Learn the case interview basics, practice with 30+ cases, and benefit from extensive test materials, and interactive self-study tools.

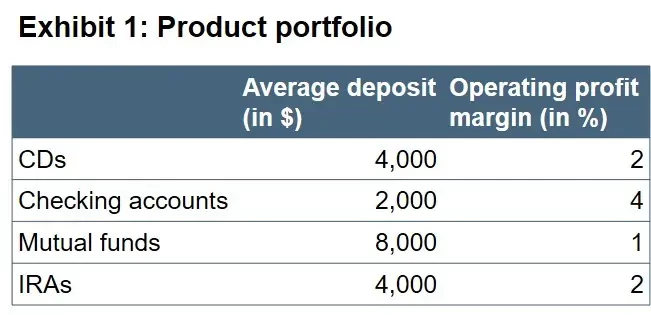

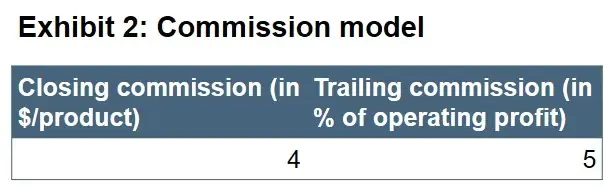

RetailBankingCo is a regional, US-based retail bank that is looking to increase its revenues. As a result, the client is considering introducing a commission-based incentive program for its sales force.

RetailBankingCo wants to determine the conditions under which implementing the incentive program would be economically viable.

14.9k

Times solved

Beginner

Difficulty

Do you have questions on this case? Ask our community!