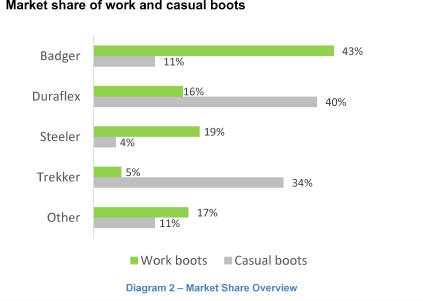

Duraflex is a German footwear company with annual men’s footwear sales of approximately €1 b.

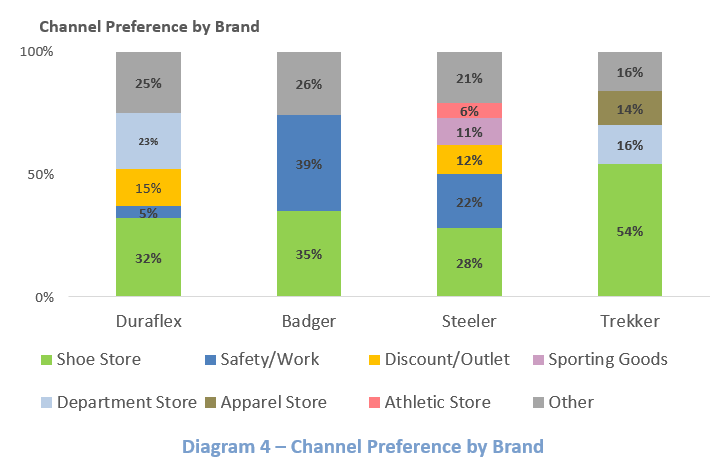

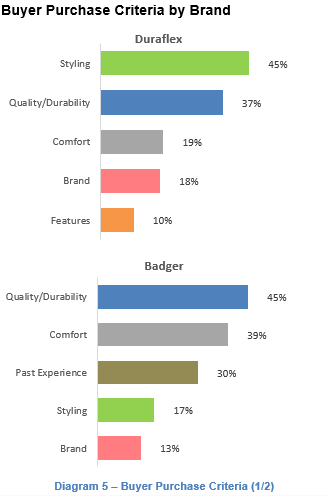

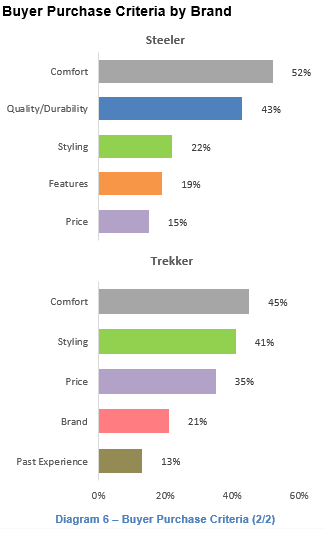

They have always relied on the boot market for the majority of their volume. In this market they compete with three other major competitors.

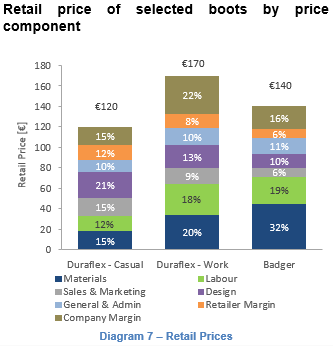

In the fall of 2019, Badger – one of Duraflex’s competitiors – launched a new line of aggressively priced work boots. The strong success of this line has caused Duraflex’s management to re-evaluate their position in work boots.

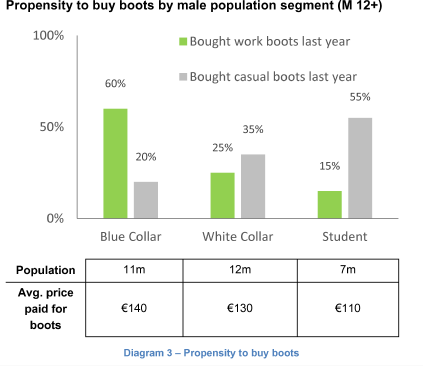

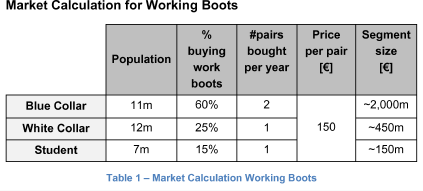

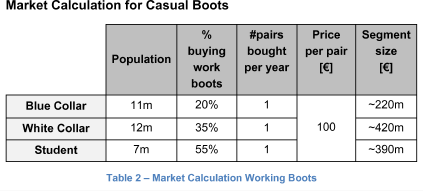

With limited additional resources, the management must now decide if they should focus their efforts on competing with Badger in the work boot sector, or allocate their resources on further strengthening their position with casual boots. The management team approached you and asked for your advice. In order to advise them on their future work boot strategy please prepare first some insights regarding market size and competitive landscape.

Deloitte Case: Footloose

i