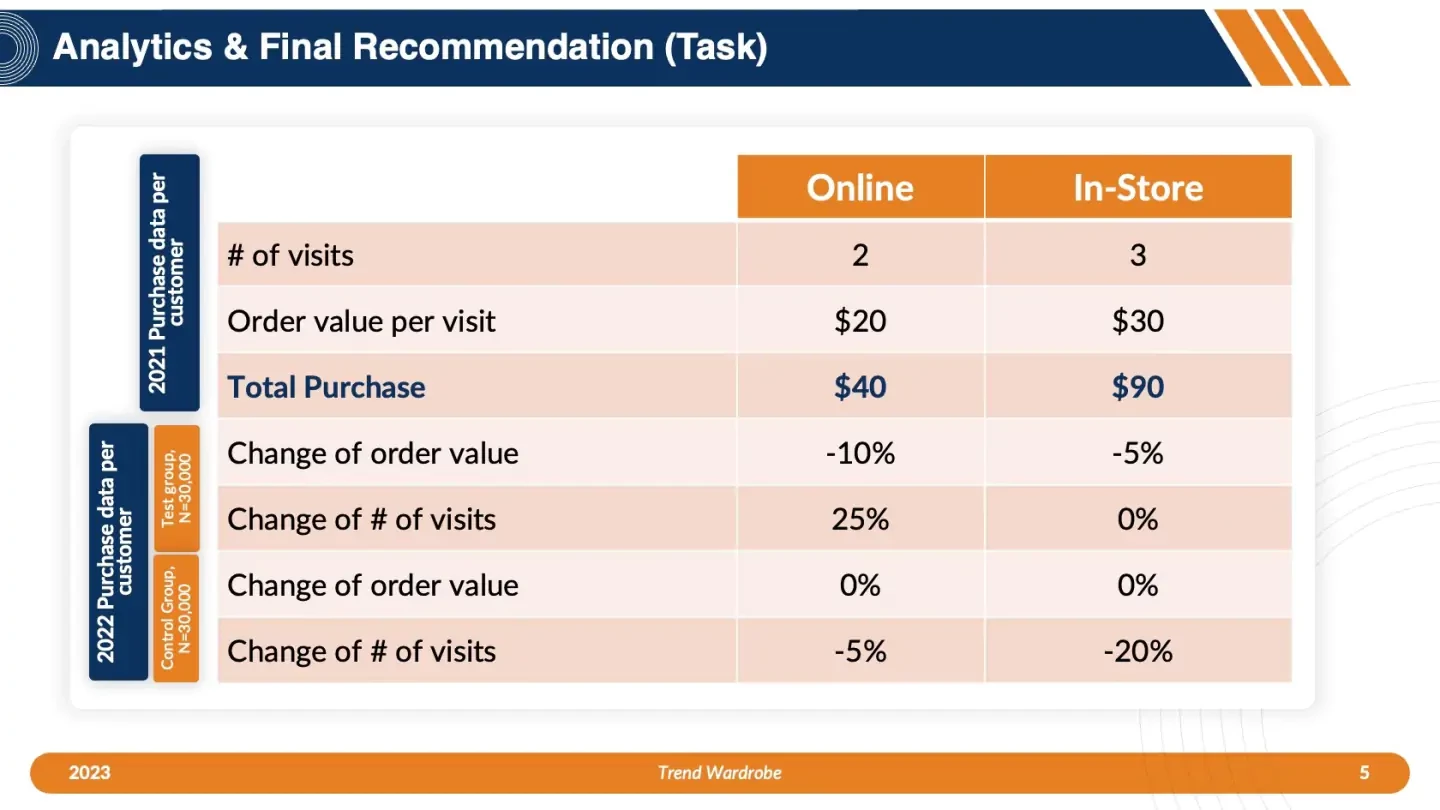

Our client is TrendWardrobe (TW), a clothing retailer in the US. It offers a wide range of fashionable clothing and accessories for men, women, and children. TW operates 200 stores across the top 50 cities in the US. These stores are typically spacious and situated in suburban areas. Additionally, TW has a robust online presence through its website, trendwardrobe.com. However, in the past two years, TW has experienced declining revenue compared to its competitors.

