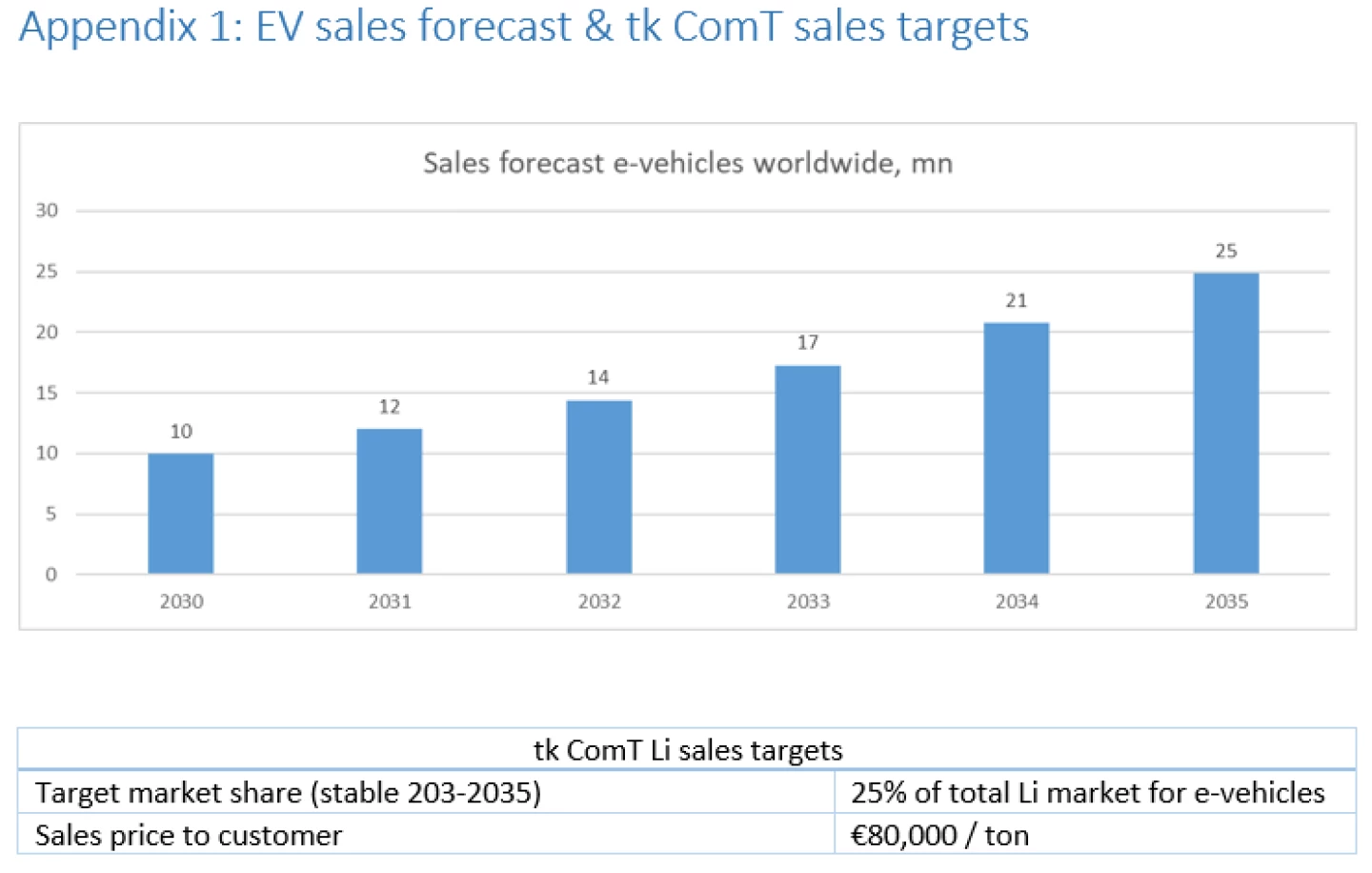

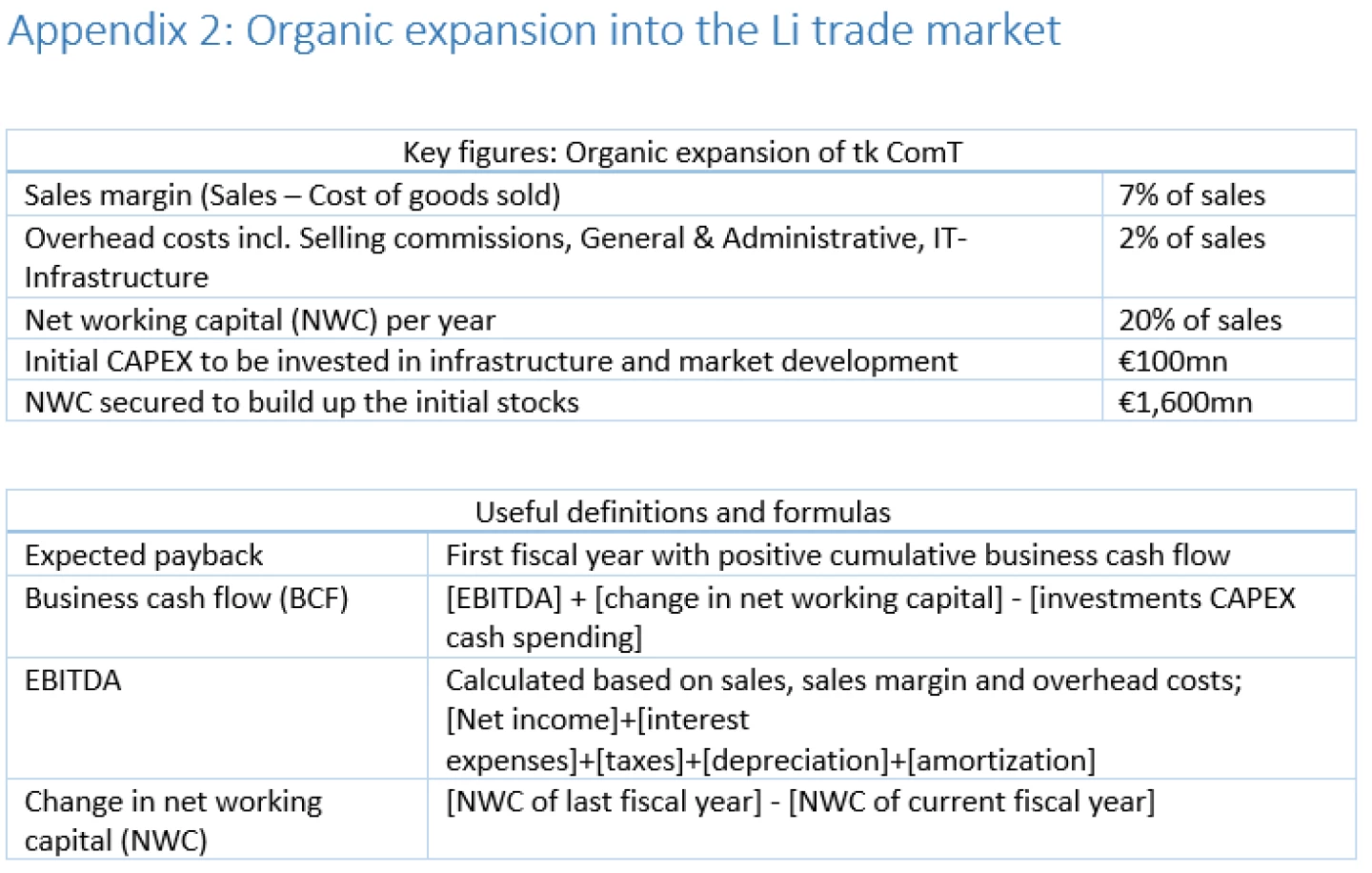

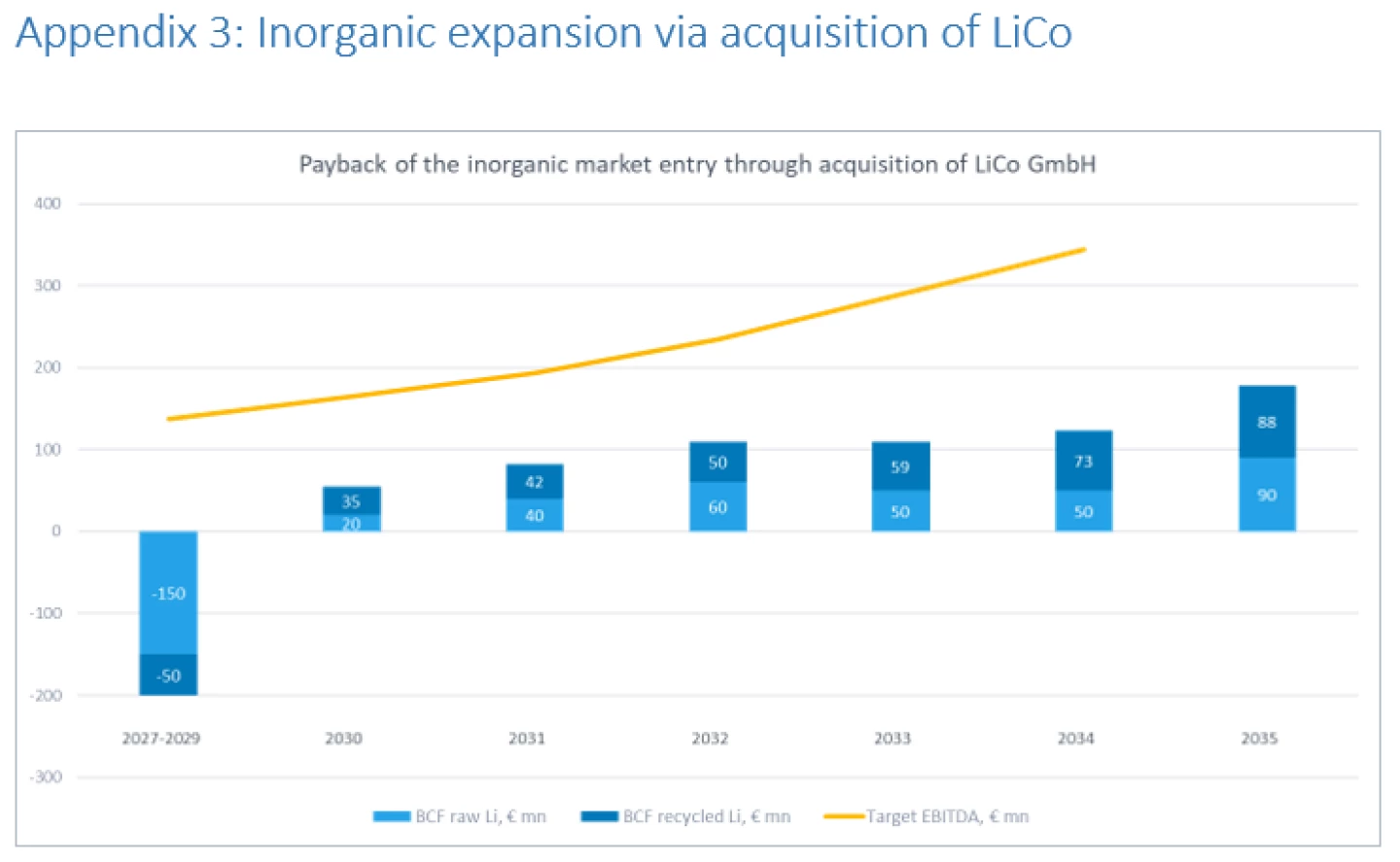

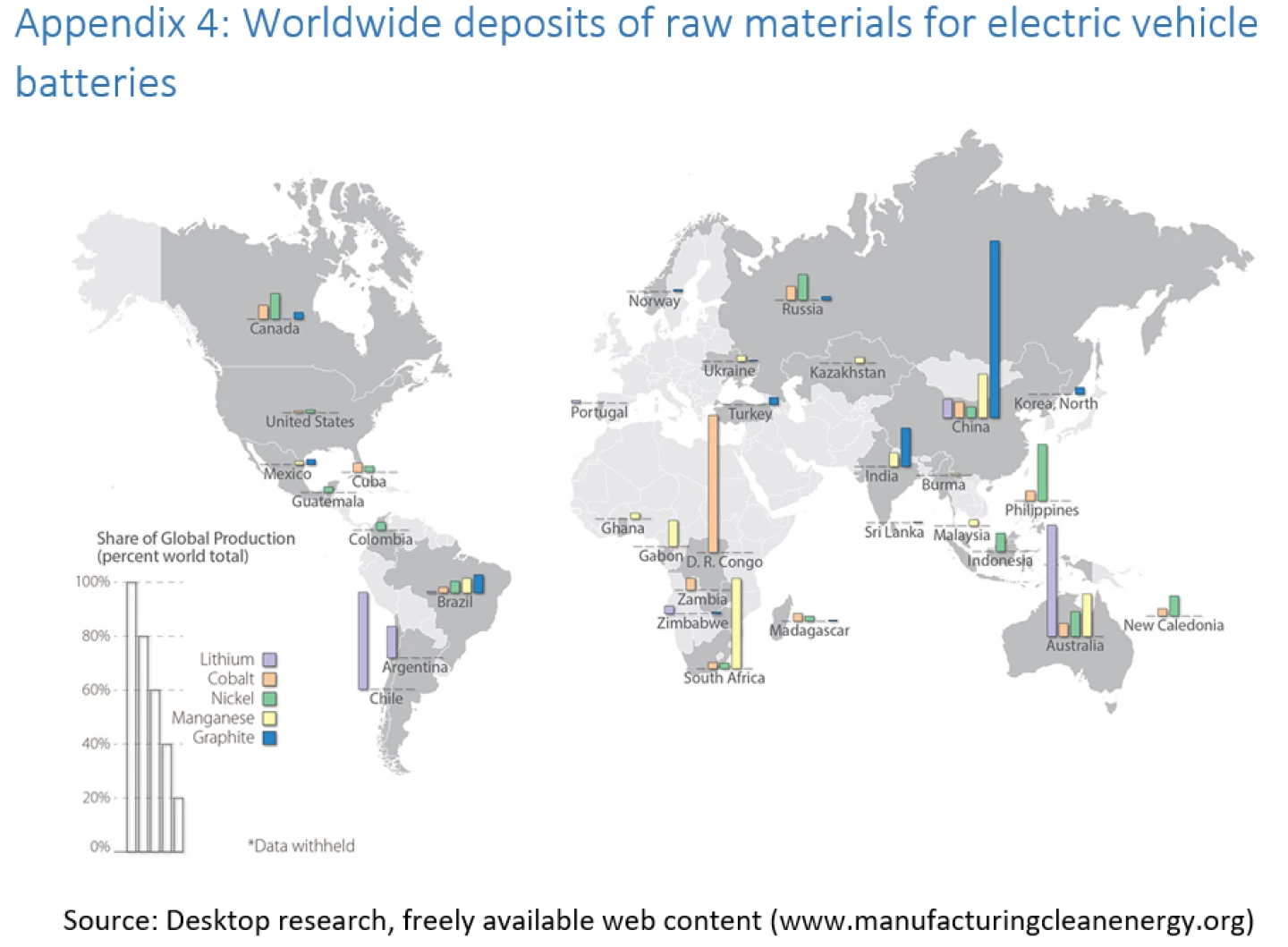

