Your client is a holding company that has three larger companies in its portfolio. The successful portfolio has developed very dynamically over the last two years and the companies are facing different challenges. The management takes this situation as an opportunity and wants to carry out a portfolio optimization. As a consultant, you are first asked to carry out a portfolio analysis and then to prepare recommendations for action for the portfolio decisions.

Case Prompt:

1A. What information about the companies would you be interested in to perform a portfolio analysis?

In general, as much information as possible should be used to analyze a company. The following information, among others, can be interesting in particular for a portfolio comparison:

- General information such as company headquarters, company size, production locations and industry sector

- Sales figures incl. sales breakdown by country and industry

- Cost figures incl. breakdown into cost categories (e.g. personnel)

- Profitability KPIs such as EBIT

- Cash flow KPIs such as free cash flow (FCF)

- Development of the above figures and KPIs in recent years and an outlook for the coming years

- Market development and competitive situation

1B. How would you rate the three companies in terms of their market attractiveness and competitive position?

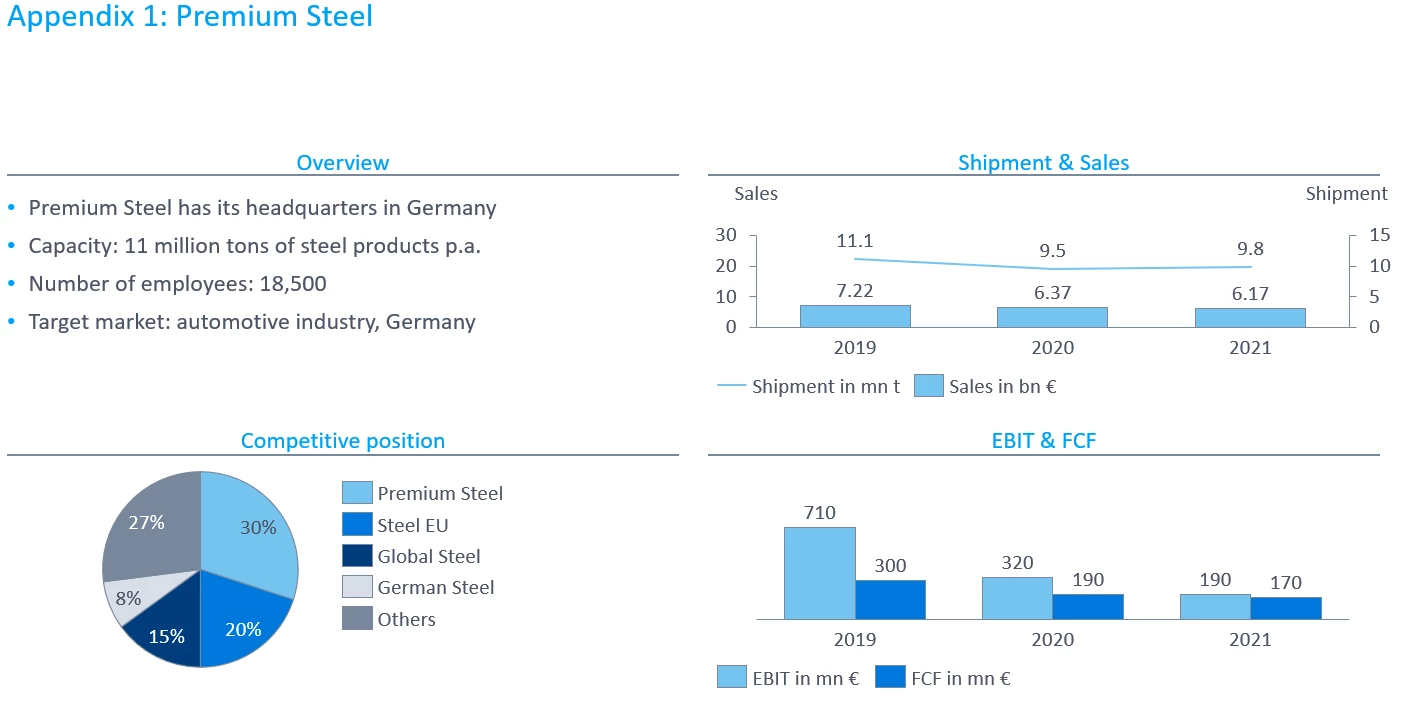

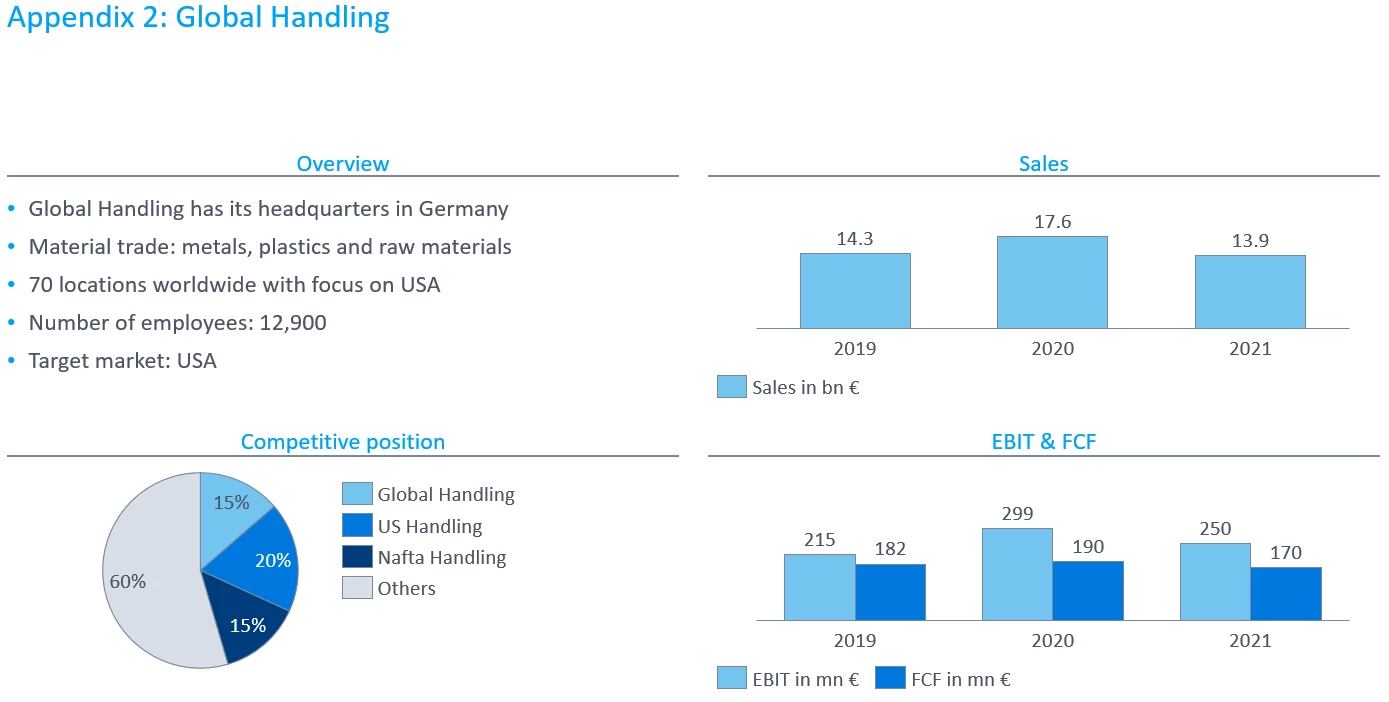

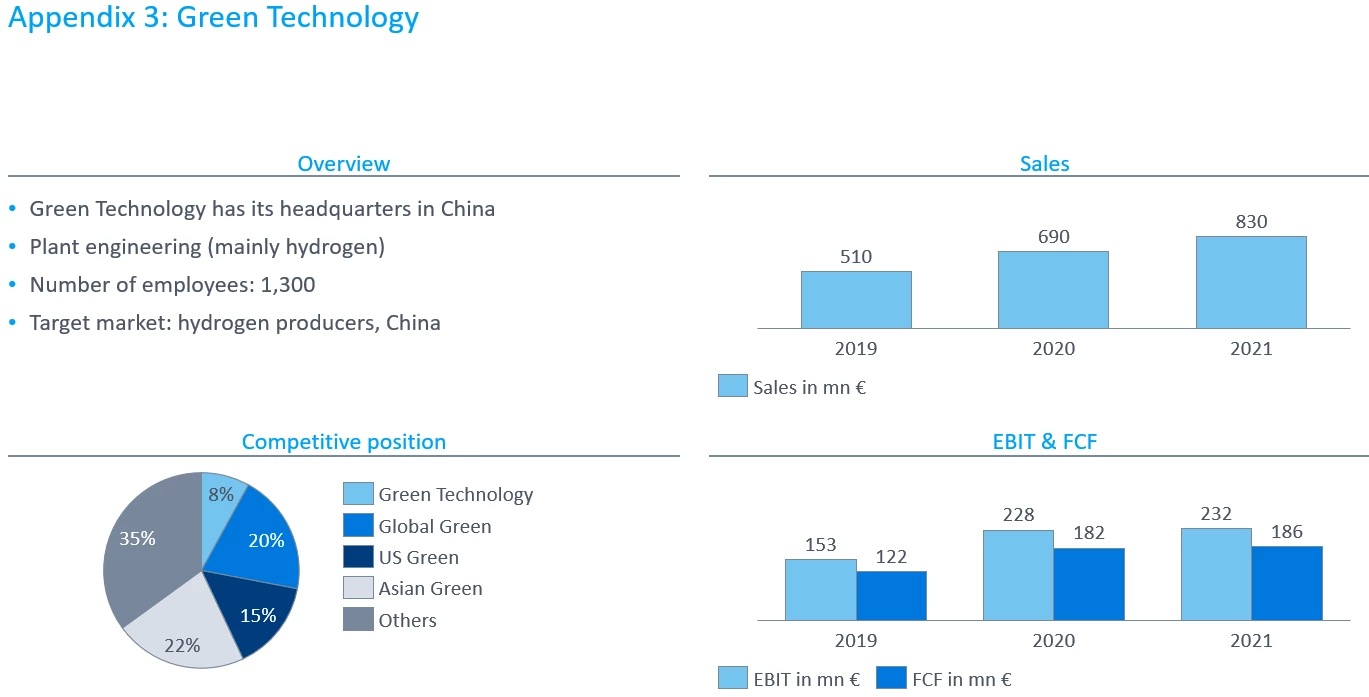

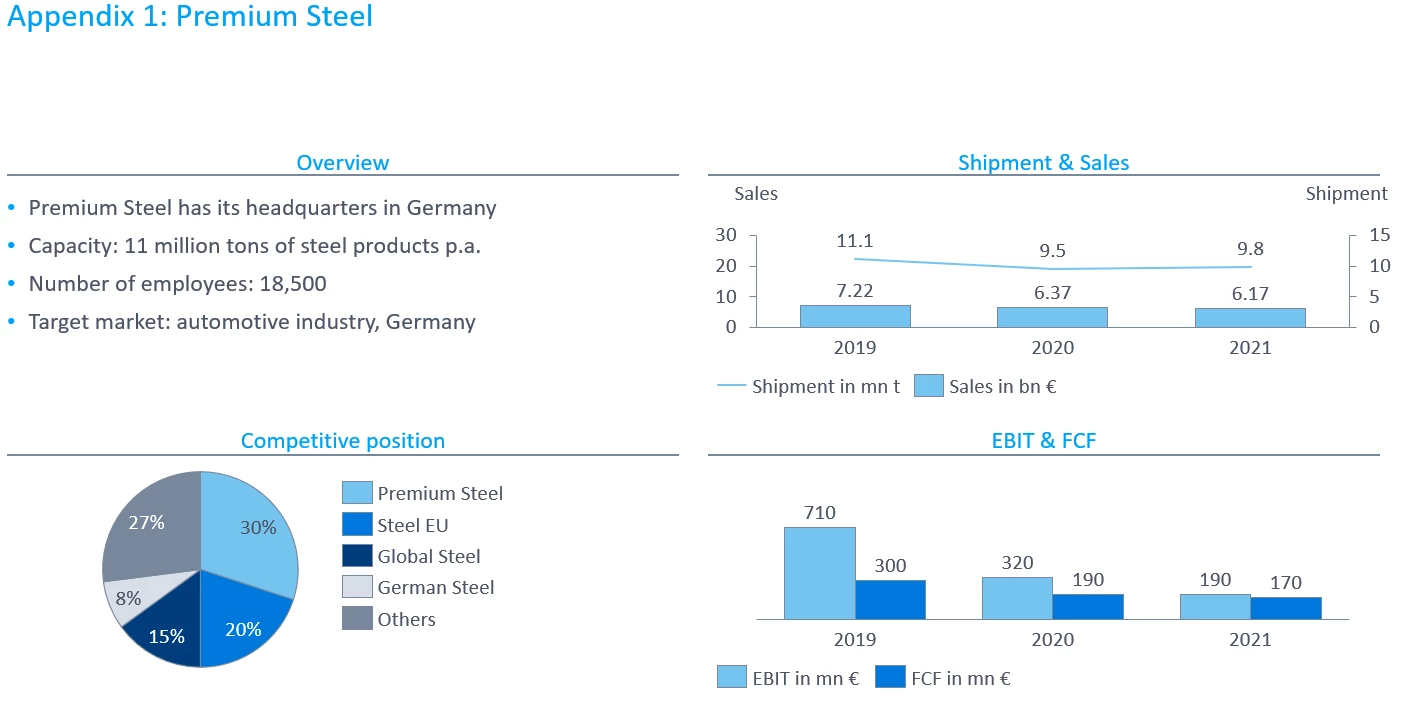

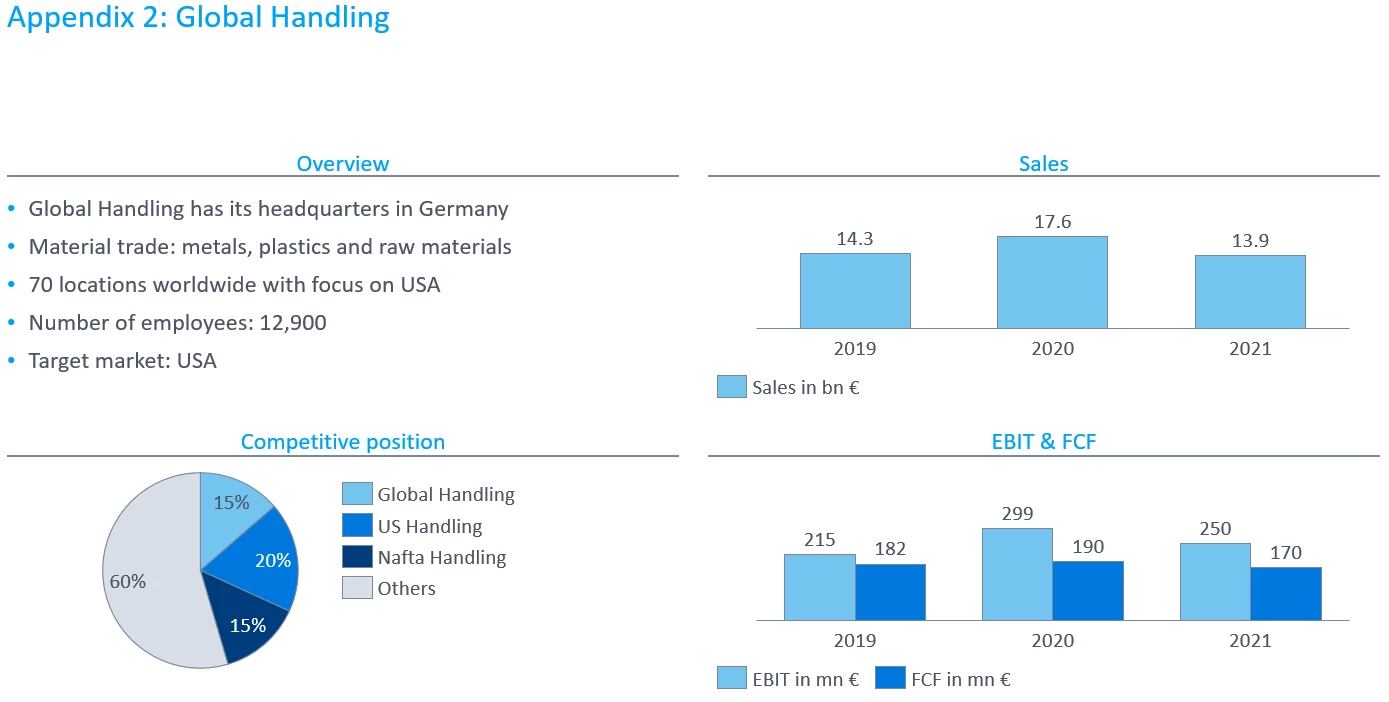

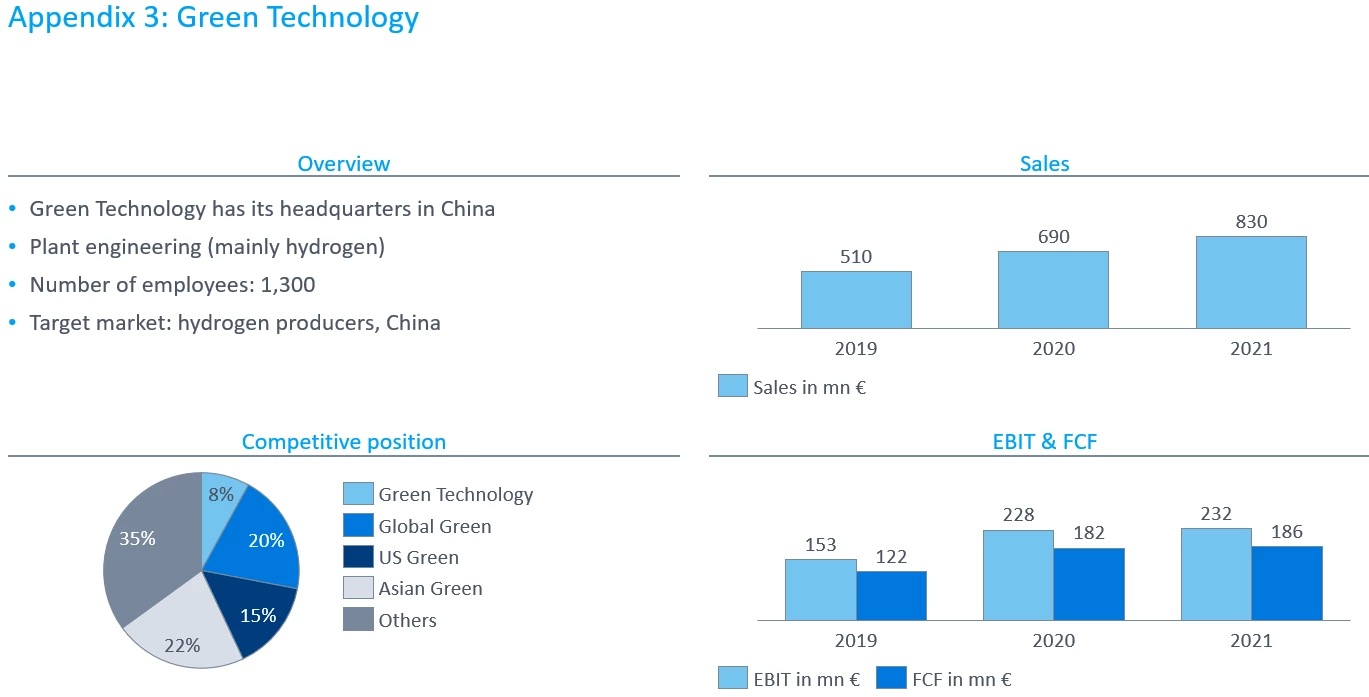

- Please refer to the individual company profiles (appendix 1-3).

- Present your assessment visually.

