I have upcoming interview where the format of the case is supposed to be as follows:

1. Interviewer will ask a high level question as a one liner, the rest is upto the candidate to figure out. Questioning the interviewer for more information is allowed.

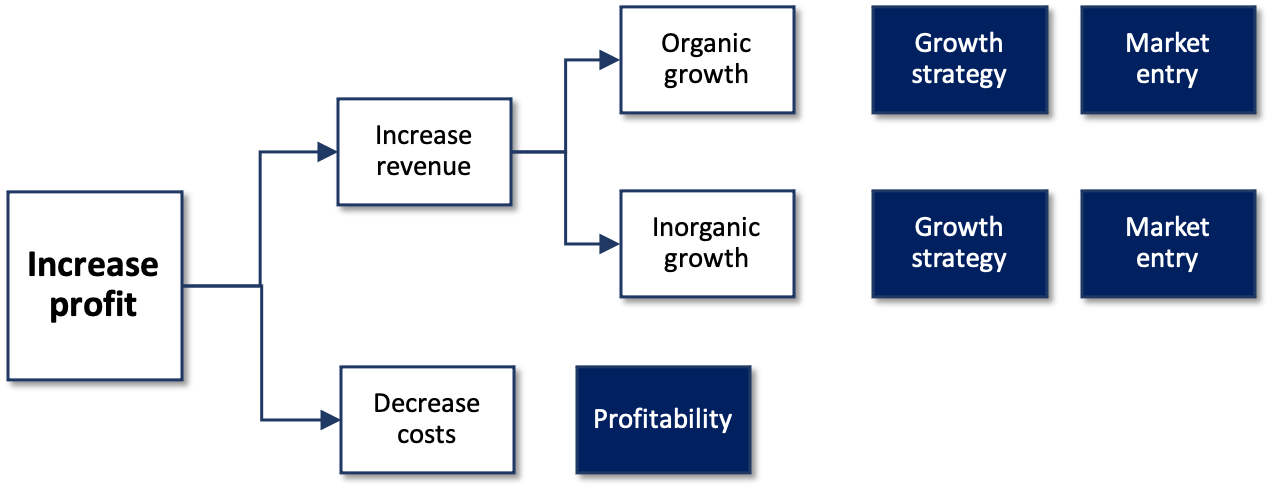

Q. If you were tasked with new ways to increase an online banks profit, how would you go about doing that?

If I'm asked the above question, what strategy does it belong to? I'm confused whether it's a profitability, growth strategy or market entry case? Or is it a combination of them?

Any insights on how one can approach such one liner case statements are appreciated!!

Thanks in advance!