There seems to be a flaw in the solution of question 2.

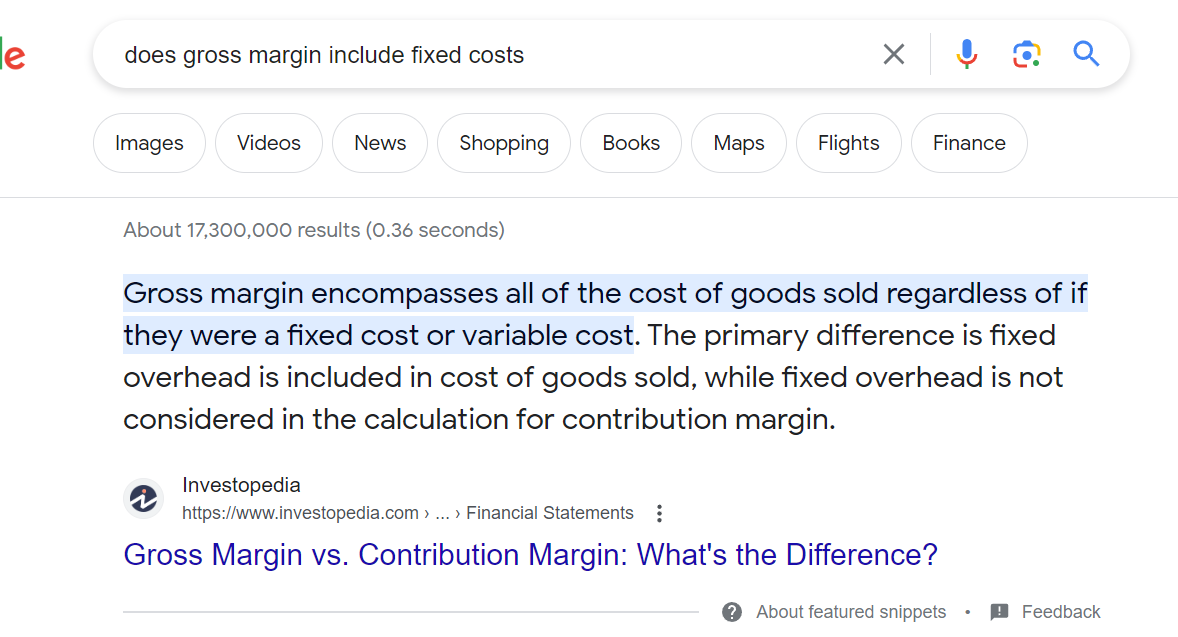

Reason: COGS are not considered

Currently, calculation says:

Revenue 1bn - 920m fixed costs = 80m profit = 8% margin

But If we know that the gross margin is 50%, only 50% of the revenue of 1bn is available to cover the fixed costs (gross profit), the other 50% (500m) are the COGS.

Therefore, the calculation would be:

Gross profit 500m - 920m fixed costs = -420m which would result in -42%

Please let me know your thoughts.