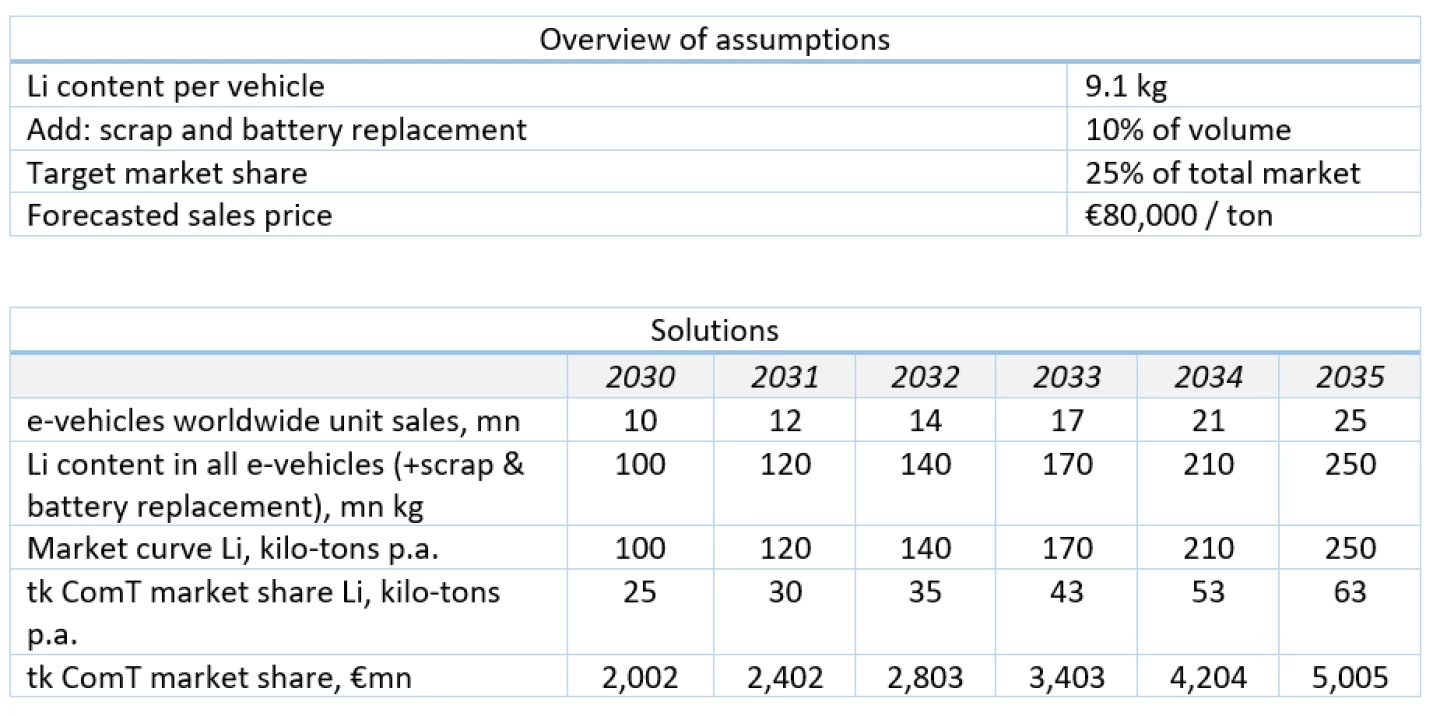

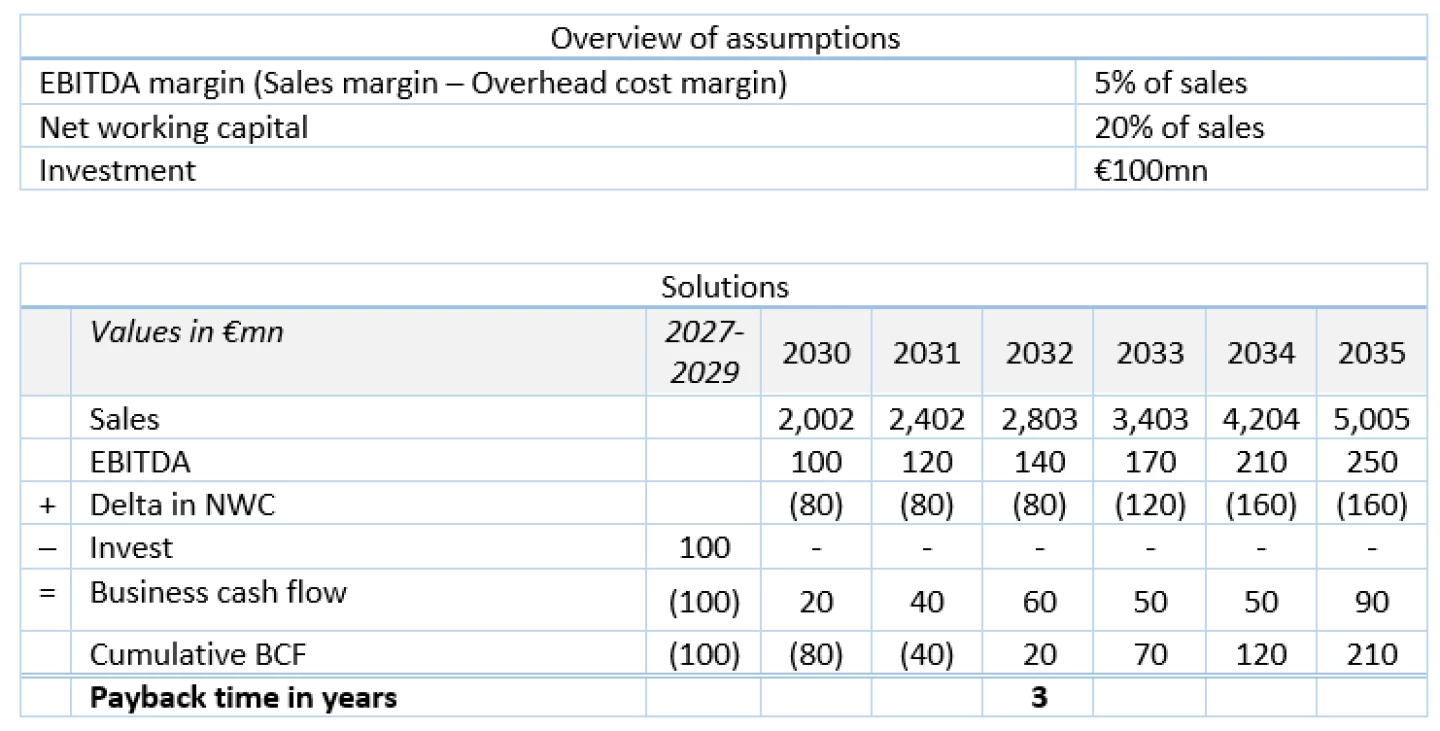

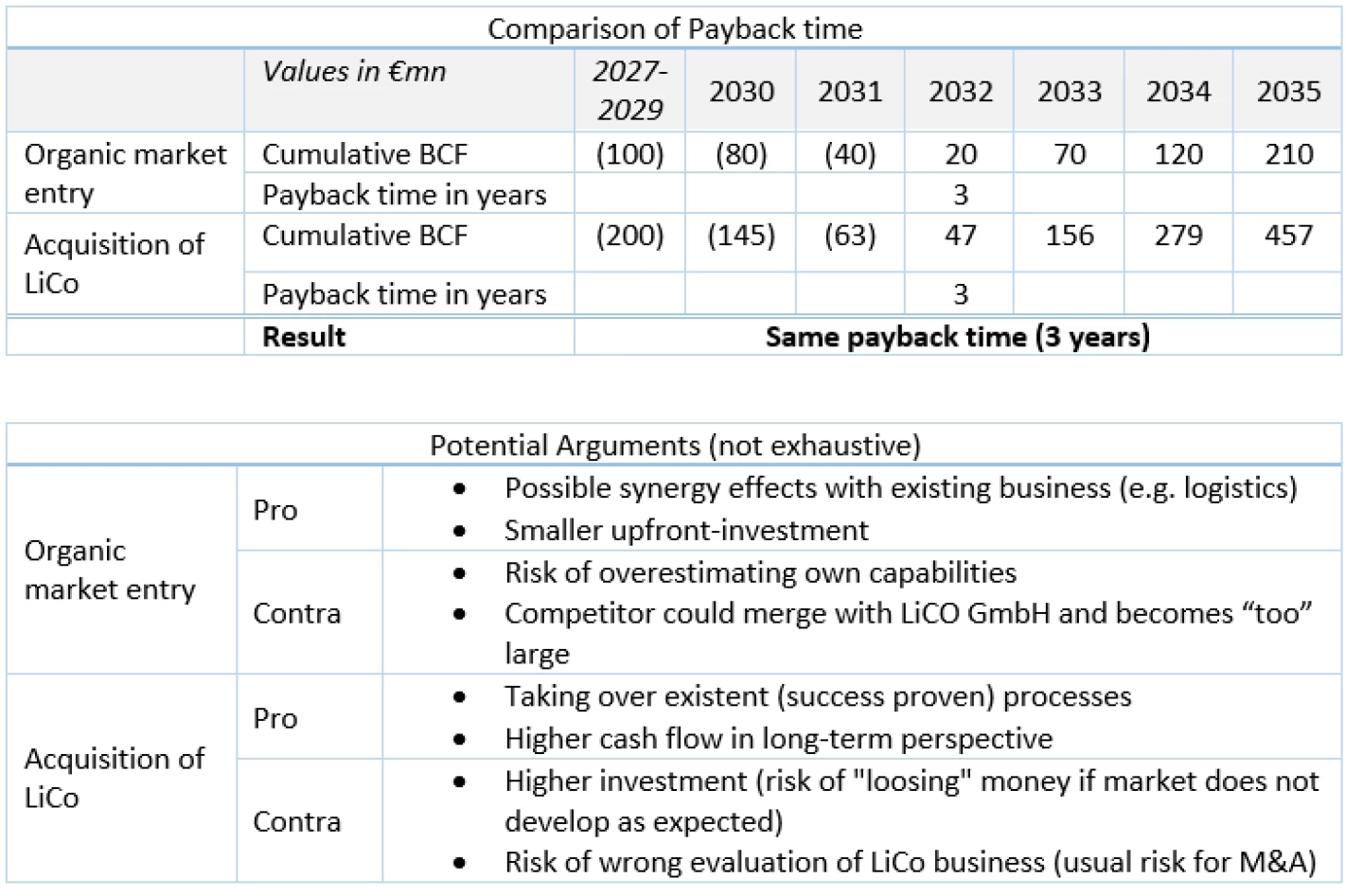

Your client tk Commodity