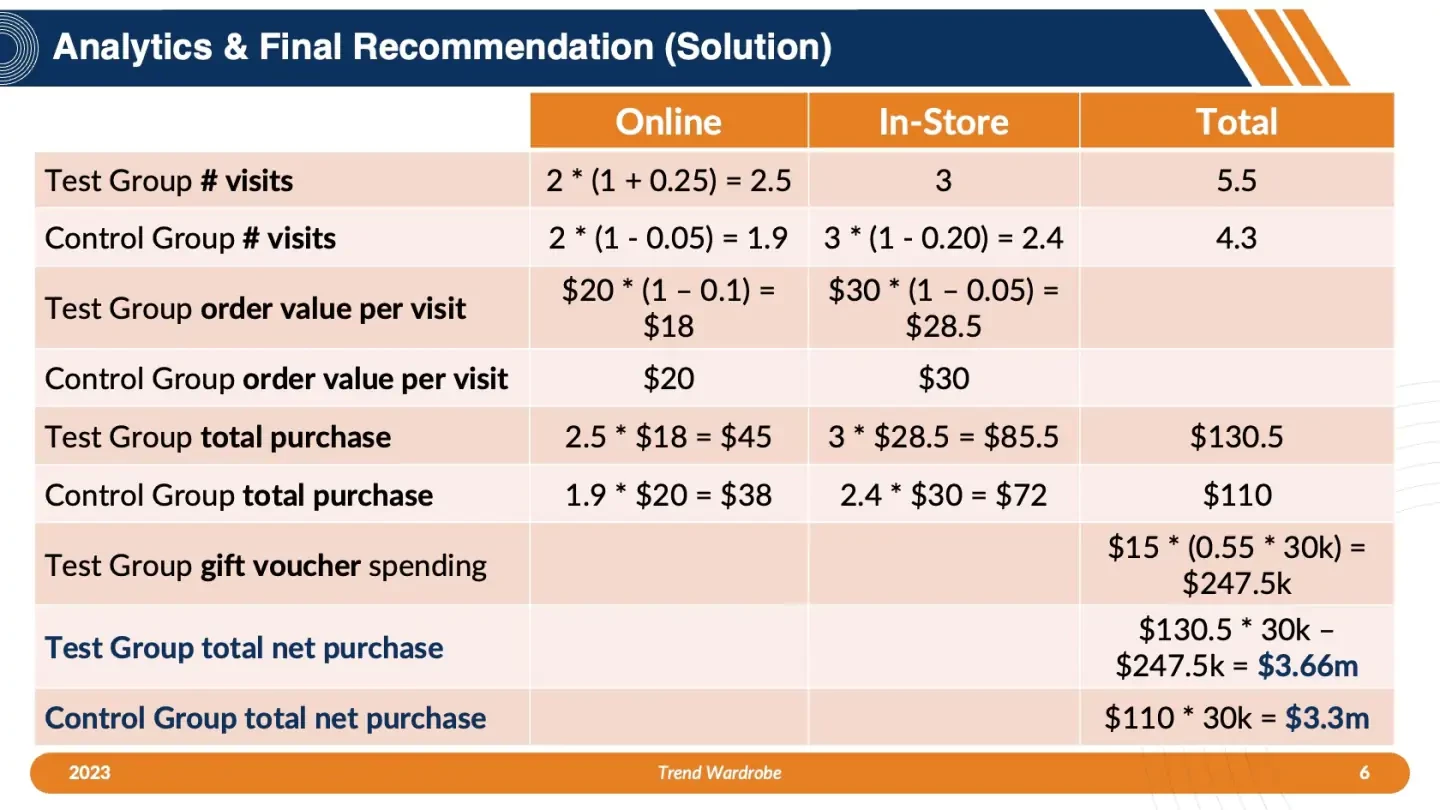

A thorough analysis conducted by the strategy team at TrendWardrobe has revealed a significant decrease in customer visits. This indicates a decline in the number of unique shoppers visiting TW stores or making online purchases. Recognizing the need to reverse this trend and drive revenue growth, TrendWardrobe is exploring various measures to boost its performance over the next two years.

