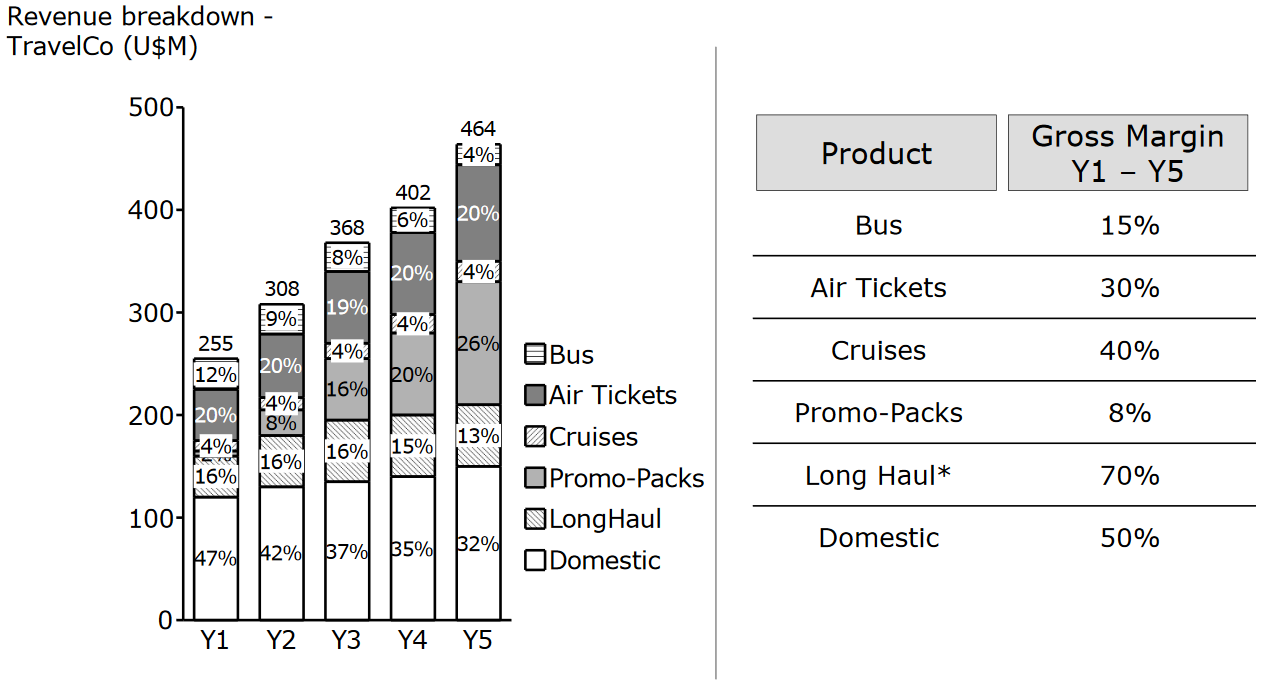

Hello! I'm doing a sample case and I'd like to know how can I find what year had the highest gross margin from a chart.

I know the gross margin would be the revenue minus the cost but I know there would be a more simple way since I do not have the cost in this chart but have the revenue breakdown year by year.

This looks like a simple question but I am not 100% sure how I can solve this.

Thanks in advance for the help!