Trade (tk ComT) is a global materials trader - they buy and sell raw materials. tk ComT had stable EBITDA margins in recent years. They consider expanding their target market and entering the Lithium (electric vehicle battery grade) trade, due to the current high demand for electric cars and Lithium-ion batteries. The client is concerned about minimizing the cash spending and about improving the payback period for this market-entry campaign, due to corporate cash policy.

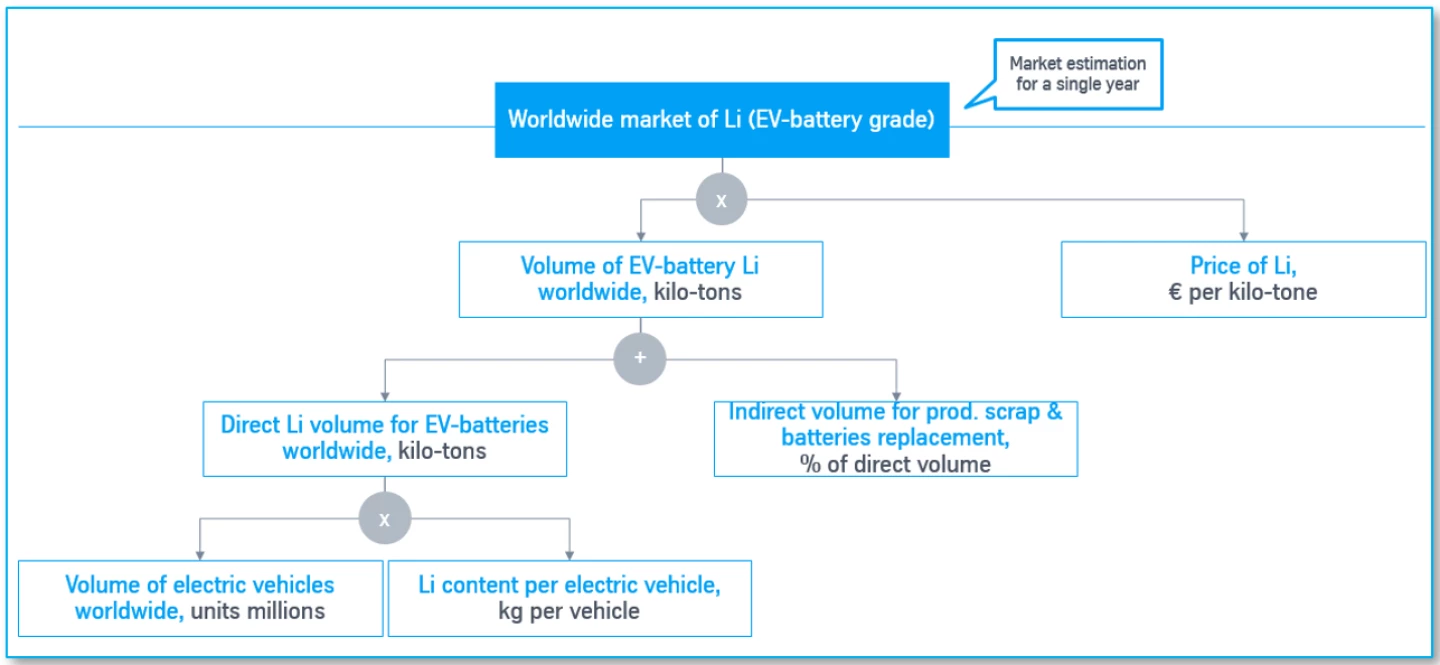

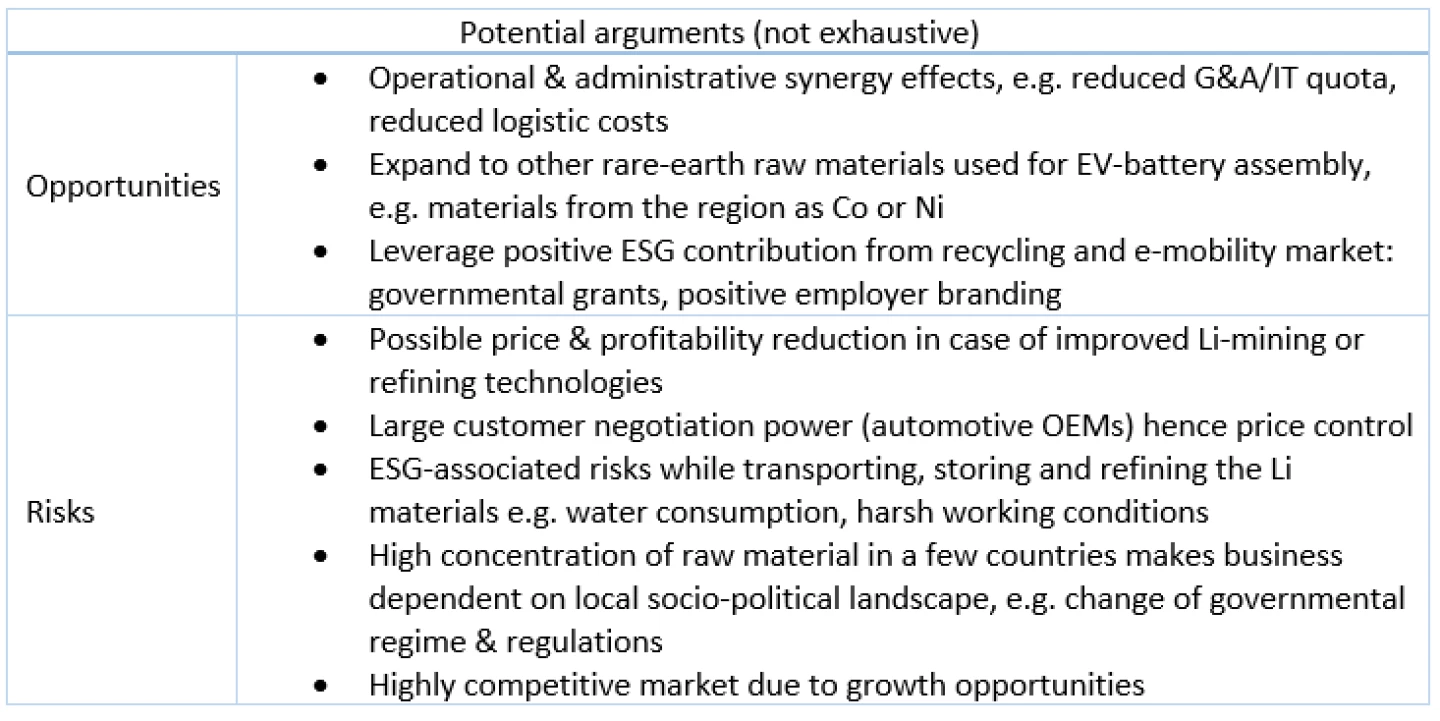

As a consultant, you are expected to calculate the size of the Lithium market and to assess the payback periods for an organic market entry (with own resources) as well as for the acquisition of an established company. Finally, the client expects a proposal about the best market entry strategy and potential opportunities and risks.

tkMC Case: Market entry strategy in the lithium materials trade market