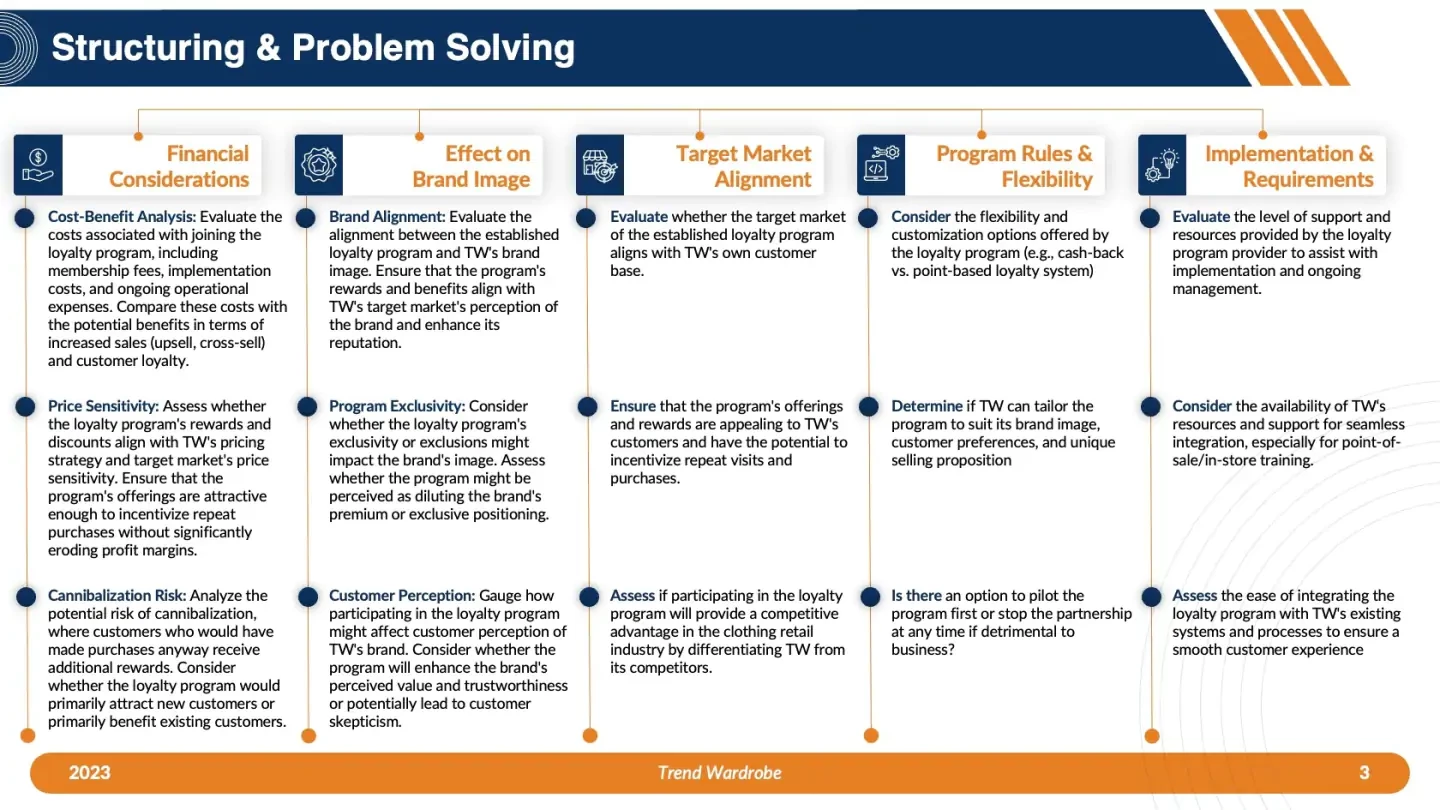

The challenge for TrendWardrobe is to identify strategies and initiatives that will accelerate revenue growth and enable the company to regain its competitive position. By implementing effective measures, TrendWardrobe aims to attract more customers, increase sales, and catch up with its competitors in the clothing retail industry.

TrendWardrobe

i