BabyformulaCo is a leading producer of baby formula with a 30% market share in the US that is looking for ways to increase their market share without significantly lowering profitability. Recently, a Special Supplemental Nutrition Program for Women, Infants, and Children (WIC) for low-income women and their children was introduced, which provides vouchers to purchase baby formula.

The client is interested in bidding for the tender contracts but needs help in determining the appropriate bidding price.

Case Prompt:

Sample Structure

1. Quantitative analysis

1.1. Option space for bid price

1.1.1. Cost-based pricing

1.1.2. Competition-based pricing

1.2. Economic assessment

2. Qualitative analysis

2.1. Risks and mitigation

2.2. Capacities

3. Recommendation

Background

Provide the candidate with the following information upon request.

- Each program participant receives a voucher that gives them a certain discount at the check-out.

- The tender contract lasts for 12 months, so suppliers need to participate for a full year, but the supply contracts can be extended up to several years.

- The tender is based on the price of a single can of baby formula, currently priced, on average, at $25 per can.

1.1. Quantitative Analysis | Option Space for Bid Price

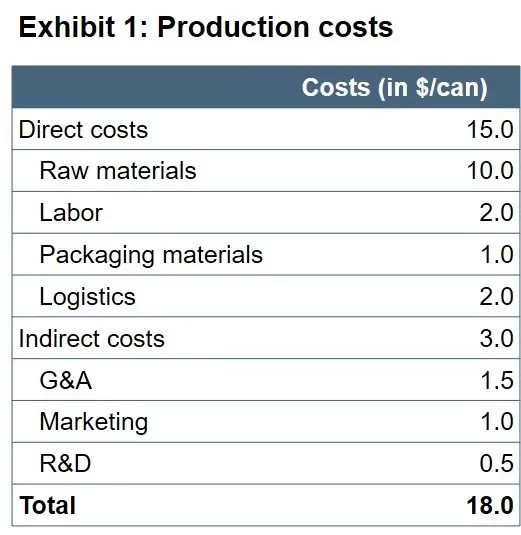

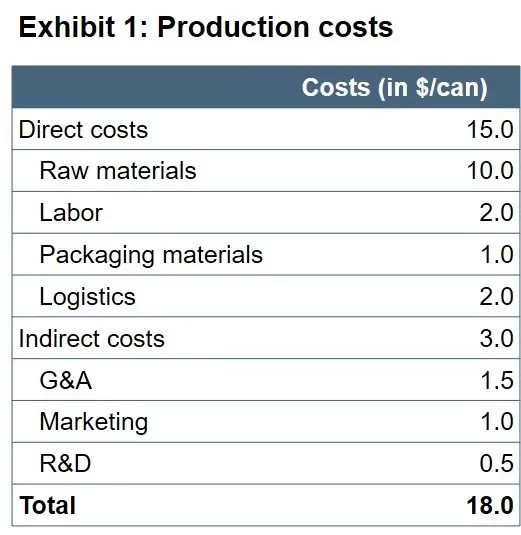

Let the candidate brainstorm both direct and indirect costs associated with the production of baby formula before sharing exhibit 1.

Let the candidate know that we found that two potential competitors might bid for the contract, one of which has a market share of 15%, and the other is a new entrant with no market share. We estimate that the potential competitors will bid around $20 per can.

Based on this estimate, the minimum price the client can bid without incurring losses is $18 per can.

Based on both the cost and competitive information, the client should bid $20 per can. While the client could also lower the bid price to $19, given the strong market presence, $20 should suffice to beat competitors.

1.2. Quantitative Analysis | Economic Assessment

Provide the candidate with the following information upon request.

- If a supplier wins the contract, it also means they get to increase the amount of shelf space in stores since they need to supply more products. As such, our client would increase their market share to 33%.

- The total market size for baby formula is estimated at $4.3b.

- The sales volume of baby formula through the WIC program will be 3m cans.

Revenues BabyformulaCo (before WIC) = $4.3b × 30% = $1.29b

Sales vol. BabyformulaCo (before WIC) = $1.29b ÷ $25 = 51.6m

Add. revenues BabyformulaCo (WIC) = 3m × $20 = $60m

Add. revenues BabyformulaCo (market share increase) = ((((33% - 30%) ÷ 30%) × 51.6m) - 3m) × $25 = $54m

Total add. revenues BabyformulaCo = $60m + $54m = $114m

Revenue increase BabyformulaCo = $114m ÷ $1.29b = 8.84%

2.1. Qualitative Analysis | Risks and Mitigation

Let the candidate brainstorm risks and how they might be mitigated.

- Brand image: The client needs to be aware of the potential risk of damaging their brand image if they are seen as exploiting the WIC for profit. To mitigate this risk, I would advise the client to offer some additional benefits to the welfare program, such as providing information on infant nutrition and health.

- Price war: The client needs to be aware of the potential risk of future price wars which can lead to a loss of profitability. To mitigate this risk, I would advise the client to bid at the price that was defined in the analysis. Moreover, the client should monitor the market closely and adjust their pricing strategy accordingly.

2.2. Qualitative Analysis | Capacities

Let the candidate know that the client has ensured that they have sufficient production capacity and backup suppliers in case of disruptions.

BabyformulaCo has sufficient production capacity and backup suppliers to manage the increase in sales volume.

3. Recommendation

- First of all, I would advise the client to bid $20 per can. This is a price that is competitive but still generates an increase in revenues of almost 9% for the client. Bidding at this price will also help the client maintain their brand image and prevent potential price wars in the future.

- Moreover, to mitigate the decline in profit margin resulting from the sale of baby formula through the WIC program, the client could consider developing an inexpensive by-product that WIC customers can purchase at full price, in addition to the rebate product, and engage in cross-selling.

Baby Formula