- Tip: To assess the market attractiveness, use the sales trends and your impressions of the industry developments based on the latest news.

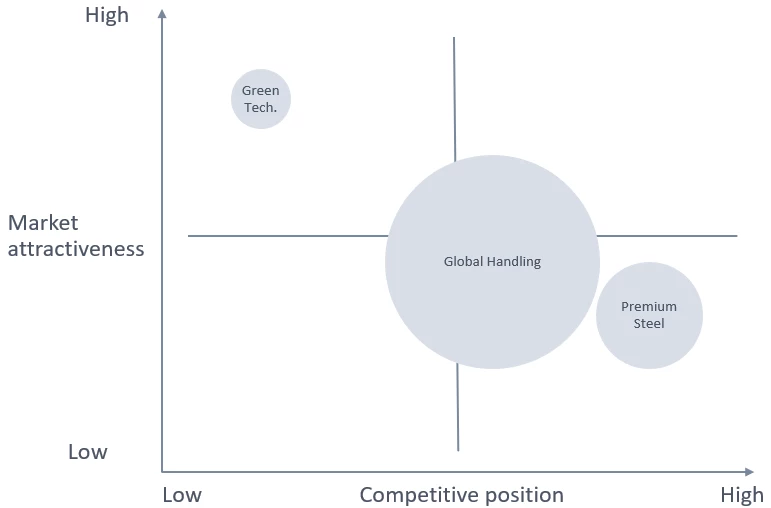

Here, the candidate should map and compare all three companies in a matrix, for example. The market attractiveness could be assessed on the basis of the sales development, the competitive position on the basis of the market share. The size of the bubble could indicate the level of sales.

