Hi all,

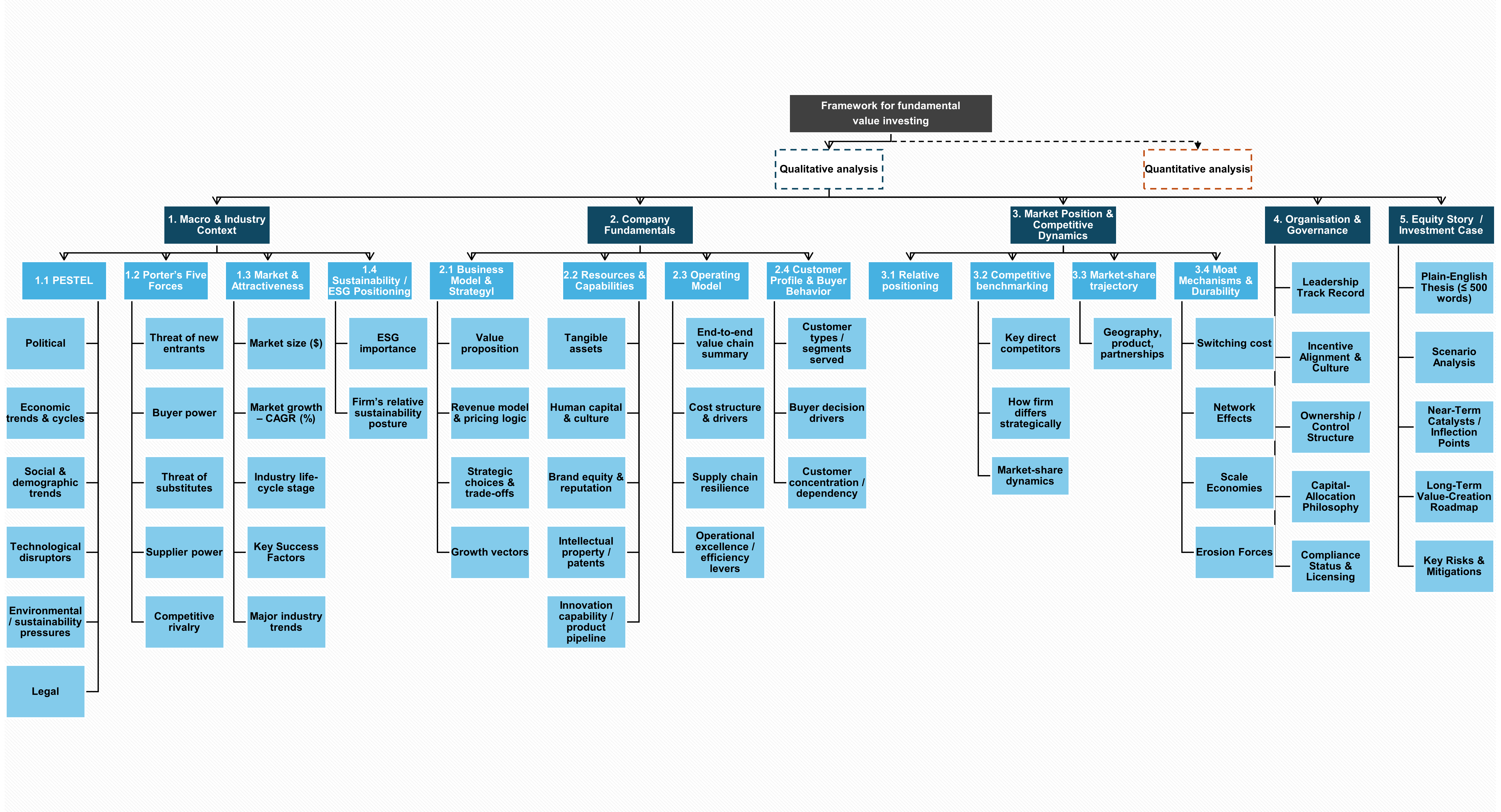

I’m in the process of refining a structured framework I use to analyze companies at a fundamental level before diving into strategy design, transformation planning, or financial valuation.

The core idea: Before making recommendations, designing initiatives, or building models, I want to fully understand the business - its market context, customer dynamics, competitive positioning, operational levers, and risk landscape. The framework is designed to be adaptable across industries and types of engagements (M&A, growth strategy, operational improvement, etc.).

Why I’m posting

👉 I’d really appreciate feedback from the PrepLounge community on:

- Are there dimensions or angles you’d add / refine / drop?

- How do you structure your qualitative business understanding before starting a client engagement?

- Any frameworks, tools, or best practices you find particularly effective in building a comprehensive business diagnosis (especially for MBB-style work or top-tier boutique engagements)?

Thanks for taking the time to share your thoughts - I really appreciate your detailed feedback. That’s a great clarifying question!

The structure I shared is meant to reflect an internal framework one can use before starting an engagement - whether it’s project-based client work in consulting or, from a valuation perspective, a qualitative deep-dive into the business to build a solid understanding before tying numbers to the story. Think of it as a holistic toolbox designed to help get a thorough grasp of the business on the qualitative side before diving into the detailed work, whether for consulting, valuation, or broader investment banking purposes.