Hi

I'm preparing for my upcoming BCG interviews and would like your expert opinion on how to best structure the initial framework for this specific product launch case.

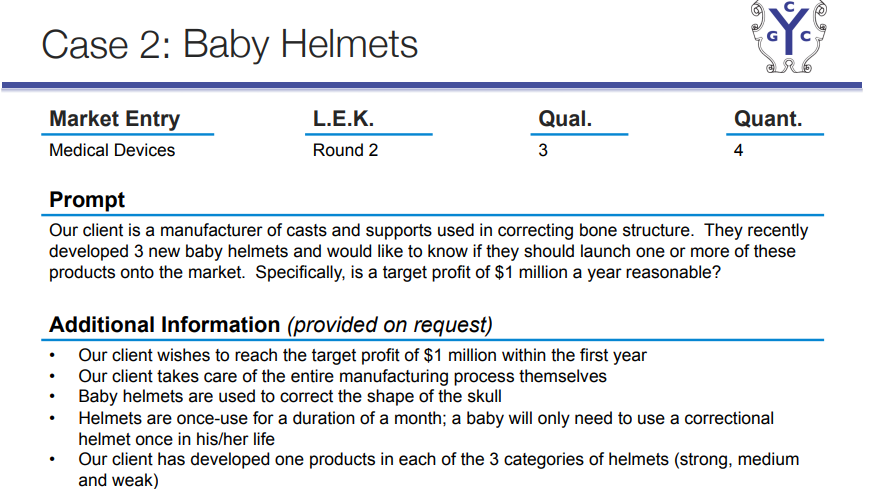

Case Prompt: A client has developed 3 new baby helmets and wants to know if their target of $1M in annual profit is reasonable, and if they should launch one or more products.

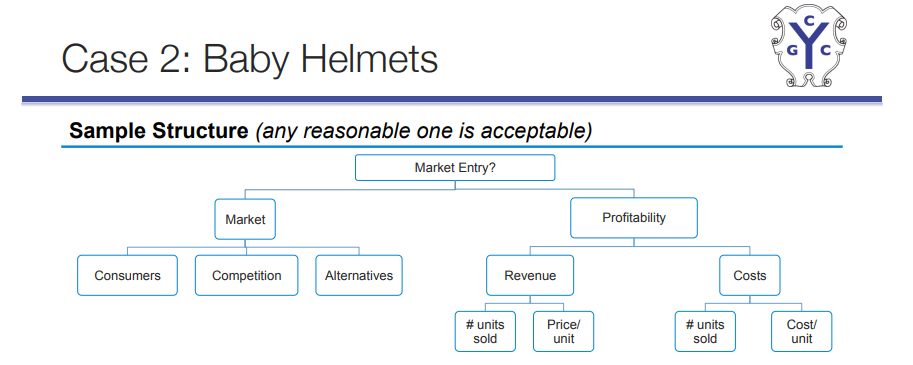

A simple, financially-focused approach would be to structure the analysis around two pillars: 1. Market Opportunity Assessment (to size the market) and 2. Profitability Analysis (to see if we can hit the $1M target).

However, my instinct tells me that a truly robust, partner-level answer needs to consider the practical realities of the launch. I felt that buckets like Operations, Implementation, and Stakeholders were also critical.

My core question for you is about scope: In a real BCG interview, would adding a third pillar for implementation and operational factors be seen as insightful and comprehensive, or would an interviewer consider it 'out of scope' for the initial framework?

Here was my rationale for wanting to include these factors:

- Operations & Capabilities: My thinking was that we first need to understand our production capacity. The most "reasonable" plan might be to launch the helmet we can produce at the highest volume without needing new investment, which is a key operational consideration.

- Implementation & Timeline: The client's goal is to hit the $1M profit target within the first year. I felt it was necessary to have a bucket to discuss the timeline and key steps required to make that happen.

- Stakeholders: A medical device like this isn't sold in a vacuum. I believe that understanding how we would align with key stakeholders like doctors, hospitals, and insurance companies is critical to a successful launch and therefore should be part of the initial plan.

I am struggling with how to balance being MECE and strategically thorough without being told I am "boiling the ocean." I would greatly appreciate your advice on how you would structure the approach to this problem.

Thanks

simple version:

1. Strategic Rationale (Why should we do this?)

- Market Opportunity: How attractive is the market we are targeting, and what is the competitive landscape?

- Customer & Brand Impact: Does this move strengthen our relationship with customers and enhance our brand?

- 2. Financial Viability (Do the numbers work?)

- Profitability Projections: What are the expected revenues, costs, and ultimate profit from this initiative?

- Investment & Returns: What is the required upfront investment, and what is the expected return (e.g., ROI or Payback Period)?

- 3. Execution Feasibility (Can we actually do this?)

- Operational Capabilities: Do we have the necessary operational capabilities, technology, and talent to execute this successfully?

- Implementation Plan & Risks: What is the step-by-step plan to launch this initiative, and what are the key risks we must mitigate?