Possible findings from this:

- Green Technology with the most attractive market but poor market position

- Premium Steel with high market share in a rather unattractive market

- Global Handling with the largest sales and medium-sized market share

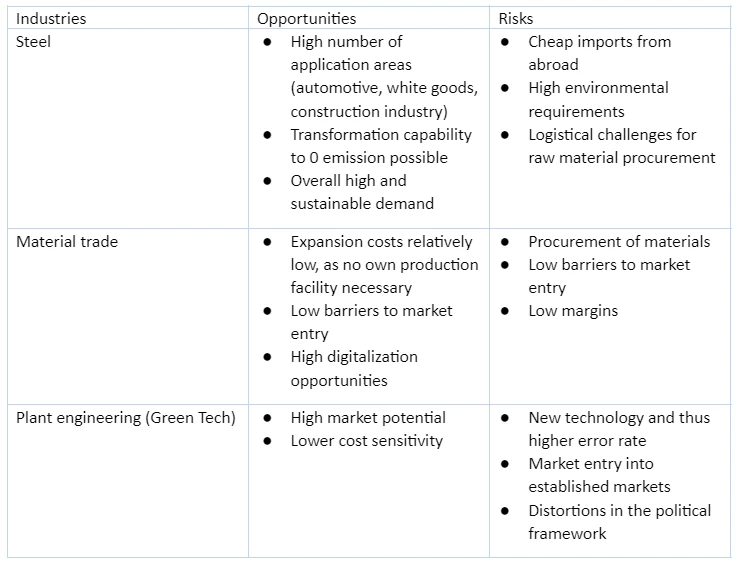

1C. What are key opportunities and risks of the companies' different industries and target markets? (Advanced)

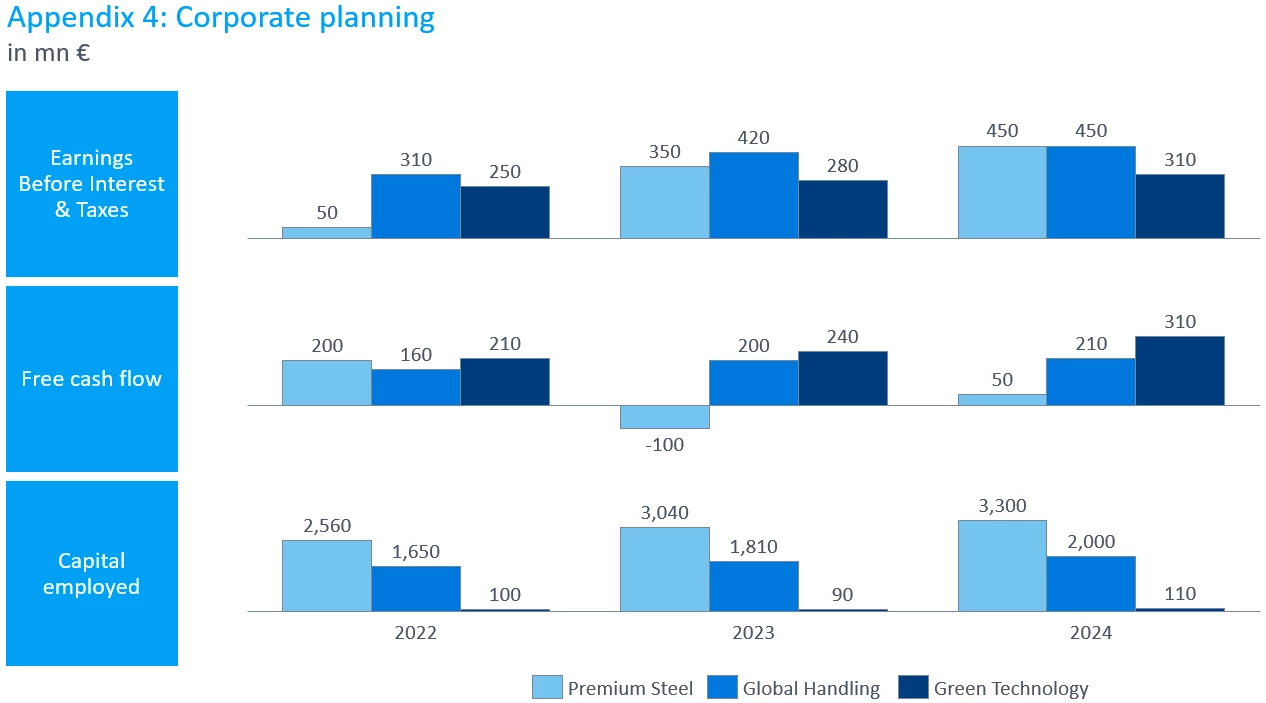

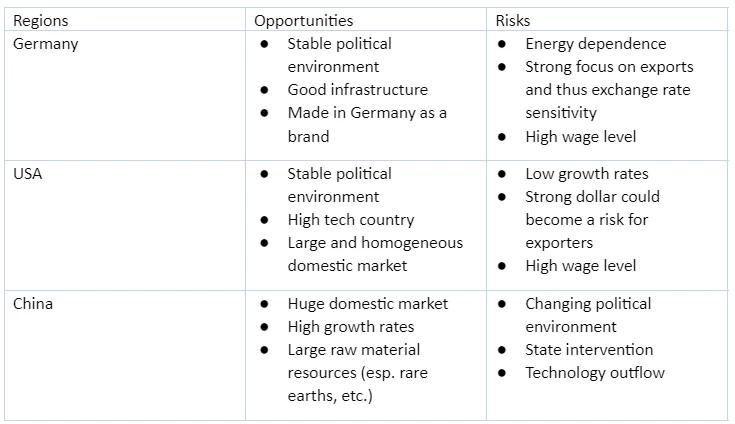

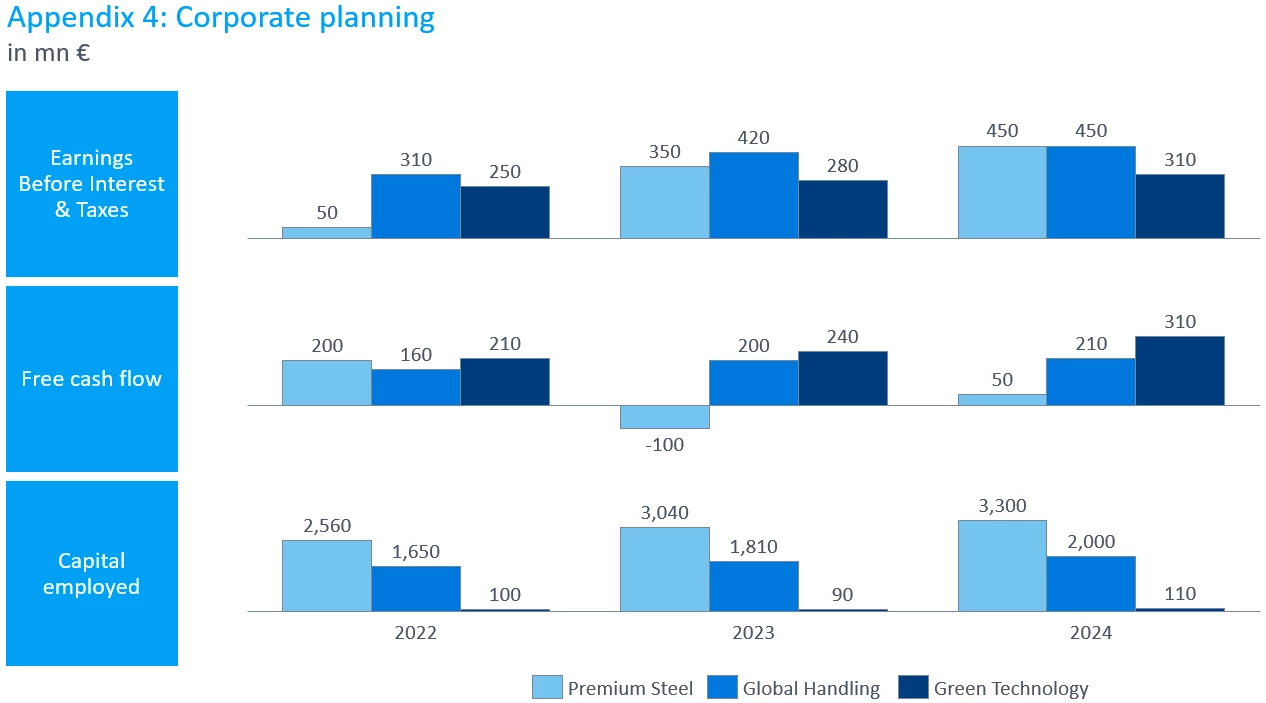

2A. Determine the economic value added (EVA) of each company. How do you assess the companies in terms of their development potential?

- Economic Value Added (EVA) is the residual operating profit of a company after deducting the cost of capital. It is often used to indicate the profit surplus of a period or to calculate the profitability of an investment.

- EVA = EBIT - CE*WACC

- EBIT = Earnings before Interest and Taxes

- CE = Capital Employed, is the capital required to finance assets required for operations (e.g. non-current assets, inventories and receivables).

- WACC = Weighted Average Cost of Capital, indicating the cost of a company's capital.

- The holding company currently expects a WACC of 7% for 2022 and a value two percentage points lower for the two following years.

- Relevant information is presented in appendix 4.

Here, the candidate should determine EVA based on the plan data provided.

Possible highlights for assessment:

- All companies develop positively over the next few years (EVA increases).

- The development is particularly strong at Premium Steel, where EVA is changing from negative to positive.

- At Green Technology, the values remain constant in the positive range.

- Global Handling has the largest EVA in 2024, followed by Green Technology.

- Good development potential at all three companies with positive EVA values.

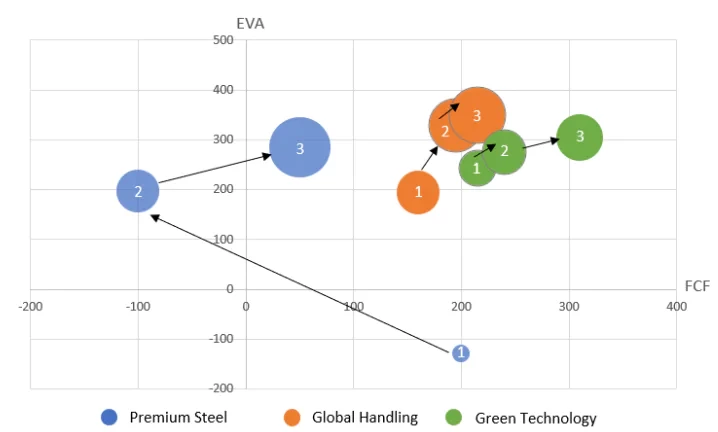

2B. Visualize the results together with the companies' cash contribution and draw conclusions.

- Tip: For example, you can use a coordinate system for visualization.

Possible illustration via: Y-axis EVA, X-axis FCF, bubble size EBIT.

Possible conclusions:

- Companies with high EVA and at the same time high cash contribution are arranged in the top right-hand corner.

- In general, the development of the companies is positive.

- Green Technology and Global Handling with consistently positive ranking based on FCF and EVA.

- Premium Steel with positive trend until 2023 in terms of EVA, but with sharp drop in FCF.

3. The management board of the holding company would like to have a final presentation. What are your recommendations regarding the individual companies?

- Summarize your findings as briefly and precisely as possible into clear recommendations for action.

- Tip: Consider market attractiveness and competitive position as well as value creation and cash contribution from tasks 1 and 2.

Summary from task 1 and 2:

- Premium Steel:

- Very good market position, but unattractive market

- Strong fluctuations in FCF and EVA must be avoided in the future

- Global Handling:

- Good market position in relatively attractive market

- Good and constant EVA and FCF development

- Green Technology:

- Market seems to grow

- Market share is quite low

- Business with consistently good EVA and FCF development

Recommended Action Alternative 1:

- Premium Steel:

- Shift in product portfolio by investing in production of low emission products

- Market penetration with existing products in new markets

- Global Handling:

- Defend market position through broad-based investment in new markets

- Gain market share through increased market penetration with existing products and services

- Green Technology:

- Divest the business to finance investments in other business areas such as Premium Steel

Recommended Action Alternative 2:

- Premium Steel:

- Divestment strategy due to low market attractiveness and fluctuations in EVA and FCF

- Global Handling:

- Defend market position through targeted investment in digitalization and increased networking with customer logistics in existing markets

- Green Technology:

- Increased investment in hydrogen, a technology of the future, to develop a star within the portfolio

tkMC Case: Portfolio optimization of a holding company